American stock market strategist and financial analyst Carter Worth said that Bitcoin (BTC) and Ethereum (ETH) are at each breaking point. He even noted that he was “wandering sinisterly” in these spots. Another analyst said that the overall crypto market is testing support levels. Here are the details…

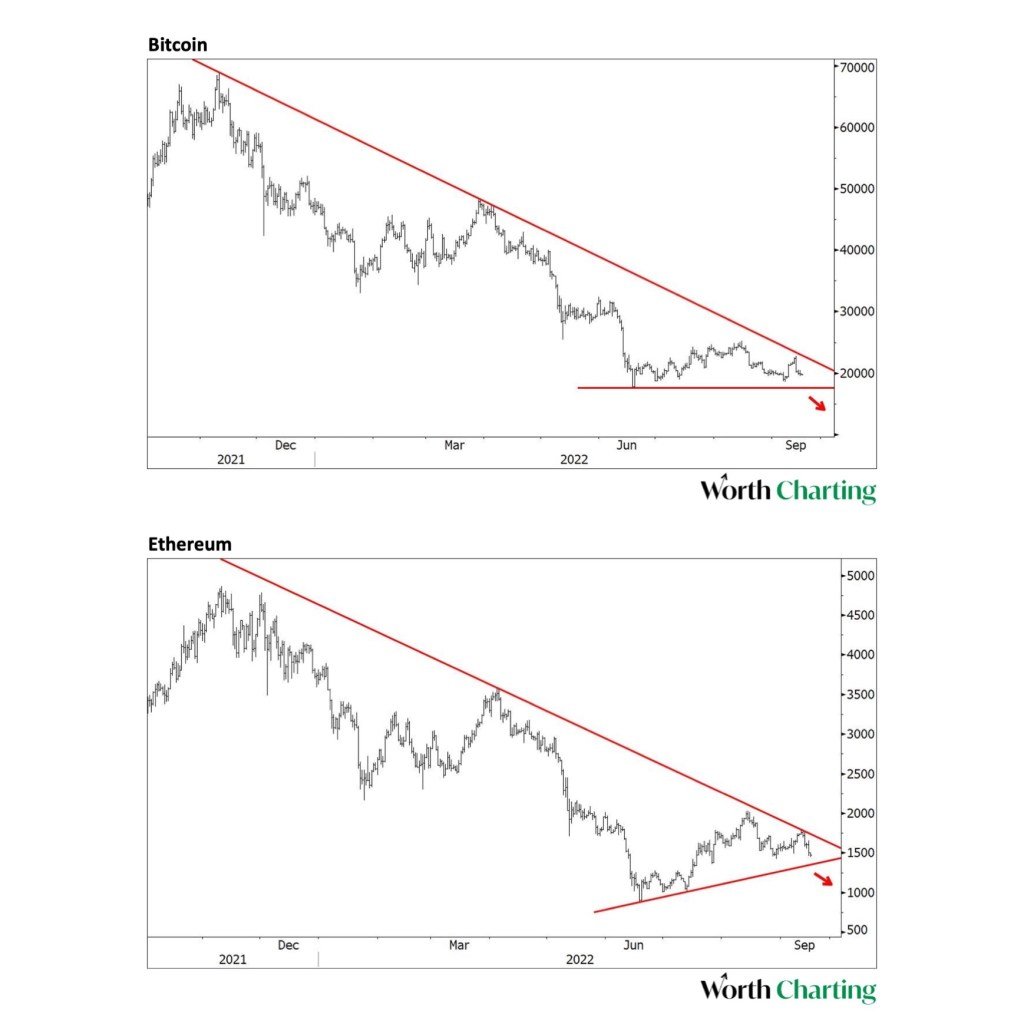

Stock market strategist: Bitcoin and Ethereum at breaking point

Stock market strategist Carter Worth commented on the two biggest cryptocurrencies, Bitcoin and Ethereum. He believes that both of these cryptocurrencies will likely fall further. The Wall Street veteran’s apocalyptic warning came after Bitcoin slumped to an intraday low of $19,458. As we reported on cryptokoin.com, the biggest cryptocurrency showed some signs of recovery earlier this September.

