New analysis shows that Bitcoin price could drop further in Q4 of 2022. But the new 2023 could be a year when the bulls take the stage.

According to the majority of investors, Bitcoin is in the hands of the bears

Well-known cryptocurrency market analyst Benjamin Cowen surveyed his more than 700,000 followers on Twitter. In the survey, “How do you feel as we enter Q4 for BTC?” asked the question. Below that left 2 answer options: bullish or bearish. 11,299 respondents expressed their feelings, most of them ready for further declines.

How do you feel going into Q4 for #BTC?

— Benjamin Cowen (@intocryptoverse) October 1, 2022

Such results are emerging even as more and more indicators are showing that we are near the bottom. On the other hand, there are strong arguments that point to the absolute bottom of this bear market yet to come.

Here is the duration of Bitcoin bear markets

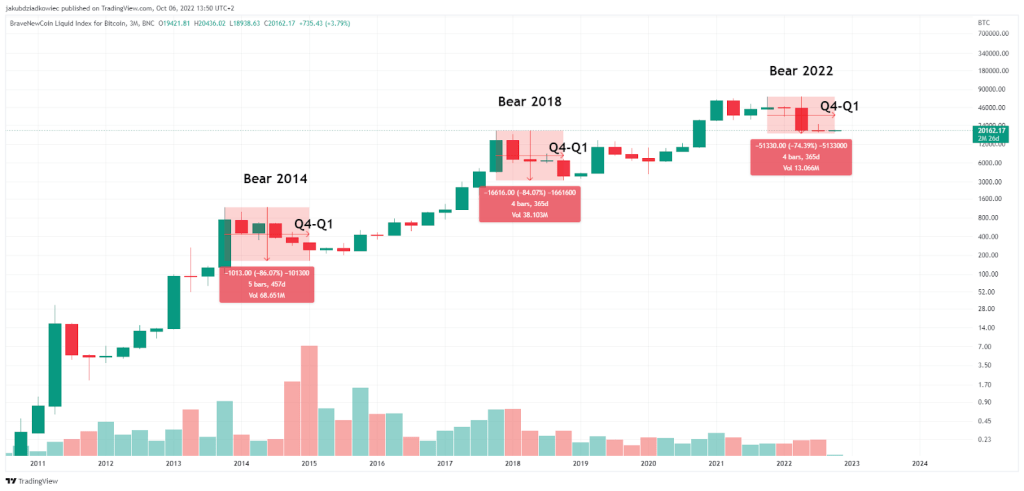

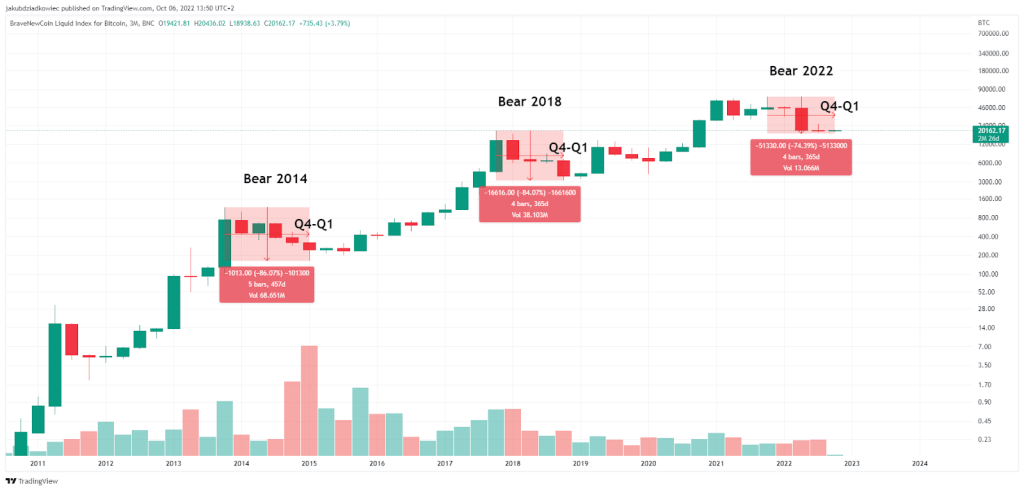

Another crypto analyst, Rektcapital, has published data on the duration of historical bear markets. According to his calculations, the period in which Bitcoin has steadily depreciated in this cycle has reached a length comparable to previous bear markets:

