Bitcoin and major altcoins have fallen from their weekly highs. However, according to Crypto analyst Rakesh Upadhyay, the bulls are trying to form a higher bottom. This shows that purchases were made on declines. Will the bears seize the initiative and push major altcoins including Bitcoin and DOGE lower, or will buyers regroup and push prices higher? To find out, the analyst examines the charts of the top 10 cryptocurrencies.

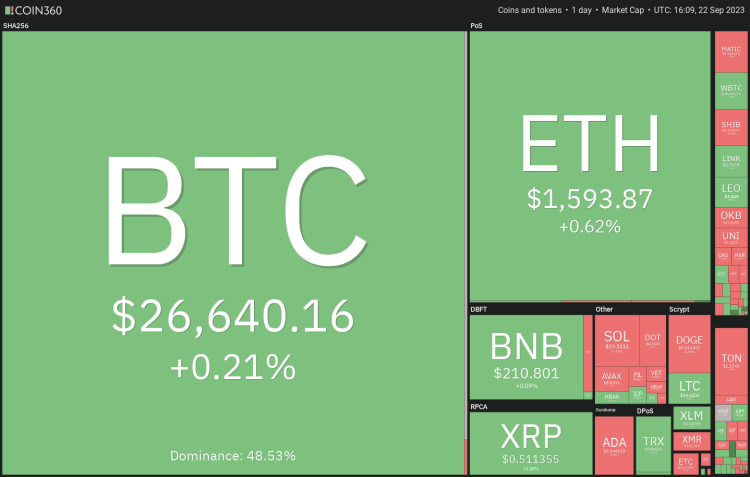

An overview of the cryptocurrency market

As you follow from Kriptokoin.com, the Federal Reserve did not increase interest rates at its meeting on September 20. But he hinted that interest rates could remain high for longer. At the press conference held after the meeting, Fed Chairman Jerome Powell warned that “there is a long road ahead of the process of sustainably reducing inflation to 2%.” This possible scenario has triggered a sell-off in US stock markets and also in the cryptocurrency space. Risk assets generally tend to underperform in a high interest rate environment.

Daily cryptocurrency market performance. Source Coin360

Daily cryptocurrency market performance. Source Coin360Altcoins could not maintain their weekly gains due to risk-off sentiment. However, it is an encouraging sign that Bitcoin and major altcoins have largely managed to stay above key support levels. It is likely to witness a fierce battle between bulls and bears. Therefore, price action over the next few days is critical.

BTC, ETH, BNB, XRP and ADA analysis

Bitcoin (BTC) price analysis

Bitcoin has been trading between moving averages for the last few days. This narrow range trading shows indecision between bulls and bears regarding the next directional move.

![]()

Buyers are trying to keep BTC above the 20-day exponential moving average ($26,520). If the price rises from the current level, the bulls will again try to break the barrier at the 50-day simple moving average (SMA) ($27,050). If they are successful, it is possible for BTC to rise to the next resistance point at $28,143. Conversely, if the price breaks below the 20-day exponential moving average (EMA), it will indicate that the bears are in command again. This will increase the possibility of a retest of the crucial $24,800 support.

Ethereum (ETH) price analysis

ETH’s turn down from the 20-day EMA ($1,628) on September 20 suggests that the bears continue to sell in rallies.

![]()

The bears dragged the price below the vital $1,530 support. Thus, they will try to further consolidate their positions. If they manage to do this, it is possible for ETH to start a downside move towards the next major support at $1,368. Conversely, if the price turns up from the current level or recovers from $1,530, it would indicate that lower levels attracted buyers. The first sign of strength will be a break and close above $1,670. This would pave the way for a potential rally to $1,745.

Binance Coin (BNB) price analysis

BNB turned down from $220 on September 18 and broke below the 20-day EMA ($214) on September 20. This shows that the price will consolidate between $203 and $220 for a while.

![]()

If the price stays below the 20-day EMA, the bears will make another attempt to sink BNB below the key support at $203. If they are successful, this will indicate the resumption of the downtrend. The next support on the downside is at $183. On the upside, the bulls will need to clear the hurdle at the 50-day SMA ($222) to signal a reversal. It is possible that BNB will try to climb first to $235 and then to $250. We expect this level to attract sellers.

Ripple (XRP) price analysis

XRP broke above the 20-day EMA ($0.51) on Sep 19. However, the bulls are struggling to sustain the recovery.

