USDC, one of the popular altcoin projects, temporarily lost its peg at 1 dollar. On the other hand, Jeremy Allaire, CEO of USDC issuing company Circle, made various statements. Here are the details of what happened…

SEC should not be commissioned on stablecoins, Circle CEO says

Circle CEO Jeremy Alliare argues that the US financial regulator, the SEC, should not regulate stablecoins. On the other hand, the stablecoin USD Coin (USDC), issued by Circle, temporarily lost the 1 dollar parity with the US dollar. Circle CEO Jeremy Allaire told Bloomberg in a recent interview that the US Securities and Exchange Commission (SEC) should not be tasked with stablecoin regulation. Allaire argues that stablecoins are payment systems, not “securities.” Allaire quoted:

I don’t think the SEC is a suitable regulator for stablecoins. There is a reason why governments say payment stablecoins in particular are a payment system and banking regulatory activity.

As we reported on cryptocoin.com, Circle maintained its stance that “not all stablecoins are created equal” when the SEC issued a Wells Notice to Paxos, which issued the stablecoin Binance USD (BUSD). Because stablecoins like USDC are payment systems, it “tacitly” excludes stablecoins from classification as securities, according to Circle. That said, the Circle CEO said he favors a recent proposal from the SEC on crypto oversight that would make it much more difficult for exchanges in general to offer custody services. He drew attention to the importance of providing quality custody services.

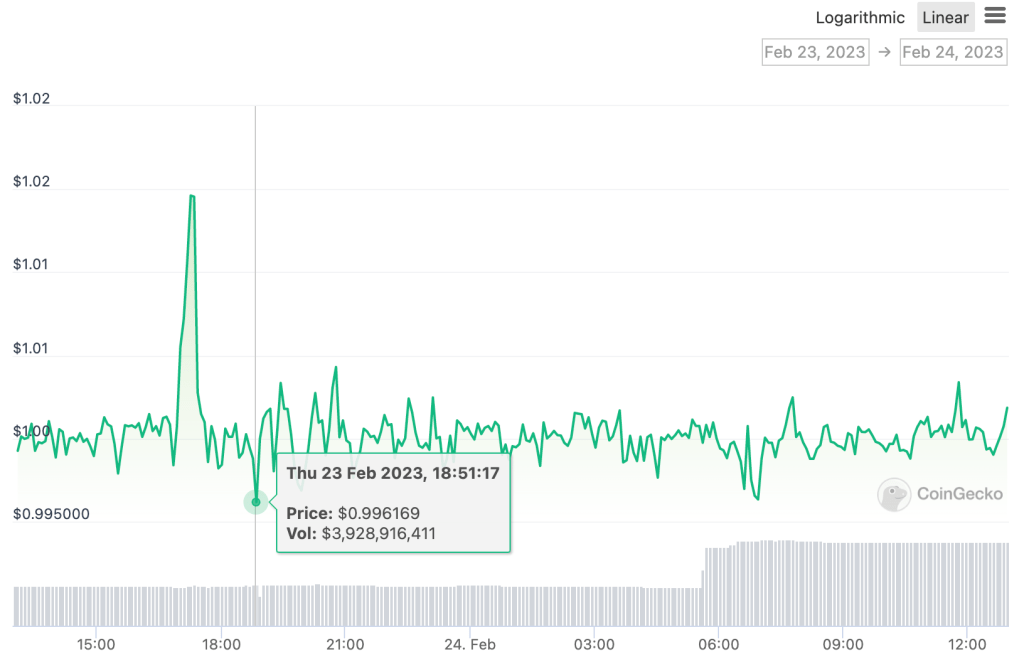

Popular altcoin loses dollar peg

The stablecoin USDC, issued by Circle, has temporarily lost its 1 dollar parity with the US Dollar. USDC dropped to a 24-hour low of $0.9961 before returning to the $1 level. The stablecoin has experienced a temporary de-peg event several times since February 23, as the chart below shows. The US SEC has yet to comment on its stance on Circle’s stablecoin.

Circle is the issuer of USD Coin (USDC), the second largest stablecoin in the world. It has a circulating supply of $42.2 billion, providing a market share of 31 percent. Tether remains the dominant stablecoin with a supply of $70.6 billion and a market share of 52 percent, according to CoinGecko. The US financial regulator recently launched its crackdown on stablecoin issuers and cryptocurrency exchange platforms. On February 23, Allaire announced that he was joining SEC Commissioner Hester Peirce, who said the agency should appeal to Congress. Due to the lack of legislation, some believe the SEC has taken over its responsibilities regarding crypto regulation and enforcement.