Its modest rally, however, rose with higher-than-expected inflation data released on Tuesday. On Thursday, the top cryptocurrency fell below the $20,000 level once again due to another downturn in the US stock market. Earlier this September, technical analyst Scott Redler predicted that Bitcoin price could drop to $10,000 if it fails to maintain the $17,600 support level. Bitcoin’s market cap is currently at $376 billion. The cryptocurrency has dropped 71.48 percent from the record level recorded last November.

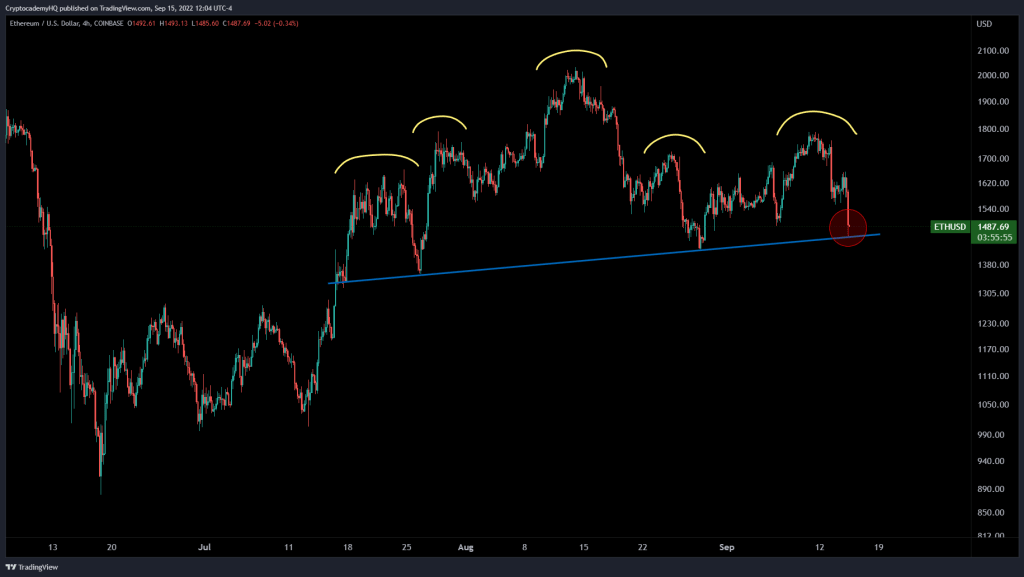

Justin Bennett: Ethereum is testing these levels

Crypto analyst and trader Justin Bennett warns his followers that Ethereum (ETH) could drop by about 45 percent if the current support is broken. The founder of Cryptocademy told his 108,500 Twitter followers that ETH is testing the “neckline” in a possible head and shoulders trend. He stated that if this level breaks down, the target is around $800. ETH is currently trading at $1,400. Therefore, a drop to $800 represents a 44 percent drop.

