Nonfarm Payrolls in the US are expected to increase by approximately 179,000 in April. The data will be announced today at 15:30. If the figure comes in below the expected level, the Bitcoin price may show a bearish trend. In the gold market, employment data is easing ahead after bulls set new ATH.

Bitcoin price awaits US nonfarm payrolls data

Bitcoin price is currently trading just above $29,000. Its rise to over $30,000 and its performance for the rest of the weekend are directly tied to US employment data. Also known as a Nonfarm Employment report or jobs report, the data shows the number of jobs added in the last month. According to the reports;

- Better numbers expected indicate that the market is strong right now and people’s spending power is increasing. This will eventually move away from Bitcoin price as the broader market hints at a bearish dollar strengthening.

- On the contrary, if the report comes in below the expected numbers, then the crypto market will take action. This is because the US Dollar weakens, potentially diverting capital to Bitcoin.

However, expectations are that April added around 180,000 jobs. According to FXStreet principal analyst Eren Sengezer’s analysis:

Markets believe that the Federal Reserve will not change its policy in June, despite Chairman Jerome Powell’s post-meeting press conference refraining from committing to a pause in the tightening cycle. A recovery could be seen in US Treasury bond yields and the US Dollar (USD) as the April jobs report confirms tight labor market conditions with a strong rise in Non-Farm Employment (NFP) close to 250,000.

Investors are asking which way Bitcoin price will go over the weekend

According to expectations, if the US jobs report comes in above expectations, the cryptocurrency market will see a bearish effect. BTC could dip below $28,000, which coincides with the 50-day EMA and the 100-day EMA. In case of further declines, the $26,000 region will act as support.

https://twitter.com/YouHodler/status/1654131835344158722

Conversely, if the employment report falls short of forecasts, Bitcoin price will target $30,000. This price point, which is a critical resistance, will prepare the BTC price for further increases. So the next 24 hours will be important for Bitcoin in determining the path the market will take over the weekend.

Gold market awaits NFP data after new ATH

The Federal Reserve (Fed) hints at a pause after raising interest rates to 2007 levels. Following this, mixed US data on Thursday and rising market bets on the Fed’s September 2023 rate hike are adding strength to the gold price increase. Additionally, banking problems in the US and fears of ending the debt ceiling are also straining XAU/USD investors.

Alternatively, given strong early signals, China’s softer PMIs and possible difficulties for the US jobs report to meet pessimistic forecasts are angering gold sellers. Moving on, the monthly prints of the April US jobs report will be important to watch for clear directions.

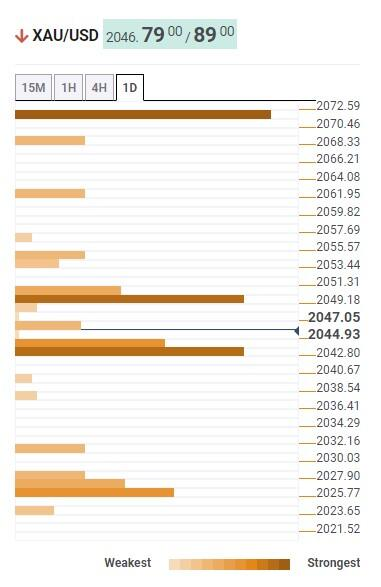

Key levels to watch in gold price

According to the indicators, the gold price is fluctuating above the support turning into resistance at $2,042, which includes the one-day upper Bollinger band, one-month Pivot Point R1 and one-week Pivot Point R3. A clear drop from $2,042 will lead to the $2,027 support zone. It is worth noting that a downside break from $2,027 could remind of the round figure at $2,000.

On the contrary, the previous month’s high is putting tough resistance to gold buyers in the $2,053 region. Following this, a quick rally towards $2,073 will be an important level for the bulls to watch ahead of $2,100. As Kriptokoin.com, we will be conveying the first impact of the US non-farm employment data on the price at 15:30 on this page.