Market makers drew liquidity after the US SEC sued Binance and Coinbase. After that, there was complete turmoil in the market and Bitcoin and altcoin prices fell. Here are the details…

Bitcoin, Ethereum and altcoins fell hard!

The crypto market suffered a complete crash on Saturday. The global crypto market cap fell to $1.04 trillion in the last sharp drop. With more than 190,000 traders liquidated in the last 24 hours, the total liquidation reached $400 million. The largest single liquidation took place on crypto exchange OKX with $2.18 million worth of ETH-USD-SWAP.

While the Bitcoin price dropped 4%, the big drop took place in just 2 hours. BTC price dropped to a 24-hour low of $25,500. Bitcoin is currently trading around $25,700, with a high probability of a drop below the $25,000 level. Ethereum price is down 6%, with 24-hour lows and highs at $1,765 and $1,854. ETH price is currently trading below $1,750. Selling pressure continues to increase with increasing trading volumes.

Meanwhile, Filecoin (FIL), Polygon (MATIC), Cardano (ADA), Solana (SOL), Chiliz (CHZ), Sandbox (SAND), Decentraland (MANA), Axie Infinity (AXS) and similar altcoins are 25% off. It has seen more than . Meme coin Shiba Inu (SHIB) dropped 30% on the day, leading the crypto market crash. On the other hand, some buying was recorded from the decline.

Reasons behind its collapse in Bitcoin and altcoins

There have been massive purges of cryptocurrencies named in lawsuits filed by the US SEC against Coinbase and Binance. However, the massive liquidation came after Binance.US stopped supporting USD fiat on the exchange. Also, Robinhood’s delisting of Solana (SOL), Cardano (ADA) and Polygon (MATIC) increased this.

As you follow on Kriptokoin.com, the US SEC mentioned BNB, BUSD, SOL, ADA, MATIC, FIL, ATOM, SAND, MANA, ALGO, AXS and COTI as securities in the Binance lawsuit. The agency listed SOL, ADA, MATIC, FIL, SAND, AXS, CHZ, FLOW, ICP, NEAR, VGX, DASH, and NEXO as securities in the Coinbase lawsuit.

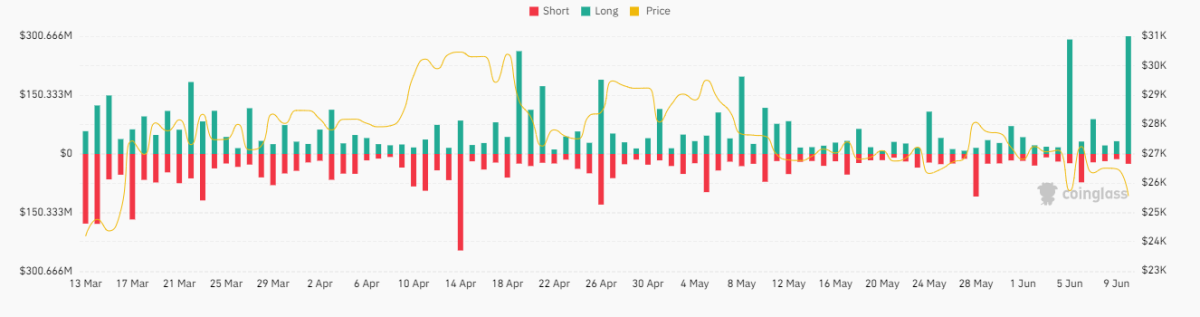

According to Coinglass, over $300 million long positions have been liquidated in the last 24 hours. In addition, $30 million of short positions were liquidated. Liquidations largely took place at Binance, OKX, and Bybit. When we look at the details of these, we can see BTC ($ 50 million), ETH ($ 46 million), ADA ($ 17 million), SOL ($ 16 million), LTC ($ 12 million), DOGE ($ 11 million), BNB ($ 10 million). dollars), FIL ($10 million), and MATIC ($9 million).

Crypto Market Liquidation / Source: Coinglass

Crypto Market Liquidation / Source: CoinglassAnother factor was Grayscale Investments. The company has submitted a request to the US SEC to withdraw the Statement of Trust Registration on Form 10 for the Grayscale Filecoin Trust. SEC staff continue to view Filecoin (FIL) as a security. But Grayscale says it will continue to believe that the FIL is not a security.

On the other hand, market makers like Jump Crypto and Cumberland pulled all liquidity from altcoins. Market makers have been caught throwing major cryptos on Binance and Coinbase exchanges. Binance.US partners were reluctant to work with the exchange, causing a huge sell-off in the market. Moreover, more than 4 trillion Shiba Inu (SHIB) tokens worth millions were moved from Shiba Staking to crypto exchange Binance. This triggered a selling wave in SHIB and BONE prices. Scimitar Capital, the hedge fund said to be behind the massive $2 billion altcoin liquidation, said:

Our fund has made the strategic decision to liquidate our crypto assets and return the capital to our valuable LPs. We believe this move will provide more stability and opportunity.

[BREAKING]

The fund that liquidated $2B of altcoins late Friday night in the broad crypto selloff is rumored to be Scimitar Capital pic.twitter.com/e23mbpuJda

— thiccy (@thiccythot_) June 10, 2023

Binance CEO’s views on the market drop

Changpeng Zhao, CEO of Binance, targeted by the SEC, said no one really knows why the market is rising or falling. He also noted that in a market there are many sellers and buyers, each with their own reasons. In this context, CZ shared the following:

Why is the market rising or falling? Nobody really knows. Many people claim to know and can often attribute it to a single (often wrong) cause. In reality, there are many sellers and buyers in a market, and everyone has their own reasons.

https://twitter.com/cz_binance/status/1667439122137358336