- 2013-2014 : 413 days from peak to bottom – 86% drop from ATH

- 2017-2018 : 364 days from peak to bottom – 84% drop from ATH

- 2021-2022 : 333 days after peak so far – 74% drop from ATH so far

“These numbers suggest that a BTC bottom should happen in the next 1-3 months,” Rektcapital says.

A closer look at Bitcoin’s 3-month logarithmic chart confirms the analyst’s observations. We see the bear market continue for several quarters after every BTC historical peak. It also hit an absolute bottom in the fourth and early first quarters, usually about a year after the peak.

It is also worth noting that the bull market does not begin immediately after reaching the bottom, but the accumulation continues for another 2-3 quarters. This means that even though the bottom of the bear market has already formed or is about to be reached, one should not expect large increases in the first months of 2023.

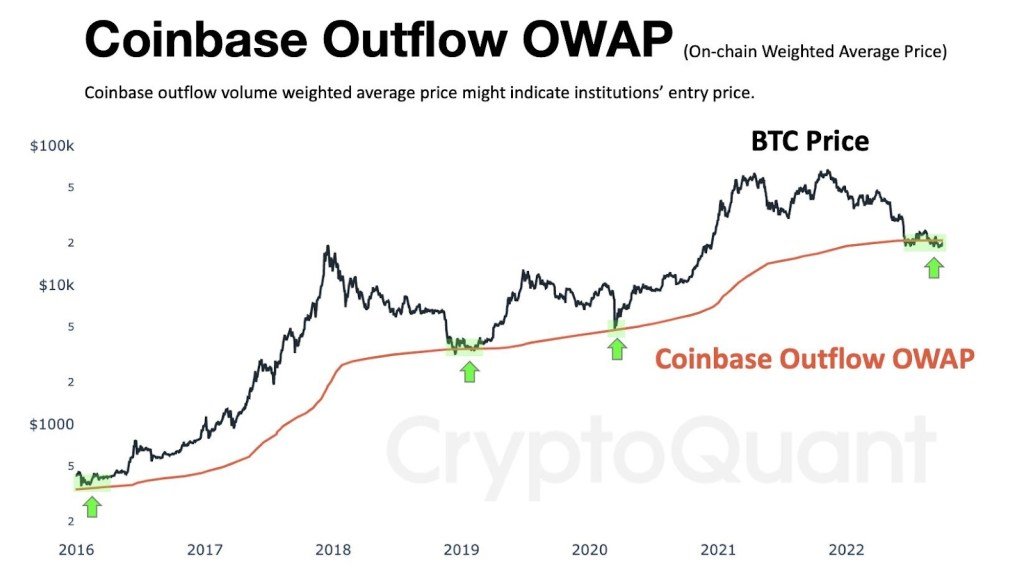

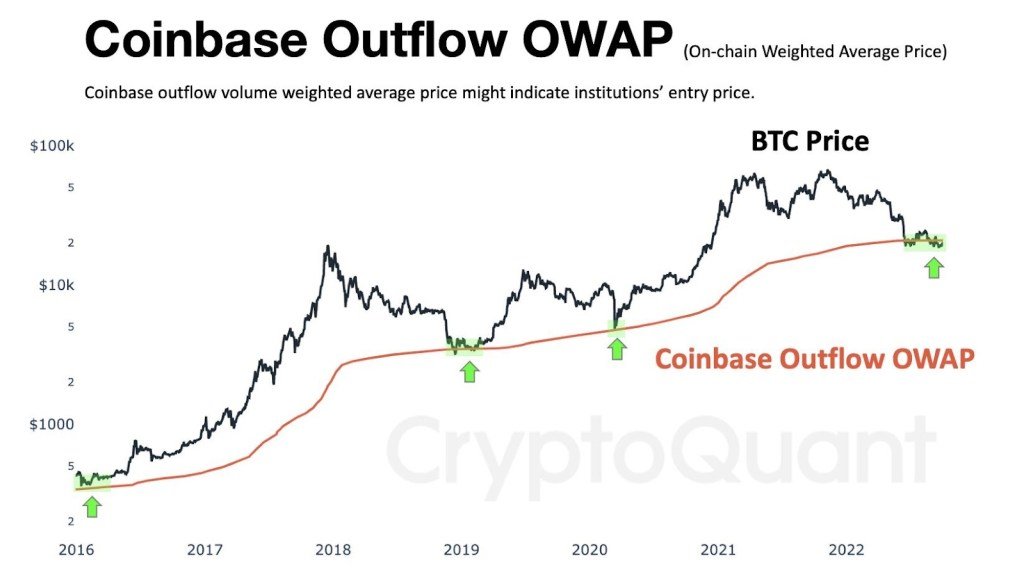

Exits from exchanges – Coinbase case study

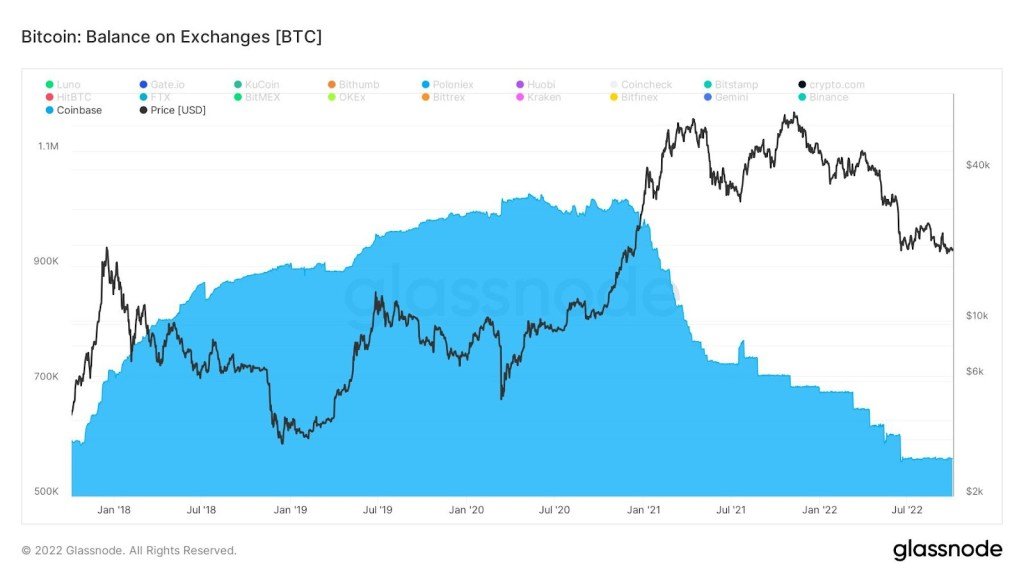

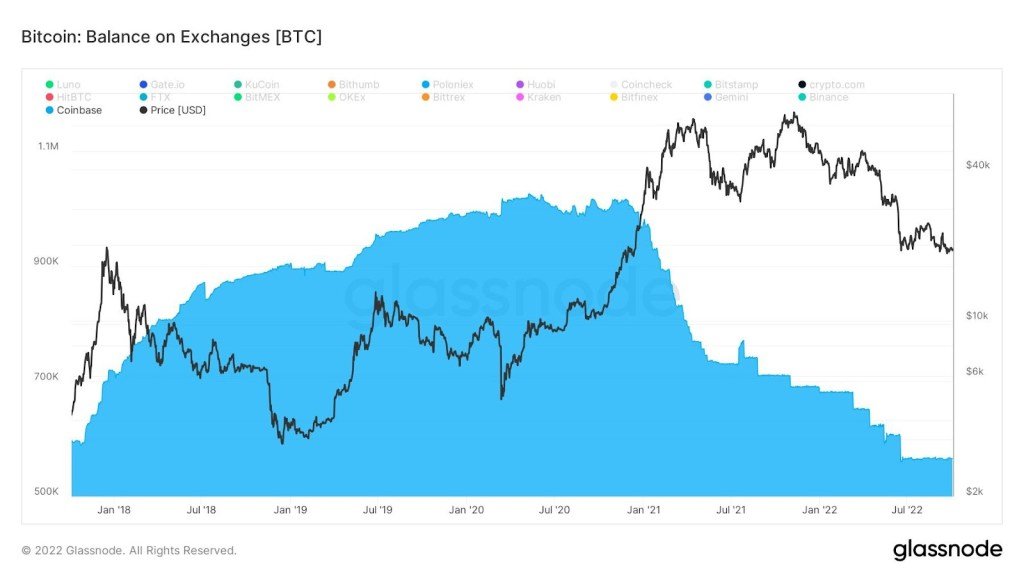

Currently, there are many signals that the Bitcoin market is in the process of bottom formation and accumulation. Many relate to activities on exchanges led by Coinbase. Based on the data released this week, we can see increased BTC outflows occur. From their perspective, Bitcoin price has reached a key support level that has historically marked absolute bottoms.

The first chart published by IIICapital shows how Bitcoin volume on Coinbase has been falling steadily since the start of the bull market launched in Q4 2020. Interestingly, the reversal of the trend in BTC price and their decline in 2022 has yet to happen. The period from June to date alone shows a clear recession on the blue chart and the relative stability of the BTC supply on Coinbase.

Meanwhile, the second chart published by Ki Young presented an argument that the bear market is not over. Based on the so-called exit OWAP for Coibase, we can see that BTC price is in a long-term support area today.

The orange line shows the approximate entry price of institutional investors buying through Coinbase. If it’s true that institutions play a key role in the cryptocurrency market, reaching the light green accumulation area is a signal of a bottom.

