According to a new Statista report, Korean investors generally prefer to stay away from a particular industry while being moderate to cryptocurrencies. Ethereum (ETH) remains the country’s most popular cryptocurrency.

Korean investors holding Ethereum are moving away from this altcoin industry

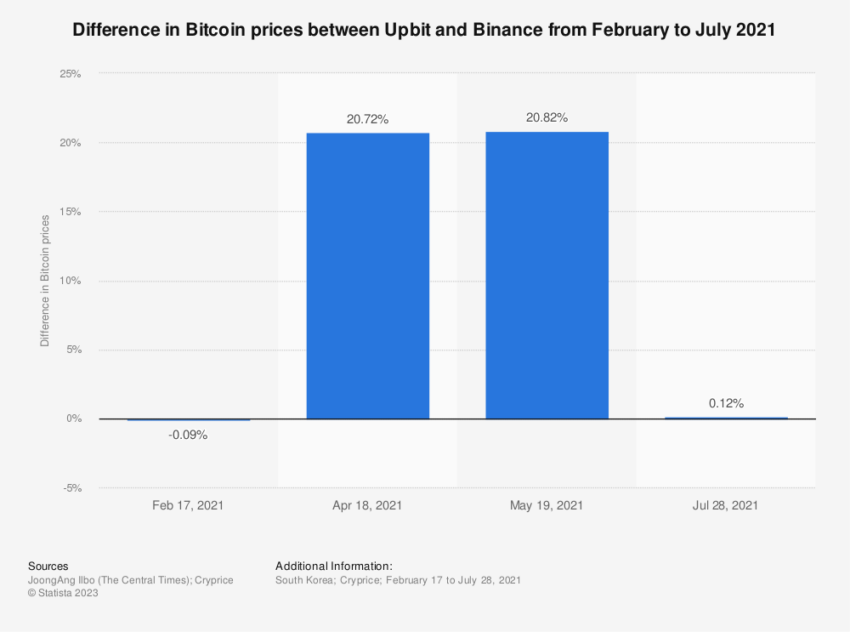

South Korea, with a population of 50 million, handles an astonishing 20% of all Bitcoin transactions. However, Ethereum continues to take on the largest market cap in the country. This increased demand leads to what is called the “Kimchi premium”. This phenomenon represents when the local price of Bitcoin rises as much as 40% from its US counterpart.

However, South Korea is interestingly opposed to DeFi despite the crypto craze. Despite the efforts of major blockchain firms like Klaytn, backed by Korean tech giant Kakao, the DeFi industry has struggled to gain traction in the country. We can list a few items for this reason:

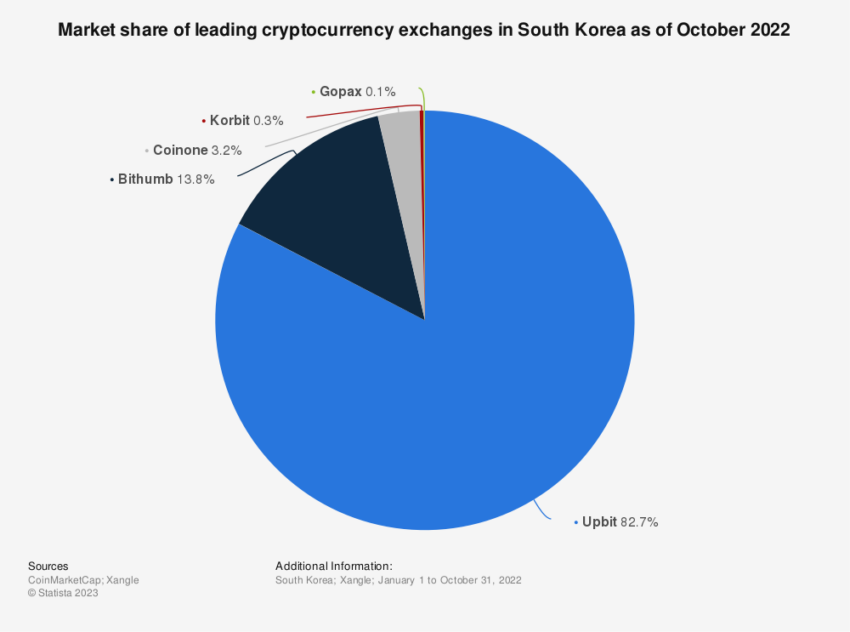

- Trust in traditional systems: South Koreans rely heavily on the financial and banking sectors. Centralized exchanges like Upbit and Bithumb are more efficient brokers with less complexity than DeFi platforms.

- User experience barriers: The average Korean crypto enthusiast finds it difficult to navigate DeFi platforms. Creating wallets, protecting private keys, and managing deposits and withdrawals are perceived as cumbersome.

