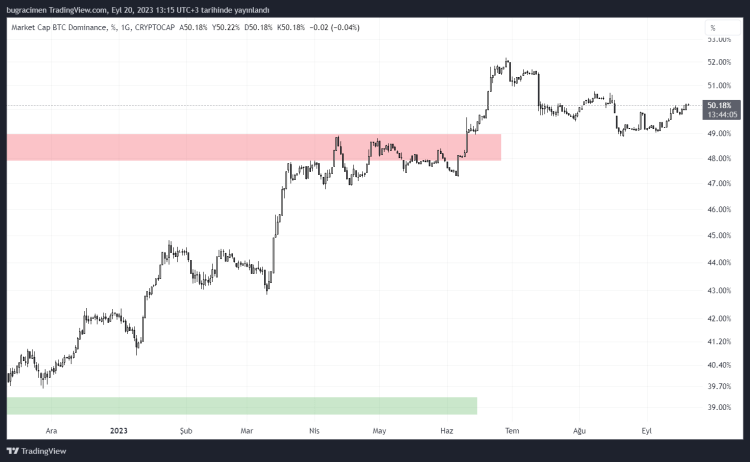

Although the cryptocurrency market was active from time to time, it generally had a quiet summer month. Due to the negative developments in the sector, investors’ preference for Bitcoin instead of Ethereum and others led to the loss of power of altcoin units. As a result of the more conservative preferences of crypto lovers, Bitcoin dominance, which was 40% at the beginning of the year, has increased to 50% today.

Due to the increase in Bitcoin’s share in the market, altcoin units have not received enough share from the rising market since the beginning of the year. While BTC has increased by 65% since January 1, this rate has remained limited to 35% for ETH.

Long-Term Ethereum Investment Is Increasing!

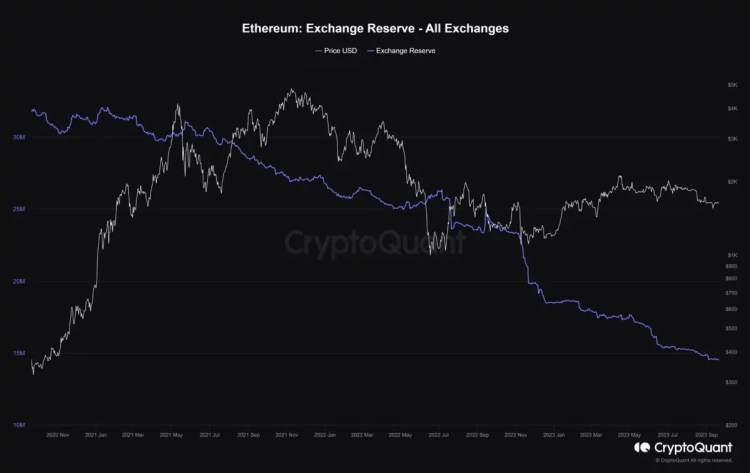

On-chain data for the largest altcoin unit, Ethereum (ETH), tells a different story. Despite the poor performance of Bitcoin’s biggest rival, there is a large amount of ETH outflow from central exchanges.

According to the table shared by Cryptoquant, the Ethereum exchange supply, which was over 30 million units in late 2020, has decreased below 15 million in recent days. This reveals that investors are making longer-term investments by moving ETH tokens to cold wallets.

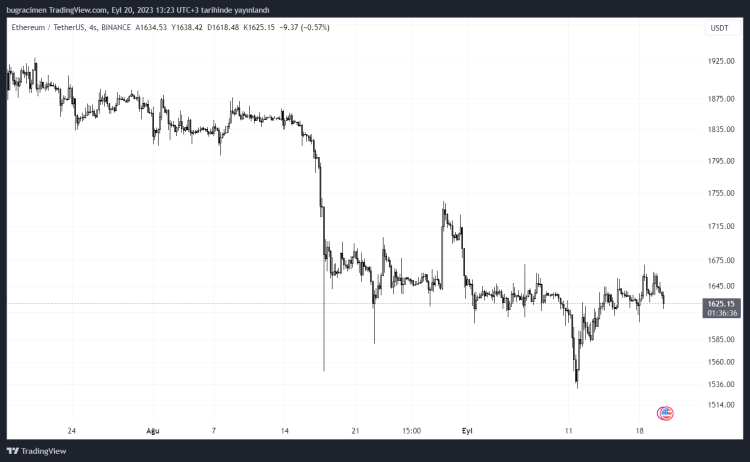

ETH Price

The cryptocurrency, Bitcoin’s biggest rival, rose slightly after the recent decline. While Ethereum dropped to $1,530 on the night of September 12, it is currently trading at $1,626.

The recent fluctuation of the Ethereum price forces analysts to determine a clear support and resistance point. Investors withdrawing ETH from exchanges causes liquidity to decrease. As a result, we are faced with larger needles at lower volumes.