![]()

The price fell back to the 20-day EMA. This is an important support to consider. If the price turns up from the current level, it will indicate a change in sentiment from selling on rallies to buying on dips. The bulls will then attempt to push the price back above the general area between the 50-day SMA ($0.53) and $0.56. On the contrary, if the 20-day EMA gives way, it is possible for XRP to drop to the uptrend line. This is an important level for the bulls to defend. Because a break below this will invalidate the bullish model.

Cardano (ADA) price analysis

Cardano’s price action has formed a descending triangle formation over the past few days, which will be completed with a breakout and close below $0.24.

![]()

Moving averages gradually moving downwards indicate an advantage for the bears. However, the bullish divergence in the relative strength index (RSI) indicates that the bearish momentum is slowing. Buyers will need to quickly push the price above the downtrend line to avoid a crash. If they do, ADA would be well positioned for a relief rally to $0.30. If the price continues to decline and breaks below $0.24, it will complete the bearish pattern. It would also set the stage for a decline to $0.22 and eventually the $0.19 formation target.

DOGE, SOL, TON, DOT and MATIC analysis

Dogecoin (DOGE) price analysis

DOGE price turned down from the 20-day EMA ($0.06) on September 21. This shows that the bears are aggressively defending the level.

![]()

However, the bears failed to strengthen their position by pushing the price below the formidable support at $0.06. Therefore, this shows that DOGE bulls are buying on dips. It is possible for the DOGE price to fluctuate between $0.06 and the 20-day EMA for a while. If the bulls push the price above the 20-day EMA, it would indicate the beginning of a sustained recovery towards the 50-day SMA ($0.07) and then to $0.08. On the downside, if the $0.06 level breaks, DOGE risks a potential decline to $0.055.

Solana (SOL) price analysis

SOL broke above the 20-day EMA ($19.57) on September 18. However, the bulls failed to push the price above the 50-day SMA ($21.01). This shows that the bears are active at higher levels.

![]()

The 20-day EMA is witnessing a tough battle between bulls and bears. If sellers hold the price below the 20-day EMA, a drop to SOL is possible at $18.50 and then to the next support at $17.33. On the other hand, if the price remains above the 20-day EMA, it will indicate that the bulls have turned the level into support. This could increase the possibility of a retest of the overhead resistance zone between the 50-day SMA and $22.30.

Toncoin (TON) price analysis

TON failed to rise above $2.59 on September 19 and 20. This encouraged short-term investors to book profits.

![]()

Immediate support on the downside lies at $2.25. If it breaches this level, it is possible for TON to drop to the 20-day EMA ($2.08). If the bulls want to maintain the positive sentiment, they need to defend this level. A strong rebound from the EMA’s 20-day level could see TON remain stuck in the wide range between $2.07 and $2.59. Another possibility is that the price returns to $2.25. If this occurs, it would indicate that traders are not waiting for a deeper correction to buy. This will increase the chances of a break above $2.59. It is possible that TON may then jump to $2.90.

Polkadot (DOT) price analysis

The bears are fiercely protecting Polkadot’s breakdown level at $4.22. So this shows that every small relief rally is sold off.

![]()

Downward sloping moving averages and the RSI in the negative zone indicate that the bears have the upper hand. In this sequence, if the price continues to decline and breaks below $3.90, it will indicate the beginning of the next leg of the downtrend towards $3.58. A slight advantage in favor of the bulls is that the RSI is showing early signs of forming a positive divergence. This shows that selling pressure may decrease. A breakout and close above $4.22 will open the doors for a possible rally to the downtrend line.

Polygon (MATIC) price analysis

MATIC closed above the 20-day EMA ($0.54) on September 19. However, the bulls failed to build on the momentum. So this suggests that demand is drying up at higher levels.

![]()

The bears pulled the price back below the 20-day EMA on September 21. Now sellers will try to push MATIC below the strong support at $0.49. If they achieve this, it is possible for MATIC to continue its downtrend. The next support on the downside is $0.45. Meanwhile, alternatively, if the price recovers strongly from the $0.50 support, it will show lower levels attracting buyers. The bulls will need to push the price above $0.55 and sustain it to signal the beginning of a stronger recovery.

Follow us on Twitter, Facebook and Instagram and join our Telegram and YouTube channels to be instantly informed about the latest developments!