Bitcoin (BTC) is changing hands around $27,500 today as markets prepare for positive US inflation data. So what’s next?

CPI prepares to decline for months

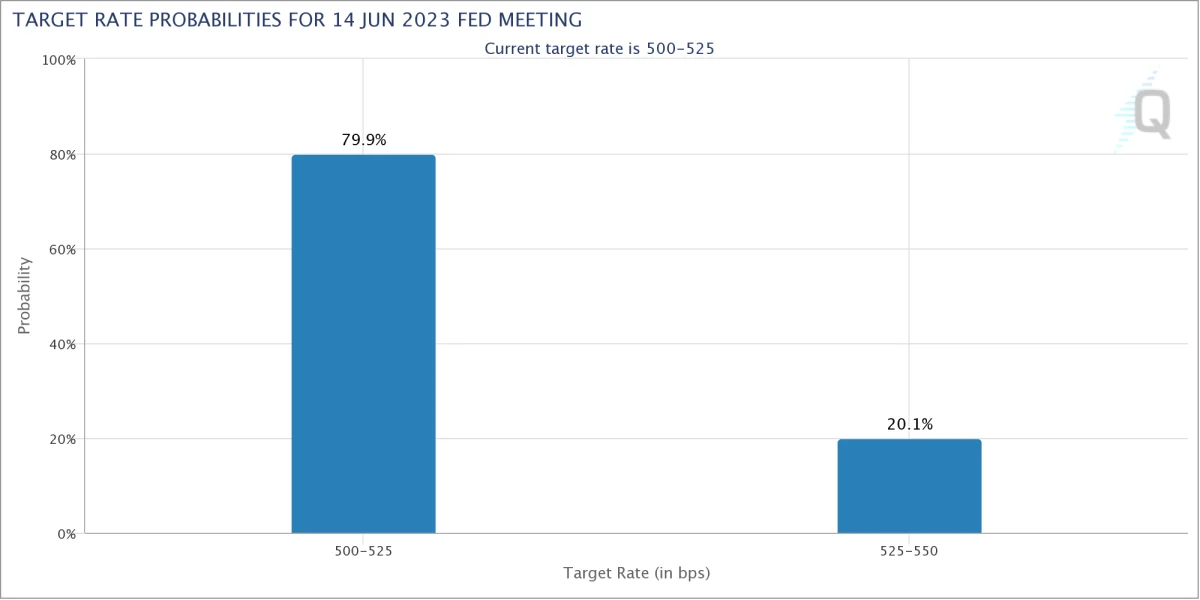

The data followed BTC/USD, which lingered in a tight trading range ahead of the April Consumer Price Index (CPI) release. A classic volatility catalyst for risk assets, the CPI is one of the key metrics the Fed considers when changing interest rates. There’s still one more month until the next rate change. However, government and private sector measures predict that the decline in inflation will continue and even accelerate in the coming months.

Finance commentator Tedtalksmacro said in a May 9 episode of his YouTube analysis, “There’s a bit of a recession right now. But there is a gradual decline in inflation over the next two to three months. In fact, we are likely to see a pretty sharp decline,” he said. Tedtalksmacro cited “Trueflation” both in the Cleveland Fed inflation forecast and separately, which is an unofficial leading indicator for inflation trends, indicating further significant declines. In his tweet, the analyst pointed to the following five levels:

CPI gameplan for #Bitcoin

Above 5.5% –> $25,000 (4% probability)

5.3% to 5.5%–> $26,500 (25% probability)

5.0% to 5.2% –> $28,500 (50% probability)

4.7% to 4.9% –> $29,000 (20% probability)

4.5% or lower –> $30,000+ (1% probability)

*Probabilities according to JPMorgan

— tedtalksmacro (@tedtalksmacro) May 10, 2023

In other words, the analyst believes that if the inflation rate is above 5.5 percent, BTC will see 25,000, and if it comes between 4.7-4.9 percent, $ 29,000. In his next tweet during the day, Tedtalksmacro separately outlined potential BTC price changes based on various possible CPI figures, along with probabilities according to JPMorgan Chase. CME Group’s FedWatch tool also shed light on the expectations. FedWatch pointed out that the Fed will pause interest rate hikes in June to control inflation. Because the expectations for such a move were at 80 percent at the time of this writing.

