According to analysts, Bitcoin Dominance will set the pace for another strong cryptocurrency market performance in February. As Kriptokoin.com, we have compiled the crypto money predictions for February for you.

Can Bitcoin maintain its dominance and price surge in February 2023?

Cryptocurrency market cap regained $1 trillion in January after hiding below $800 billion for most of the second half of 2022. The rebound is largely due to BTC’s strong performance in January.

Slowing inflation and rising institutional demand played a key role as Bitcoin dominance rose 3% to reach a 7-month high of nearly 45%.

Similarly, the ETH/BTC price ratio also showed that Bitcoin gained 30% in value compared to Ethereum in the same period. This shows that investors are firmly gravitating towards Bitcoin so far in 2023.

The short-term bullish trend in the Bitcoin dominance index has consistently been positively correlated with altcoin price uptrends and global crypto market cap. Conversely, big dips in BTC dominance are also synonymous with big bearish crypto trends.

Bitcoin holders keep prices here

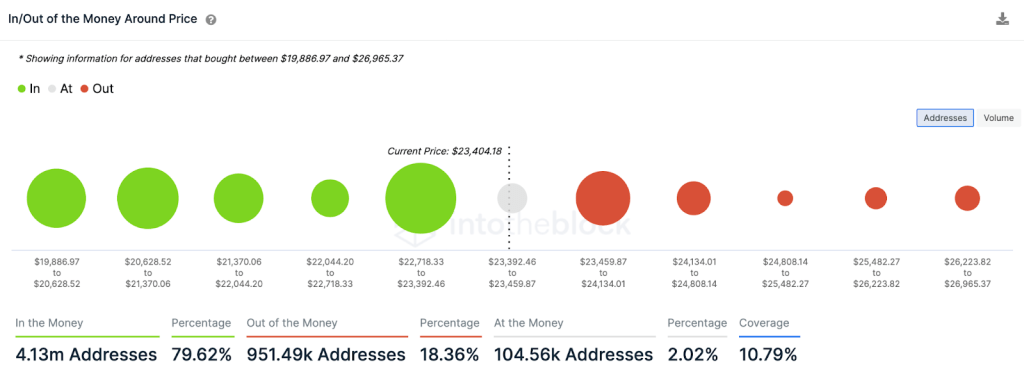

The Bulls had predicted a rise towards $25,000 in February. The broader crypto industry is poised to maintain its coveted $1 trillion valuation. Especially if BTC is holding the key $22,500 support point. From 5 million unique on-chain wallets tracked by IntoTheBlock IOMAP data sources. 36% of BTC holders In The Money are currently clustered around the $22,000 – $23,000 support point.

IOMAP stands for ‘Input-Output Market Analysis’ or ‘Money In/Out from Price’ and is a technique used to make predictions about future crypto prices based on the unrealized profit or loss positions of the distribution of token holders in a blockchain network. Historically, Holders are most likely to sell their tokens when the price reaches the average breakeven point.

Investors use IOMAP to determine key price levels at which to place large buy or sell orders by comparing the average cost of tokens held in specific wallets with current Bitcoin market prices. However, Bitcoin may face strong resistance on its march towards the $25,000 mark. Also, a sudden increase in Hash Rate and Bitcoin transaction fees could pose a serious threat to BTC dominance in February.

Bitcoin hash rate surge could trigger another miner sale in February 2023

Bitcoin Hashrate is increasing due to the rising BTC prices causing more miners to join the network rapidly. Hash rate measures the total computing power used to mine a Bitcoin block. It showed an increase of over 25%, reaching an all-time high of 295 million terahash per second on January 30.

Bitcoin’s hash strength indicates its resistance to attacks. This provides a consistent increase in mining difficulty and also means that miners now have to compete for limited block rewards.

Mining difficulty is predicted to hit an all-time high in February as more miners start putting their machines into operation. Especially if Bitcoin continues to maintain its uptrend.

