A crypto analyst who sold Bitcoin and Litecoins at high profits, which he bought during the FTX crisis last week, is warning of a major collapse this time.

Analyst who knows about Bitcoin crashes expects more losses

The popular crypto analyst nicknamed DonAlt successfully closed all his positions at the November 2021 summit. Then, he bought it again in November 2022 when Bitcoin, Litecoin, and XRP prices crashed during the FTX crisis. As the crypto market rose again in April 2023, he announced that he had closed all his positions and cashed in.

The accurate analyst, in his current analysis, suggests that the cryptocurrency market will show a decline in the short term. This is because of the drastic price movements that prey on leveraged investors. Bitcoin, which fell hard with the news of Fud yesterday, led to a long liquidation of 320 million dollars, as we quoted as Kriptokoin.com.

DonAlt finds the Bitcoin price zone between $20,000-30,000 to be quite dangerous given the current market conditions. In his latest analysis, he warned that leveraged traders could suffer more. According to their analysis:

Under $30,000 and over $20,000 are lies. We are in the market stage where we shed the blood of all leverage traders, and the BTC price will go up or down as needed within these limits to kill them.

Anything below $30k and above $20k is a lie

We're in the phase of the market in which we bleed out all the leverage traders and it'll go as far up or down in those boundaries as it needs to, to kill em

IMO anyways, have fun, don't get liq'd

— DonAlt (@CryptoDonAlt) April 26, 2023

DonAlt watches Bitcoin price movements in this region

DonAlt said last week that Bitcoin will re-enter the market once it drops to $20,000 or rises above $30,000. According to DonAlt, it makes more sense to stay on the sidelines as long as Bitcoin is trading between these two levels. The analyst plans to evaluate only the positions that will come from these two levels:

The general plan for me: If we manage to get back $30,000, I’ll get back the BTC I sold at around $30,200. If we test $20,000 again, I’ll do the same thing I sold. Choose to stay calm between the two.

General plan for me is:

Buy back BTC I sold at ~$30.2 if we manage to reclaim $30k

Buy back BTC I sold if we retest $20k

Chill in between both of those

— DonAlt (@CryptoDonAlt) April 22, 2023

How about the BTC price?

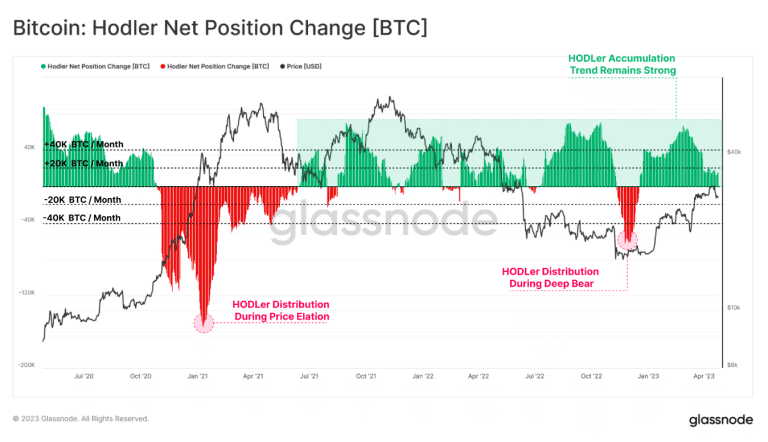

While the price of Bitcoin has been rocking wildly over the past 48 hours, it has given some investors an edge. Meanwhile, Bitcoin HODLers continued to rise, continuing to accumulate despite market volatility. In terms of price, BTC embarked on a bumpy journey with some dramatic fluctuations as it approached the close of April 27.

On the daily chart, it hit a high above $30,000. It dropped to just about $27,000 over the same period. At the end of the trade, BTC was trading at around $28,500.

According to data from Santiment, Bitcoin’s rise to the $30,000 range was accompanied by a significant increase in trading volume. Recent data from Glassnode revealed an increase in the accumulation rate by BTC Hodlers. The chart below shows a consistent upward change in position, reflecting a sustained phase of accumulation, despite the price drop and significant fluctuations.

Despite recent market volatility, the metric shows that especially long-term investors remain. BTC is now trading above $29,000 again after losses from the last 48 hours.