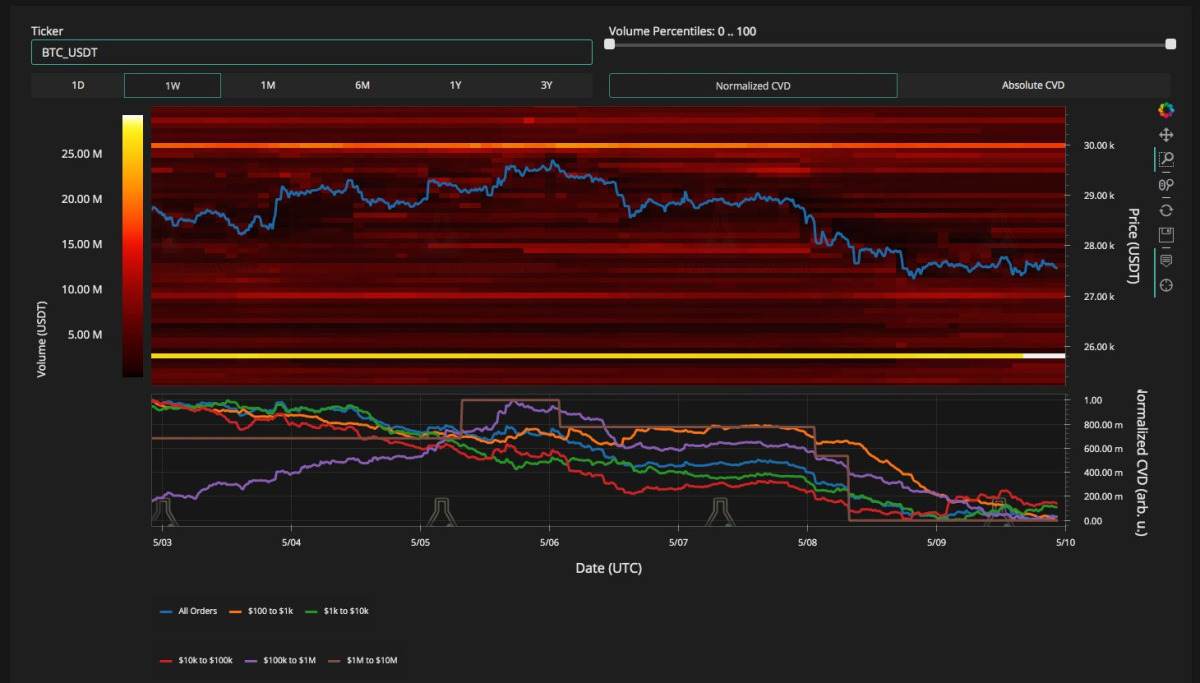

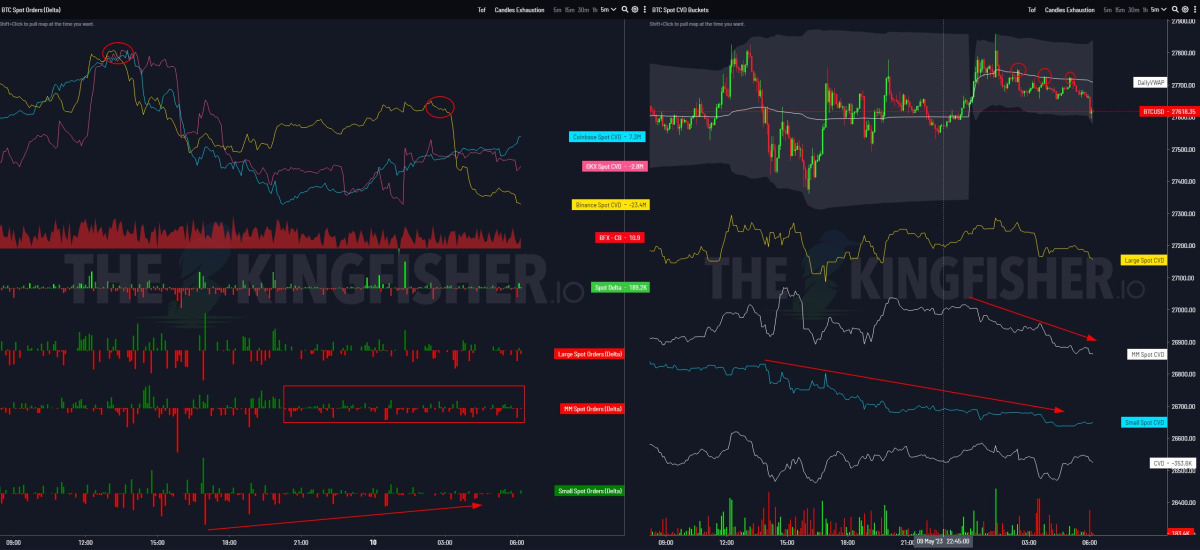

Bitcoin traders on Binance boost spot selling

Returning to the short-term BTC price action, the Binance “FUD” event at the beginning of the week draws attention. The lasting impact of this event has caused Bitcoin bulls to fail to reclaim levels close to $30,000. You can review Binance FUD in this article, which we shared as Kriptokoin.com. The monitoring resource Skew, which analyzes the status quo among traders, also pointed to interesting data. Skew said the market was “saturated with short positions.” He also noted that market makers are still selling on small price increases.

“Binance spot is in the offensive position selling the market today,” part of the Twitter comment read. Other monitoring resource Material Indicators pointed to the overnight shift in Binance’s BTC/USD order book. Material Indicators noted that this pair has increased bid liquidity just below the $26,000 mark. Among the comments in the chart, one wonders how the economic reports will affect the liquidity in the order book. Also, for many, the main question is whether to clear some of the orders in the ledger right now. Because local support and resistance is likely to be isolated by trade walls.