The cryptocurrency market has had a rough year, but what’s happening around Gemini suggests that 2023 will also be turbulent for a while. According to reports, the continued lack of volume is causing the market to bleed more.

Digital Currency Group (DCG) threatens with a massive cryptocurrency liquidation

Recently, we became aware of DCG’s problems after the collapse of FTX and numerous other crypto companies. Genesis, one of DCG’s subsidiaries, has been suspending withdrawals like FTX for a while. As Kriptokoin.com, we have included the details in this article.

Arcane Research, which researches cryptocurrencies, has published a report urging crypto investors to beware due to the ongoing financial troubles of these companies.

https://twitter.com/ArcaneResearch/status/1610652777369460736

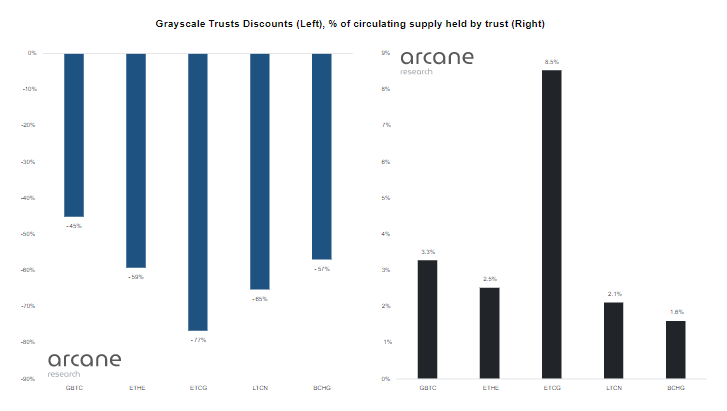

Following the disclosure of Genesis’ issues, analysts raised an important question: What will happen to DCG’s other subsidiaries, including Grayscale, which hold large amounts of Bitcoin that would be liquidated if Genesis were not as liquid?

Cryptocurrency warning from leading research firm

The bankruptcy of Digital Currency Group could spell disaster for the markets as the liquidation of funds would lead to the sale of large positions in GBTC and other Grayscale products. Investor sentiment has worsened since Gemini CEO Cameron Winklevoss recently wrote an open letter to Barry Silbert alleging that Genesis owed Gemini $900 million.

The letter made no mention of any Gemini plans to pursue Silbert if he chose to ignore the highlighted issue. A coordinated resolution between both parties, which may include a reluctant petition for DCG to appeal to Chapter 11, would be the best outcome of the situation. DCG-related companies performed poorly throughout 2022 due to a large outflow of institutional funds from the industry. Lack of liquidity may be the cause of another market crash, but next time we run the risk of reaching levels that most individual investors can’t handle.

Analysts say Ethereum (ETH) will fall further

Nicholas Merten, a prominent crypto analyst, predicted that in the midst of bankruptcies like DCG, Ethereum (ETH) would fall further and many other altcoins would lose serious value. In his latest YouTube post, he said that Ethereum is in a bearish trend and the 200-week moving average acts as resistance:

In terms of ETH-BTC, even though Ethereum has been relatively neutral against Bitcoin since May 2021, it is still in a downtrend… I believe this chart will start to drop very soon. Ethereum is currently trading well below its 200-day and 200-week moving averages. We’ve been moving below this range since the collapse of FTX in November 2022. Since then, we’ve been repeating the same pattern we saw in June, with the 200-week moving average serving as resistance.

Merten also warns that a relief will not be sustainable unless Ethereum rises above the 200-week moving average and trades at 15% to 30% of its current value, between $1,470 and $1,668. The crypto analyst expects other altcoins to follow the same route due to the overvaluation in the current market:

When we talk about the altcoin market, we’re talking about the wider crypto space where there are many false valuations and many false hopes that most of these projects will still be around in a year or two. If, like me, you’ve been actively investing and trading in crypto since 2016, 2017, you’ve gone through a market cycle or two and are probably aware of many of the great altcoins that make the top leaderboards. Unfortunately, most altcoins that exist today will not exist tomorrow.