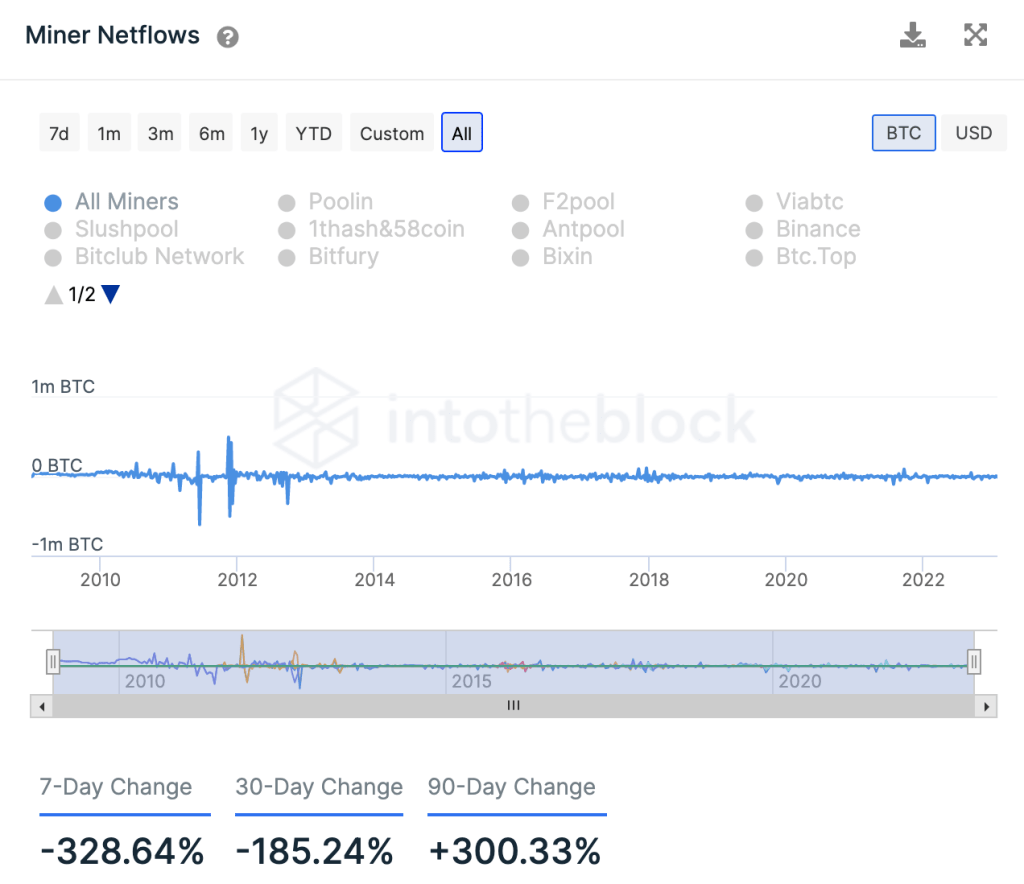

However, the trading activity of Bitcoin miners can also significantly slow down the ongoing bullish trend. Miners currently hold about 10% of the total BTC in circulation. This means that the business activity of miners is a major driver of price trends in the short term. On-chain data currently shows a net drop of 185% in the last 30 days in the balances of top miners.

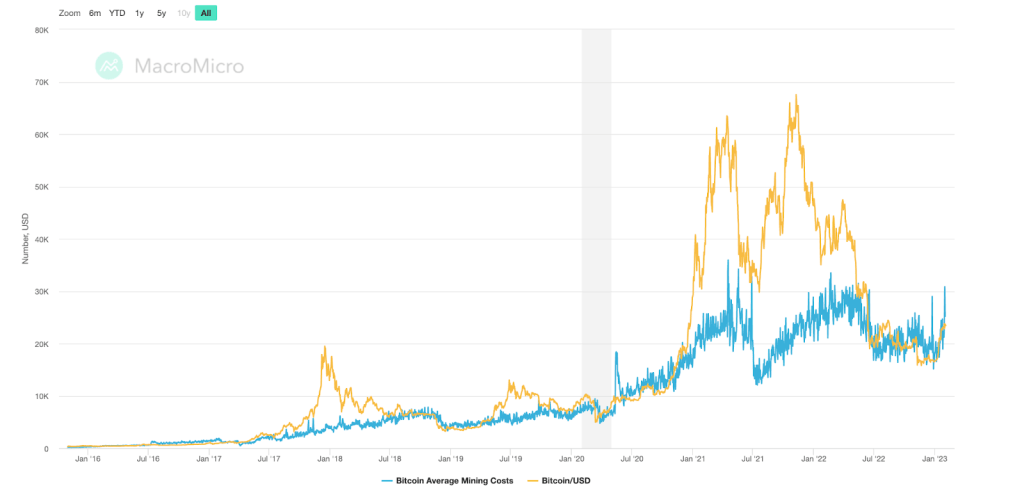

Mining costs climb again

MacroMicro, an analytics platform affiliated with the University of Cambridge, provides Bitcoin mining cost data. By observing global electricity consumption and daily bitcoin issuance.