- Education shortcomings: Most DeFi platforms cater primarily to English-speaking audiences. Due to language barriers, most educational content and resources are out of reach for the average Korean investor.

- Regulatory hurdles: In 2021, strict crypto regulations came into effect in South Korea. Requiring real-name bank accounts and reporting all crypto-related transactions added layers of bureaucracy, suffocating the free nature that DeFi platforms typically offer.

These altcoins are missing the South Korean market

The Statista report showed that Korean investors generally prefer centralized platforms. This trend is eclipsing the DeFi industry, which provides a variety of Blockchain solutions. The leaders of these altcoin projects are:

- Avalanche (AVAX)

- Wrapped Bitcoin (WBTC)

- Dai (DAI)

- Chainlink (LINK)

- Uniswap (UNI)

- Internet Computer (ICP)

- Lido DAO (LDO)

- Maker (MKR)

- The Graph (GRT)

- AAVE (AAVE)

- Stacks (STX)

- Theta Network (THETA)

- Synthetix (SNX)

- Tezos (XTZ)

- Injective (INJ)

- Phantom (FTM)

- Curve DAO Token (CRV)

- Rocket Pool (RPL)

Experts say lack of education is key factor

StableLab COO Doo Wan Nam pointed out that while Koreans show interest in DeFi elements, inclusive barriers such as language and unfamiliarity with personal surveillance options are hindering its widespread adoption.

On July 13, Nam said, “Korean users are showing interest in DeFi elements such as loans and earnings. However, the use of personal surveillance options such as Ledger and MetaMask is not common.”

1/2 After 8 years in Korea, I decided to move back to Europe.

So for this special blog post, I discuss Korean crypto culture: Why they love crypto, but not DeFi.

To provide further insight, I interviewed two actual Koreans, @DooWanNam & @GarlamWON

🔗 https://t.co/0THCPzu0Y6 pic.twitter.com/yakWjSNcOA

— Ignas | DeFi (@DefiIgnas) July 13, 2023

Meanwhile, Momentum 6’s Managing Partner Garlam Won agrees, citing structural rigidity, demanding work schedules, and timing issues with the US due to time zone difference as additional challenges. Still, Won believes that “the crazy started” when Koreans started monetizing DeFi platforms.

To bridge this disconnect, there is a consensus on making DeFi more accessible to Koreans. This includes translating resources, particularly collaborating with local organizations and promoting education.

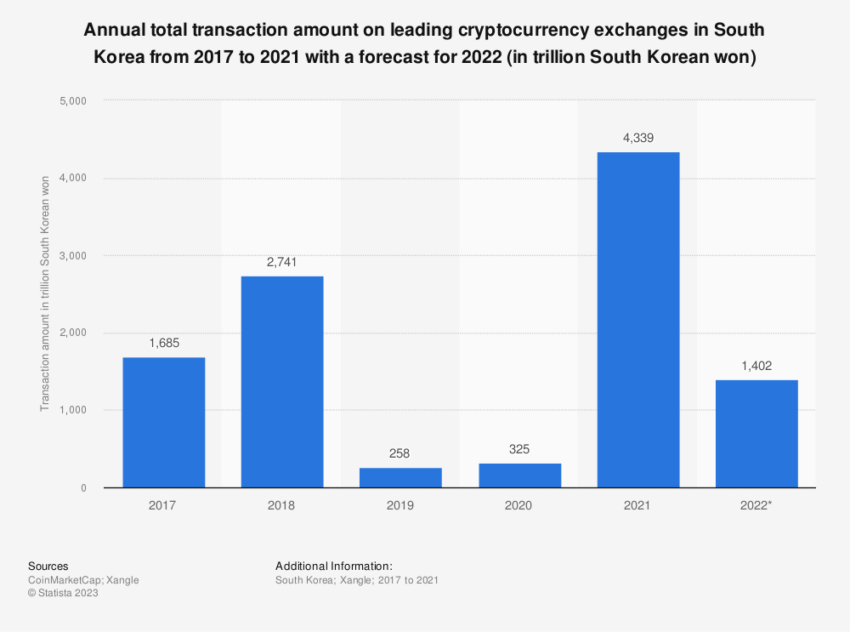

South Korea’s risk appetite grows

Another highlight of the report is that Korean investors are increasingly taking risky ways. Investors are less interested in traditional ways of accumulating wealth, such as real estate and stocks. The reason behind this is that these investors become saturated and less lucrative. This leads people to gamble because of their addictive tendencies.

According to DeFi researcher Ignas, cryptocurrencies, particularly altcoins, have provided the lure of substantial instantaneous returns that other traditional assets like gold cannot promise. But the narrative changes with DeFi. Investors prefer to stay away from foreign DeFi projects and decentralized platforms, especially due to insufficient language level. As we quoted as Kriptokoin.com, the country is also busy preparing new laws for crypto companies.