In crypto futures, the use of Bitcoin (BTC) as margin collateral has skyrocketed to 33 percent.

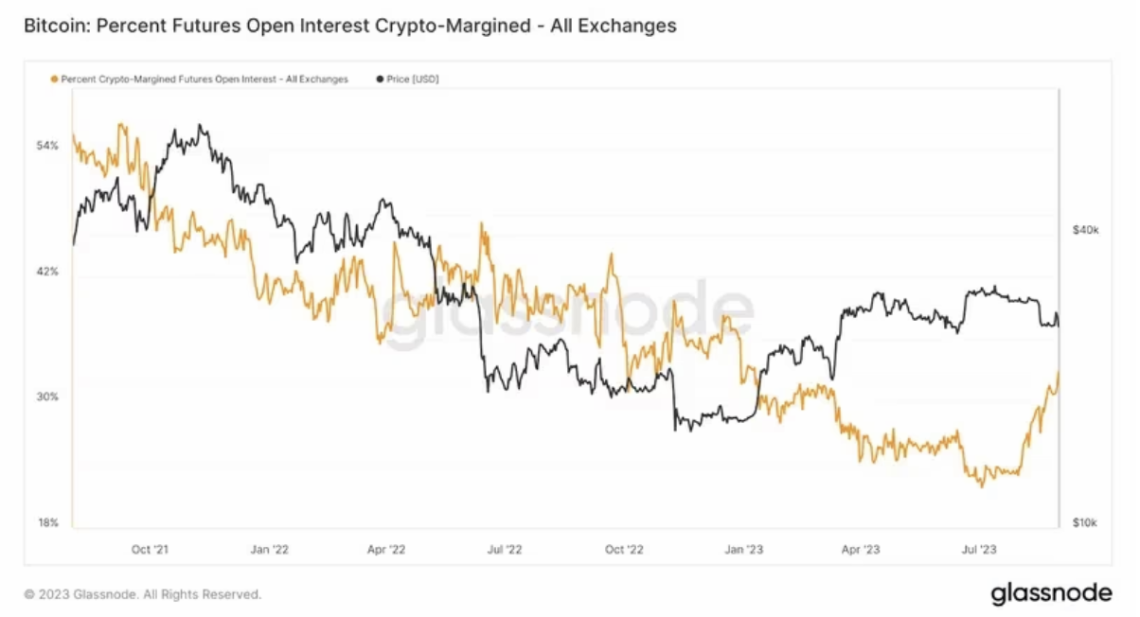

According to data shared by Glassnode, the use of futures collateral on the Bitcoin side is increasing. According to the data, the use of BTC in futures margin collateral increased to 33 percent. This rate was at the level of 20 percent in July.

The unpredictable and volatile price movements for BTC are not expected to end anytime soon. One of the reasons for this was the increase in the use of BTC in futures transactions.

Bitcoin gains dominance in futures

Futures are known as one of the preferred methods of crypto investors to achieve faster results and get sharper returns. In futures, Bitcoin, USDT and Ethereum can be used as margin collateral. Recently, there has been dominance on the USDT side. But the use of Bitcoin as a margin has increased by 13 percent in recent months.

According to Glassnode data, since July, the percentage of open interest on futures using Bitcoin as a margin has increased from about 20 percent to 33 percent. Cash or stablecoin margin contracts account for 65% of the total open interest.

According to analysts, using BTC for derivatives could be a powerful market driver. In addition, the fact that users prefer BTC as a margin in futures can significantly affect the price activity of BTC. Because the lack of liquidity on the BTC side, especially in the stock markets, is at the forefront. Blockware Intelligence stated that interest in BTC-backed futures can increase volatility and create liquidation.

“Using BTC as collateral for a BTC derivative is effectively a double blow,” Blockware Intelligence analysts wrote in their newsletter. said. The full view of analysts is as follows;

“If you are holding a bullish trade with BTC as collateral, a drop in price will get you to your liquidation point faster. Because the value of your collateral decreases at the same time. Using leverage against your BTC during the monetization phase is extremely risky. You may be directionally correct, but volatility can wipe you out no matter what.