However, the Average Cost of issuing a Bitcoin block exceeds the BTC/USD price. Miners are encouraged to increase their reserves. If the price of BTC can surpass $25,000, miner selling pressure could ease significantly. Miner accumulation will put BTC in a good place for a sustained bull run in the first quarter of 2023.

Bitcoin NFTs could raise transaction fees

Bitcoin transaction fees are on the rise. This is because it is a newly launched protocol that allows Bitcoin users to print hundreds of NFTs on the Bitcoin network for the first time. Previously, most NFT collections were primarily broadcast on Ethereum and other EVM compatible networks.

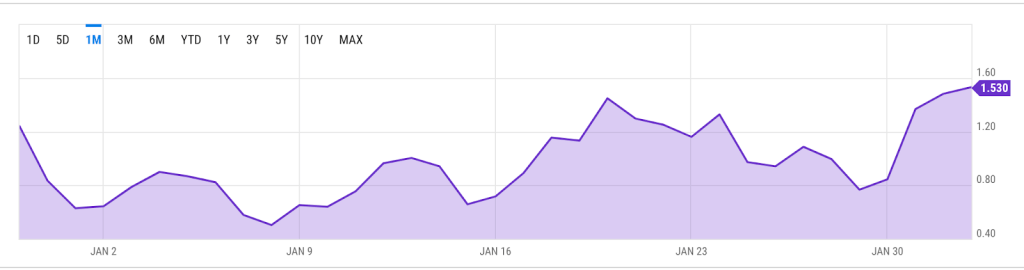

Ordinals, a Bitcoin-specific NFT protocol launched in January, has sparked a fee hike on the leading crypto network as hundreds of users begin printing digital artifacts. Following the launch of Ordinals on January 21, 2023, average transaction fees on the Bitcoin network rose above $1.50 as competition for block space escalated.

Bitcoin Average Transaction Fee measures the average fee in USD for each transaction processed by miners. Average Bitcoin transaction fees can increase during times of network congestion, such as after the launch of Ordinals. The fee increase has sparked a touchy debate in the Bitcoin community between scalability issues and competitive estimates for block space.

Bitcoin transaction fees are largely determined by the size of a transaction and the demand for block space. The popularity of the Ordinals platform is growing, with competition for block size expected to lead to a steady rise in transaction fees. This could see Bitcoin losing some of its Dominance points in February as transactional users start switching to alternative networks to avoid paying huge fees. Still, many Bitcoin developers stood behind the NFT platform, citing its potential to expand the network’s utility and increase adoption.

Ethereum to close February 2023 with net supply decline

After the merger was completed and the Ethereum Improvement Proposal (EIP)-1559 was implemented, Ethereum effectively became deflationary. EIP 1559 provides a mechanism for burning gas fees paid for transactions on the network.

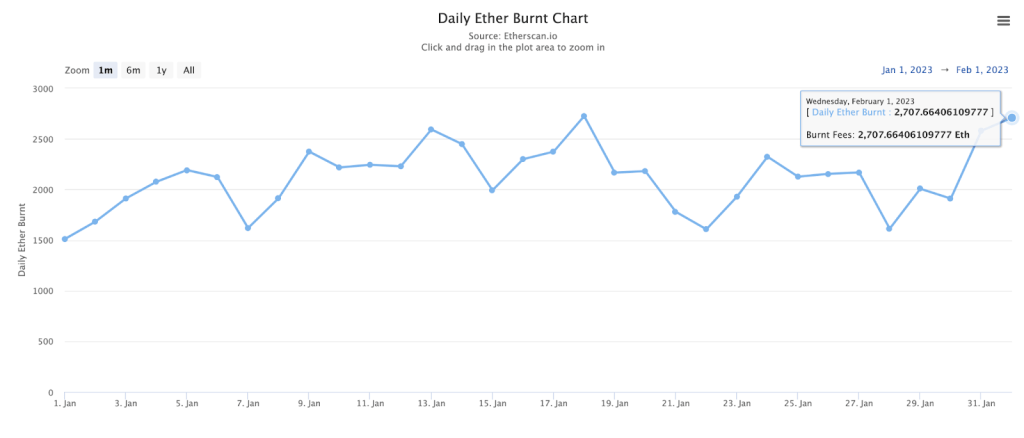

The write mechanism depends on the density of transactions in the network usage. This means that the more transactions there are on the blockchain, the more ETH is burned. The data shows that the increase in NFT transactions on platforms like Opensea is responsible for the recent increase in ETH burning.