Bitcoin cycle dynamics and similarities to 2019

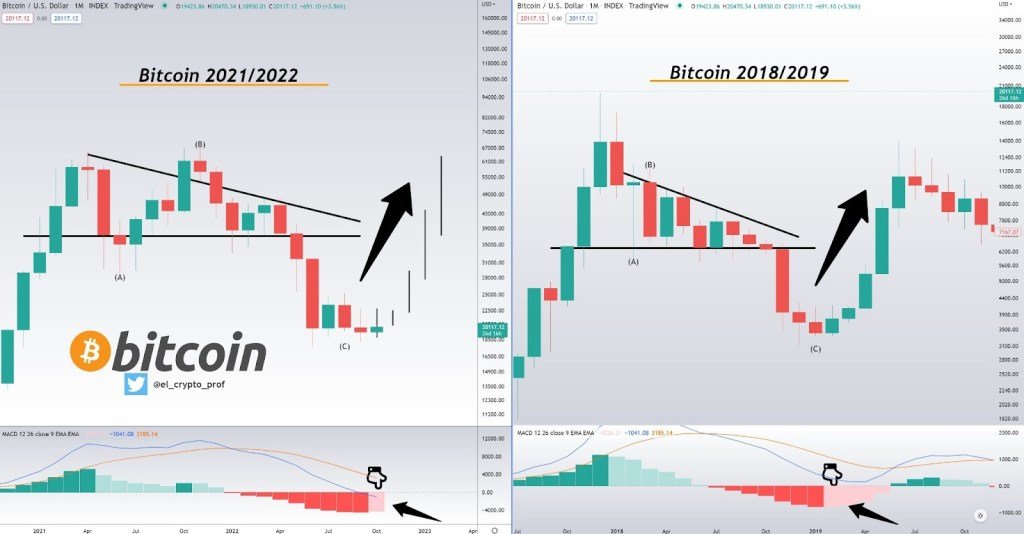

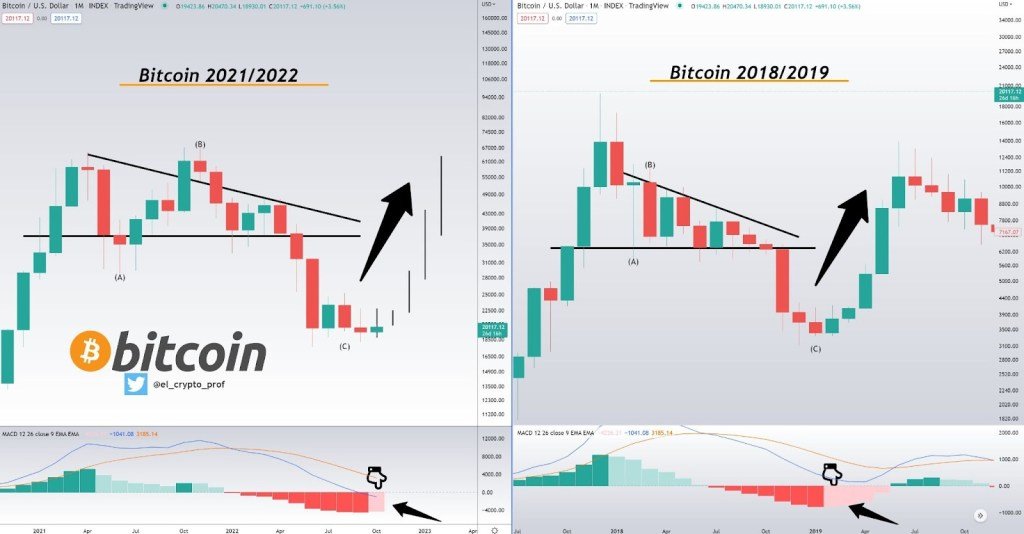

Another strategy to identify the phase of the current bear market is to try to find fractal similarities between the current price action and the 2018-2019 bull market. An interesting analysis on this issue was recently provided by analyst StockmoneyL, who found parallels in the dynamics of the last 3 cycles.

According to the analyst, Bitcoin is currently in a PURCHASING phase of about six months. Historically, it has proven to be the period with the least risk and greatest opportunity for future increases. The optimistic forecast of this analysis is that the $19,000 level will remain as support and the bottom has been reached.

In another tweet, the same analyst juxtaposed a fractal of the late 2018-2019 BTC price chart and today’s price action. What stands out among the many similarities is the sharp drop from the 40-50% support area and the way the bottom is formed.

In both cases, it can be noted that the initial low is followed by a higher low on the chart. This was followed by a consolidation phase of several months, followed by more dynamic increases. If this scenario were to repeat now, Q4 2022 would be a period of consolidation and accumulation. The bull market can only start in the first quarter of 2023.

Early bottom signals

The last way to find signs of the end of the bear market and trend reversal on the Bitcoin chart is with long-term technical indicators. One of them is the monthly MACD, which provides a very clear trend reversal signal in the previous 2018-2019 bear market.

This analysis was noted in yesterday’s tweet by @el_crypto_prof, who compared MACD readings in February 2019 and October 2022. According to the analyst, the change of the negative bar on the MACD histogram from dark red to light marked the end of a bear. A similar signal could be produced this month if Bitcoin at least holds its current level around $20,000. However, we won’t know until the end of this month.

Another signal is provided by the weekly RSI indicator, whose comment was tweeted by the same analyst. According to him, the weekly RSI’s visit to the overbought zone below 30 was a sign of market bottom.

This occurred in the areas marked below (yellow and red). It is worth noting that the lowest RSI value from all three cases occurred in June 2022. However, the always slow rising indicator has been accompanied by the sideways movement of Bitcoin price and several months of consolidation. This also strengthens the thesis that the bull market will resume in the first quarter of 2023 at the earliest.