The cryptocurrency market has faced a turbulent journey as it tries to find stable ground amid swirling financial flows. Why has Bitcoin dropped this week? What do technical and on-chain analysis say? We answered all the questions in this article.

Why has Bitcoin (BTC) dropped this week?

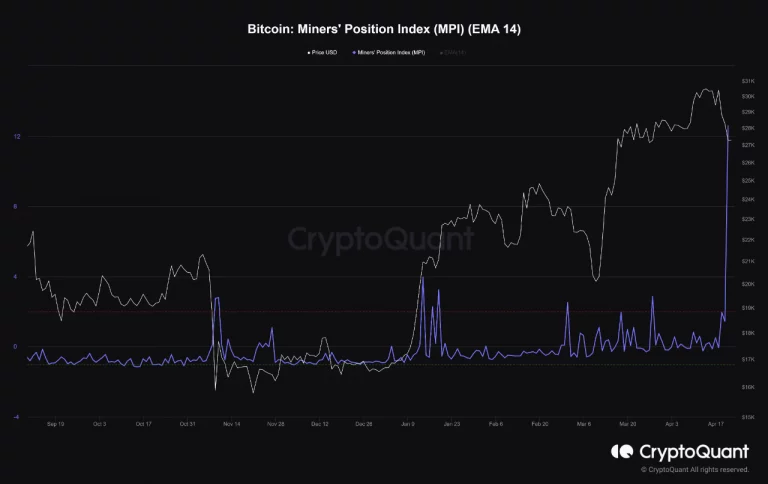

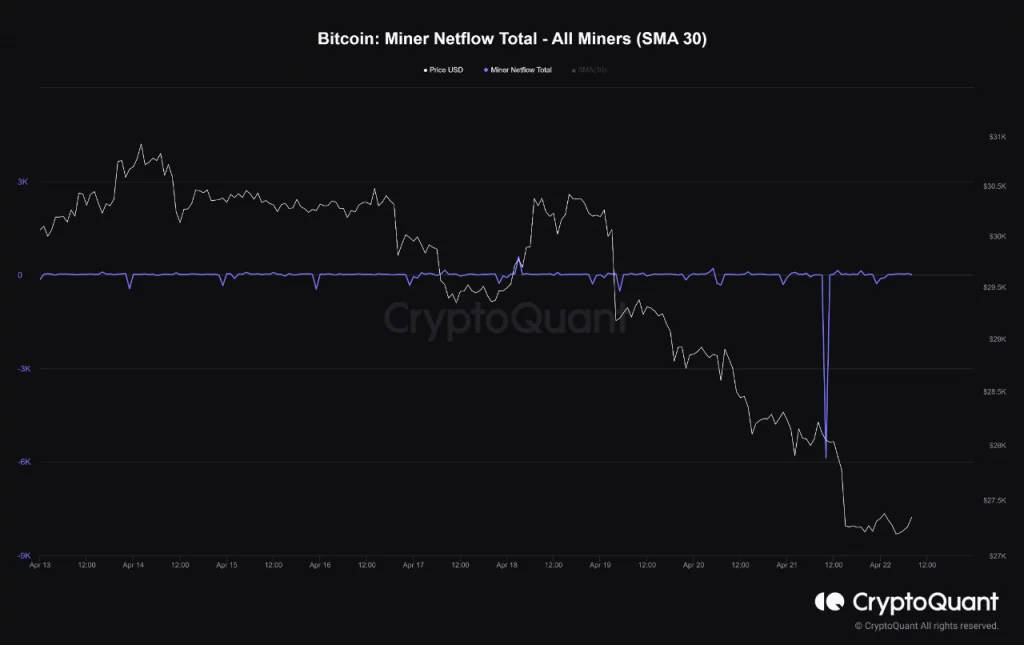

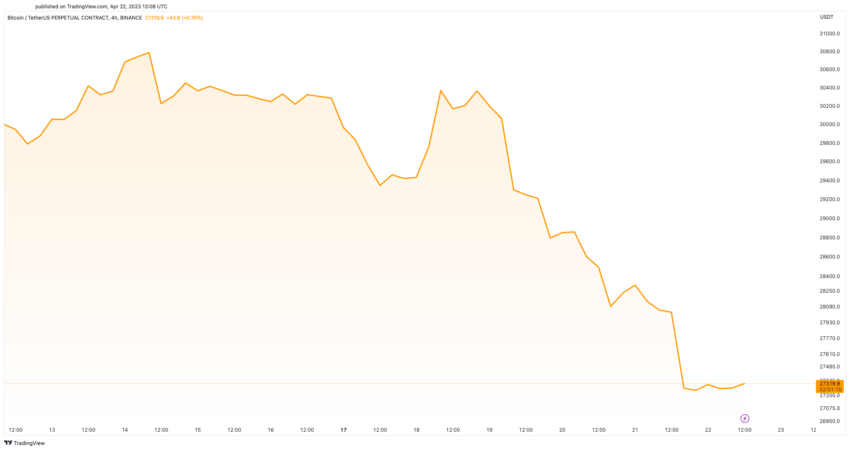

According to a recent report from CryptoQuant, the Bitcoin price has reached $27,200, a significant drop of around 10% since the start of the week. The drop comes alongside the increase in the MPI index, which shows that miners are converting more Bitcoin.

