With only 272 days left until the next Bitcoin halving cycle, analysts are putting historical data back on the table. In one of them, Plan B, the famous inventor of the S2F model, shared a new trading strategy.

Bitcoin halving strategies for maximum profits

Popular forecaster Plan B is an anonymous crypto analyst who has been making pro-Bitcoin arguments and posts for years. He is known for his S2F model, which says that the flow of Bitcoin’s current supply should be measured in the same way as other commodities such as gold and silver.

Plan B believes that each 4-year cycle of Bitcoin operates in 2 different 2-year cycles. These are a bullish cycle and a bearish cycle. According to Plan B, the ascension cycle continues from 6 months before the cycle to 18 months later. This represents a 2-year ascension cycle.

[Buy bitcoin 6 months before a halving and sell 18 months after a halving] has historically beaten [buy&hold]. The next halving is in April 2024 … will this strategy work again?https://t.co/9kjaCUulwb pic.twitter.com/cbO80Ym7iC

— PlanB (@100trillionUSD) July 3, 2023

If that happens, it means the end of October 2023 rally, 6 months before the next halving cycle at the end of April. Then, this 2-year cycle will continue until October 2025. Evidence from the previous 3 halvings shows that this is the best time to buy and hold Bitcoin. It’s even better than just buying and holding, regardless of market conditions.

Binance CEO’s recommended dollar cost averaging strategy

An important investment strategy for Bitcoin is dollar cost averaging. Those who did DCA (dollar cost averaging) for BTC did a great job. Leveraging volatility, your $200 will buy more at the lows of the bear market when Bitcoin was at $3,000 and $16.00, respectively, at times like the start of the pandemic. This way you collect more crypto at a lower cost. As we quoted as Kriptokoin.com, Binance CEO CZ recently talked about this strategy.

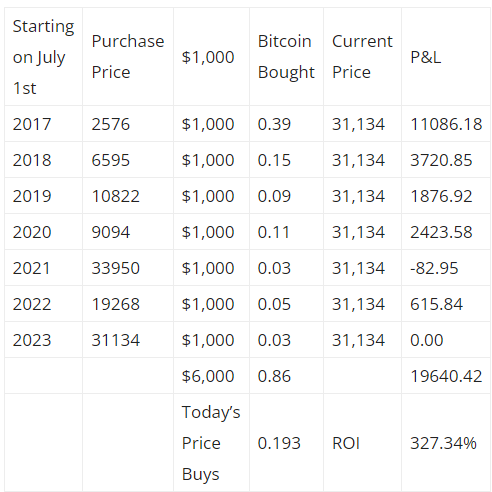

The DCA strategy is always up to date. Let’s see what it would look like if we only bought $1,000 once every July 1 for the last 6 years. Your prices will be on 1 July:

- 2017: $2576

- 2018: $6595

- 2019: $10,822

- 2020: $9094

- 2021: $33,950

- 2022: $19,268

- 2023: $31,134

More on the Bitcoin DCA strategy

In the last 6 years, your $6000 would have bought 0.86 BTC. Compare to today, where $6,000 bought only 0.19 BTC. This is a clear advantage of satoshi stacks. Also, DCA has a 327% ROI. How great is this?

Notice that our $1,000 buys us more satoshis in the fall years like 2020 and less satoshis in the up years like 2021. In this way, we use Bitcoin’s volatility to our advantage.

What is Bitcoin halving?

Bitcoin is a cryptocurrency that uses mining. It generates a new block every 10 minutes. Every 4 years, offer half the rewards to miners for this block. It started with 50 BTC as the top 10. Then 25, then 12.5 BTC. We are now at 6.25. At the end of April, less than a year from now, the reward will drop again. This time, to 3,125 BTC with each new block.