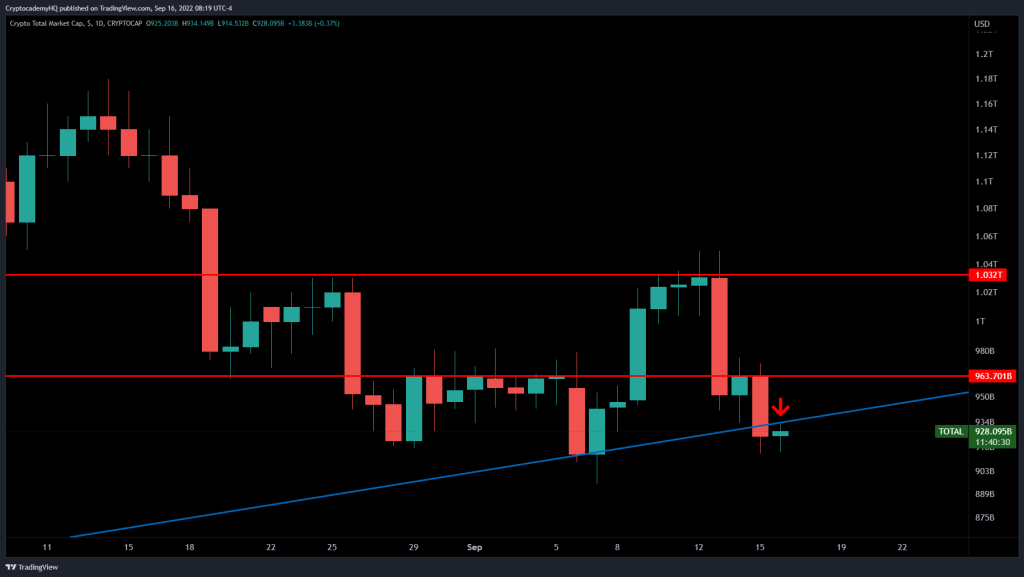

Bennett also looks at the total crypto market share (TOTAL), which is an indicator of the strength of the crypto markets. According to Bennett, stocks are causing problems for cryptocurrencies. Meanwhile, the analyst warns that the aggregate value may face upside resistance. “TOTAL is finding resistance at the 2015 trendline I mentioned. Stocks look awful. Be careful there,” he says.

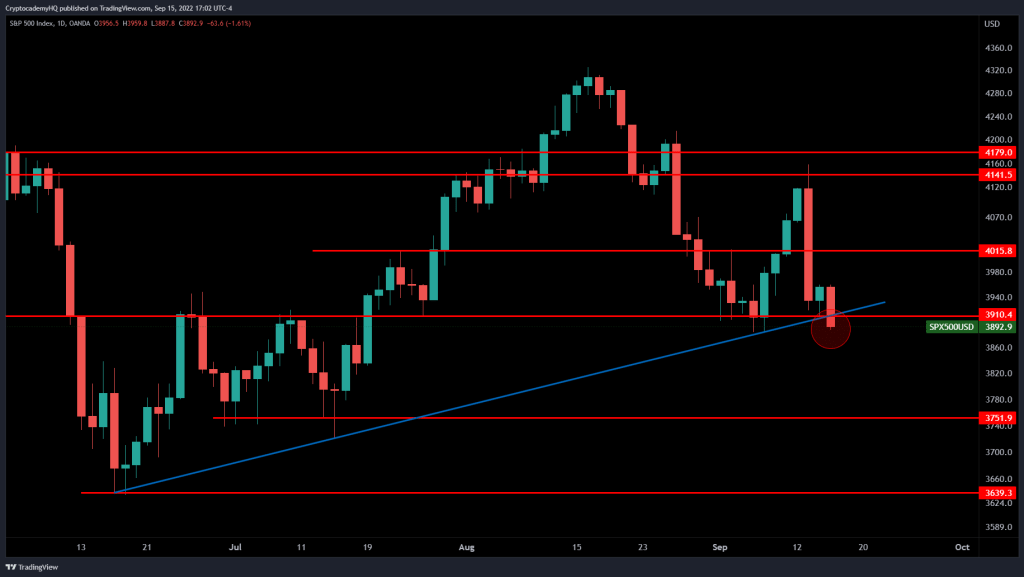

Speaking of stocks, Bennett then looks at the S&P 500 and “sees only bad news”. Saying that “the lights are out” in S&P, the analyst draws attention to the fact that the stock market index has lost the support of 3.910. He wonders how long it will take for crypto to be affected by this situation. Finally, Bennett evaluates the US Dollar Index (DXY), an indicator of the relative strength of the USD. Bennett predicts that DXY is rising steadily from its current point, creating problems for the crypto markets.