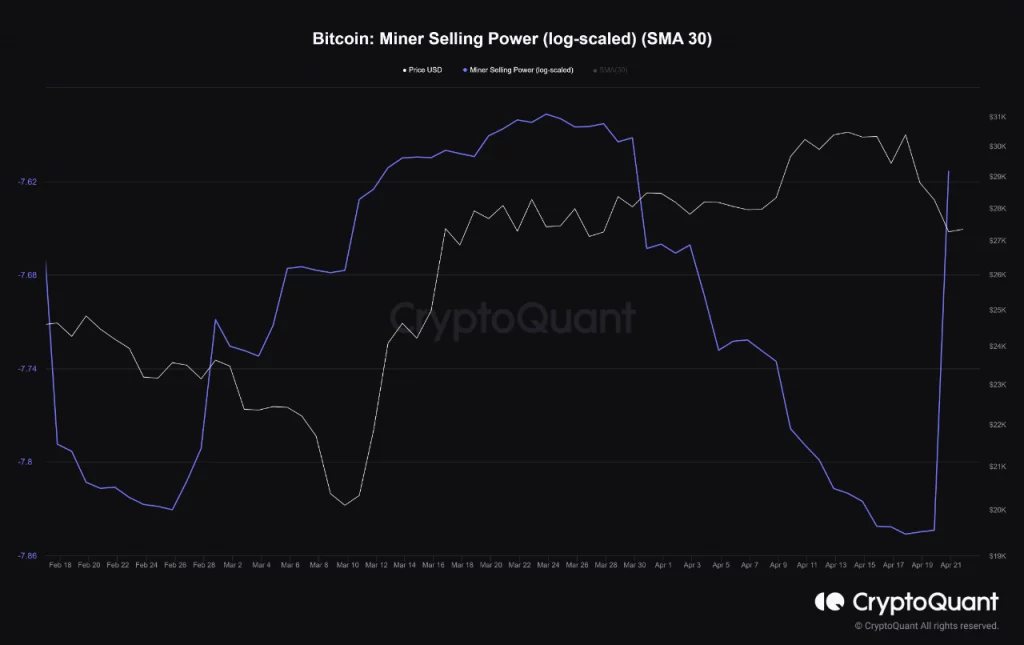

In addition, there was a noticeable increase in both the miner exit index and the sales index of miners, while there was a decrease in miners’ reserves. All these factors indicate that there has been selling pressure from miners in the last few days.

Interestingly, the Bitcoin mining cost also reached around $27,200, which is pretty close to the current price. This drop can be seen as a correction for BTC price and could stabilize in the 27,200-26,600 range if selling pressure subsides.

Analysts interpret the latest drop as a temporary correction in the market.

The volatility in Bitcoin’s price is a well-known phenomenon, and after many sharp declines there has been rapid recovery. This time, however, the selling pressure from miners is a new development that could have a more significant impact on the market.

As the market adjusts to these changes, there are still many questions about what the future holds for BTC. Will the selling pressure from miners continue or will we see this trend reverse? Only time will tell.

Overall, the recent drop in Bitcoin’s price was a significant development in the cryptocurrency market. While it may be troubling for some investors, it’s important to remember that volatility is a natural part of the tides in the market.

What’s next for Bitcoin?

On-chain analysis revealed a notable increase in Bitcoin exchange exits, potentially indicating an uptrend for the BTC price. A CryptoQuant analyst emphasizes that a significant amount of 2,138 BTC was withdrawn from centralized exchanges in the past day, which has again aroused interest among market watchers.

Technically speaking, Bitcoin price has stopped falling further as it found stable support at $27.5K. BTC rallied above the 23.6% Fib level after forming a bottom near $27,140, implying that traders are accumulating bearish BTC.

However, a recovery from $27,000 is expected and the bulls could send BTC price above the EMA-20 trendline. If bitcoin rises above $27.8k, the bullish rally could continue towards $28.5k. A successful break above the EMA-20 will lead BTC price back to its previous bullish range of $30,000.

As Kriptokoin.com, we have included what analyst Ben Lily said about the important 200-day MA in this article.

Why is the Bitcoin price falling?

Besides the above factors, the BTC price drop can be attributed to several factors, each of which plays a crucial role in shaping the market landscape. By understanding these drivers, traders can better predict price fluctuations and maximize profits.

- Market Sentiment: The collective sentiment of investors and traders can significantly affect the price of Bitcoin. Fear, uncertainty and doubt (FUD) can lead to rapid selling, while optimism and positive news can push the price higher.

- Regulatory changes: Government policies and regulations surrounding crypto can affect the price of Bitcoin. Stricter regulations or adverse policy changes can reduce investor confidence, causing the Bitcoin price to plummet, while appropriate regulation can increase market enthusiasm.

- Technological advances: Innovations and improvements in Bitcoin’s underlying technology and the broader Blockchain ecosystem can affect its price. For example, advances that improve transaction speed, security, or scalability can increase investor confidence and raise the price. Conversely, security vulnerabilities or technological glitches could cause the Bitcoin price to plummet.

- Macroeconomic trends: Global economic events such as recessions, financial crises, or geopolitical tensions can affect the Bitcoin price. In times of economic uncertainty, investors may flock to alternative assets like Bitcoin, while a stable economic environment may see a drop in demand, causing the price of Bitcoin to plummet.