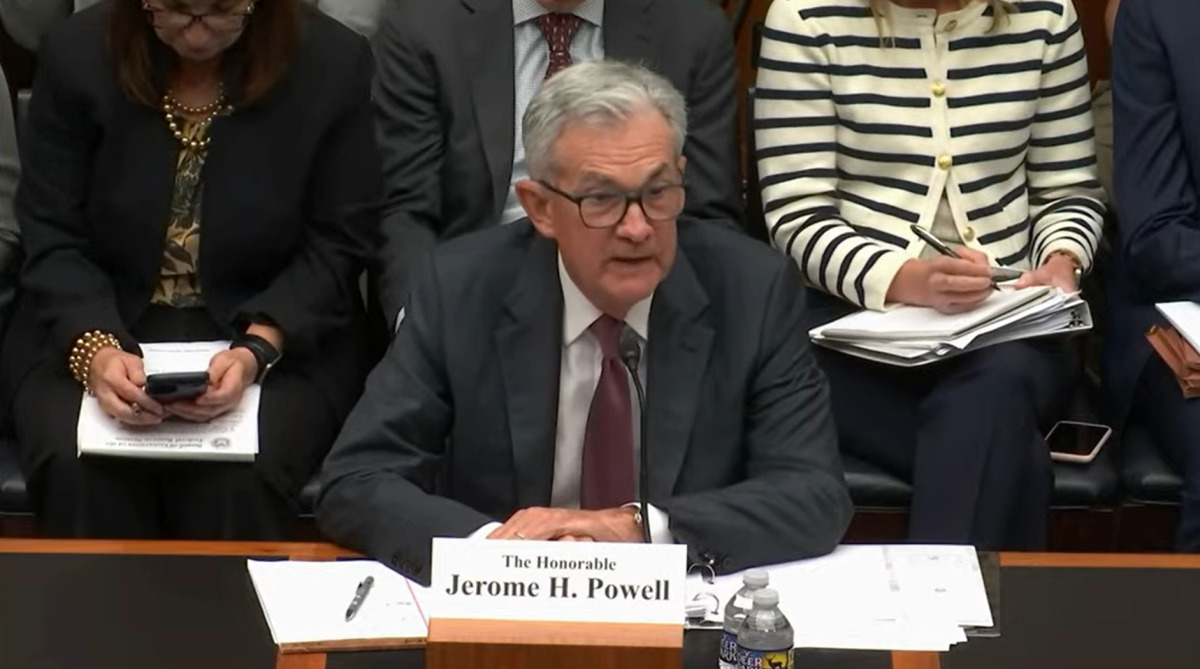

Fed Chairman Jerome Powell spoke today before the US Congress House of Representatives Financial Services Committee. In a part of the speech, which was dominated by inflation, the issue of stablecoin was also mentioned. Bitcoin is rising while the gold market remains stable. Highlights from the published text are as follows:

What did Fed Chairman Jerome Powell say today?

At the hearing, titled “The Fed’s Semi-Annual Monetary Policy Report,” congressional lawmakers had the opportunity to ask President Powell questions on a variety of topics, including funding conditions, the inflation outlook, and future monetary policy steps. Here are the key takeaways from Powell’s Q&A sessions in the US House:

There is still a significant labor shortage

- “There is an expectation that the ratio of vacant jobs to the unemployed will decrease.”

- “This is a way for the labor market to become less tight without increasing unemployment.”

- “There is still significant labor shortages.”

- “The data suggest a gradual cooling in the labor market, but there is still a significant excess demand over supply.”

- “Housing supply and demand are realigning.”

- “Housing inflation will drop significantly this year, next year.”

We are far from our inflation target

- “Our banks have very strong capital.”

- “We are far from our inflation target”

- “We are strongly committed to reducing inflation to 2 percent over time”

- “We learned from Silicon Valley that banks of this size need stronger supervision, regulation.”

- “There are situations where we need to be stronger, if not in every situation.”

Raising rates at a more moderate pace may make sense

- “The level of interest rates and the rate of interest rate hikes are different.”

- “Early in the process, speed was important, now it is less.”

- It might make sense to raise rates at a more moderate pace.”

- “Just as you can slow a car down near its destination, we soften the speed.”

- “The regulation should be transparent, consistent and not too volatile.”

- “Capital is at the heart of banking regulation.”

stablecoins

- “We see stablecoins as a form of money. It would be a mistake to weaken the role of the Fed in this context.”

The following section was aired before Jerome Powell’s speech to the US Congress.

Interest rate increase signal

The text by Jerome Powell to be presented to the House Financial Services Committee shows that the Fed Chair will reiterate that nearly all FOMC participants expect it would be appropriate to raise interest rates “a little bit more” by the end of the year.

“My colleagues and I understand the challenge posed by high inflation. We remain committed to bringing inflation back to our 2 percent target. Inflation pressures continue to be high. The process of bringing inflation back to 2% has a long way to go.”

How did the gold and bitcoin markets react?

The gold market welcomed Jerome Powell’s previous hawk comments. Now he is not reacting much to Powell’s comments as prices remain below the key near-term support at $1,950 an ounce. August gold futures were last trading at $1,940.70 an ounce, down 0.37% on the day. Technical analysis:

$Gold support test$GC back to 1936. tested a few times already this morn

the prepared remarks from Powell sound hawkish to me. Let's see if or how much he walks that back during the actual testimony https://t.co/2KsZfPcmop pic.twitter.com/t2SrKAwUUj

— James Stanley (@JStanleyFX) June 21, 2023

Bitcoin price accelerated the upward momentum after Powell’s statements. It gained an additional 2% after climbing as high as $29,200 during the day. With the recent momentum, it left behind the $29,500 region, which was the resistance level especially in the last months. Bitcoin is currently trading at $29,861.82, up over 11% on the intraday.

As Cryptokoin.com reported, ETF applications were also effective in the rise.