Ethereum PoS has burned $108 million so far

According to on-chain data provided by Ultrasound Money, more than 65,000 ETH has been burned since the beginning of the year. OpenSea topped the Burn Leaderboard in January with ~5,000 ETH currently burned.

NFT transactions are known to move in conjunction with the price trends of the crypto markets. If Bitcoin and the rest of the crypto market maintain their bullish outlook, ETH could lose February in a Net-negative supply position. However, this is not expected to cause a breakout in ETH prices in February, as on-chain data shows that investors are already pricing in the deflationary stance at the current valuation.

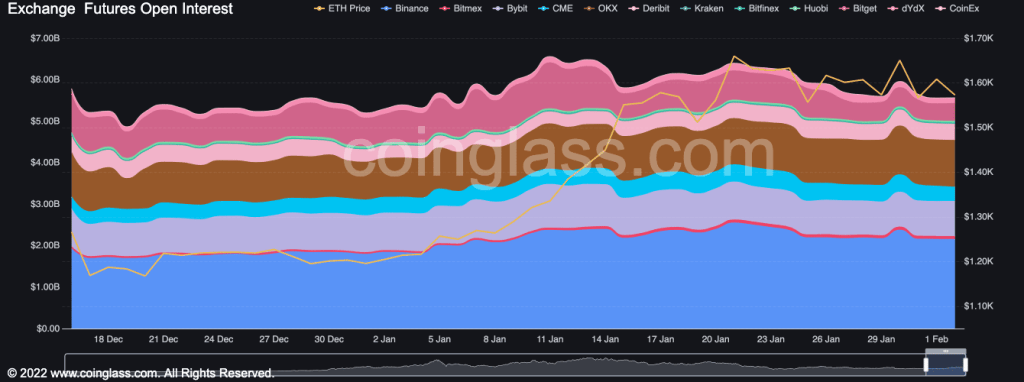

For Ethereum to experience a significant price increase, the network needs to find new demand. The lack of new demand for the second largest cryptocurrency by market capitalization has been illustrated by the sustained decline in Open Interest over the past ten days. Data collected from Coinglass has emerged. ETH’s Open Interest fell 16% during this period.

Typically, a decrease in Open Position means fewer new contracts are created as traders close their existing positions.

Big whale movement as XRP and SEC decision approaching in February 2023

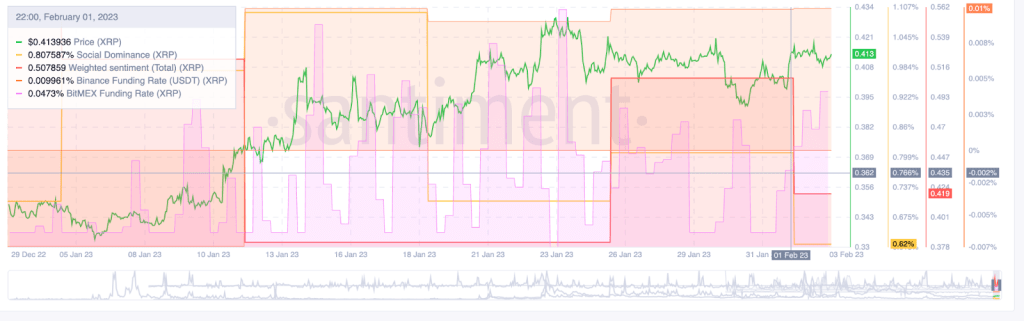

The legal battle between Ripple (XRP) and the SEC has entered its third year. Considering that the case could be finalized in February, speculation about the fate of the case intensified. The decision is eagerly awaited by the crypto community and traditional finance industry as it could set the tone for how digital assets are regulated in the future.

A decision may determine whether crypto assets are now classified as securities. A victory for the SEC could mean a massive downward trend in XRP prices, and Institutional investors are also likely to drastically reduce their exposure to crypto assets to avoid regulatory sanctions in the long run.

On-chain cryptocurrency data provided by Santiment currently shows that investors are expecting positive price action following the decision. The funding rate for XRP is positive on top exchanges. Social sentiment, as measured by a media take, saw an increase in positive sentiment at the end of January as the court verdict drew near.

As a result, both Ripple executives and SEC representatives expressed confidence in their chances of success. However, a recent poll by US attorney John Deaton indicated that the majority of the XRP community favored a deal rather than a victory decision for either side.