Liquid staking derivatives has been one of the biggest narratives of 2023 behind the Shapella upgrade for Ethereum. One such altcoin project, Lybra Finance, also benefited from this narrative. Altcoin has seen a remarkable increase in recent days. However, a whale went up for sale today, despite being in a state of harm. After that, the LBR price saw a sharp decline.

The whale, which collected altcoins, went on sale at a loss! price drops

Lybra Protocol (LBR) is a decentralized protocol designed to bring stability to the volatile world of cryptocurrency. The developers built the project on LSD (Liquid Staking Derivatives). The primary purpose of the protocol is to provide the cryptocurrency industry with eUSD, a safer, more decentralized stablecoin that offers stable interest to token holders. As a DeFi protocol, Lybra facilitates the issuance of eUSD by allowing users to borrow against their deposited ETH and stETH.

LBR price started a journey from $2.5 to $4.5 a week ago. However, the altcoin entered bearish territory in the last days of last month. Today, this decline has deepened even more. A whale selling at a loss also had an effect on this. The cryptocurrency whale in question sold off 130,000 LBR with a loss of approximately $85,635 (45 ETH) today. Looking at the on-chain movements of the whale, we see that it paid 50 ETH for 68,259 LBR on May 20. He also paid another 100 ETH for 50,944 LBR 5 days ago. Finally, he paid another 25 ETH for 11,467 LBR for 4 days. By the time he made this purchase, the altcoin had reached an all-time high. The whale we are talking about went on sale when the token price was $ 2.2. Paying a total of 175 ETH for all these purchases, the whale sold all its assets for 130 ETH. Thus, he lost 45 ETH from this trade.

The altcoin is trading at $1.34 at press time, down about 32% on a daily basis. Besides, LBR saw a 52% loss on a weekly basis as well. On the other hand, it still earns its investors over 300% on a monthly basis.

LBR 1-day price chart / Source: CoinMarketCap

LBR 1-day price chart / Source: CoinMarketCapLybra Finance took the market by storm!

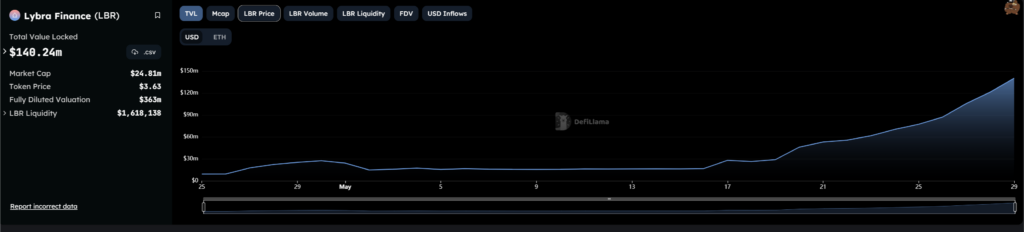

As we reported on Kriptokoin.com, Lybra Finance’s total locked value (TVL) has increased by nearly 800% over the past two weeks, reaching $140,243 million 6 days ago.

Source: DefiLlama

Source: DefiLlamaLaunched a month ago, Lybra’s increase in TVL coincided with Lido’s upgrade to v2 on May 15. The project allowed Lido users to resolve their stETH and get their ETH back. According to information from the Lybra project, the protocol “uses ETH and stETH as its main components. It also plans to support other LSD assets in the future.