Crypto analyst Filip L says that the Shiba Inu (SHIB) is trying to squeeze the bears out of their positions with a positive weekly close. Also, according to the analyst, Bitcoin price is nowhere near any signs of recovery. So, it could be set for another drop next week. We have compiled Filip L’s SHIB and BTC analysis for our readers.

Is SHIB playing bull trap or bear trap?

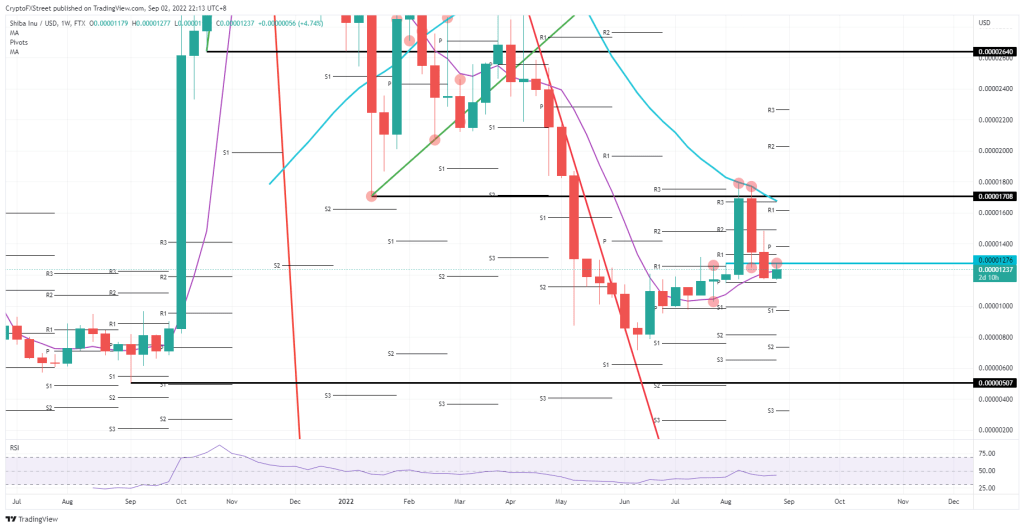

Shiba Inu (SHIB) made up for losses last week. It is also trying to squeeze the bulls that fell below the 55-day Simple Moving Average (SMA) at the end of last week. With this bear trap, the bulls are trying to prolong their bitter trading by trying to trade higher prices. However, bulls need to be cautious as a weekly rejection could take place below the 55-day SMA and a weekly rejection at $0.00001276, which could lead to another drop in the coming weeks.

It is difficult to define or tell whether SHIB is playing bull trap or bear trap. Either way, the bears will pull away from the long end of the straw. Later on, it will continue on its way unless the bulls break the last week’s high of August at $0.00001492. It looks like the bulls will not be able to make any more gains for this week. So, a drop is possible soon. That’s likely to happen next week.

SHIB weekly chart

SHIB weekly chartThus, the SHIB price will be rejected. Markets will focus on what matters: central banks. So, it will shift towards next week. Further tightening will be triggered, this time in mainland Europe, as another central bank, the ECB, lines up for the US Fed’s 75bps increase next week. This means SHIB price pulls back to $0.00001000 with new monthly S1 support.

With a weekly close above the 55-day SMA, the bulls may still be more stubborn as thought and can be seen advancing their attack at this $0.0001276 level. If it closes above this level next week, expect to see a third consecutive winning streak as September turns out to be a profitable month overall, possibly pointing to $0.00001600. This would be a 30% gain spread over roughly three weeks.

“BTC price is being cut by the bond market”

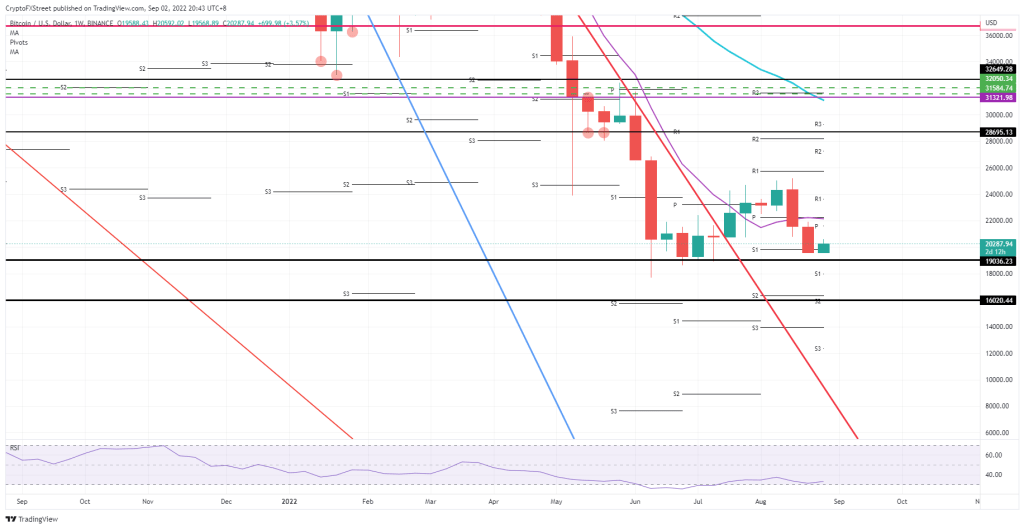

BTC is rewarding brave bulls with gains for the week after price action finally pushes back against the bear trend Bitcoin is in. Unfortunately, a weekly price chart doesn’t show a pretty picture with no signs of a reversal. Instead, a downward squeeze continues as BTC price sees it bid farewell to $20,000 for the last quarter of 2022.

In the meantime, as you follow on Kriptokoin.com, cash outflows from crypto investment products continue. Bitcoin price is going through a tough law in the fields of economy, finance and investment. The Fed continues to rise, making bonds more attractive as an investment product. That’s why investors are looking at US treasury bonds that currently yield around 3% or more. Secured government bonds get you over 3% coupons. So why pour money into cryptocurrencies that are still experiencing their worst-performing years in their holdings?

BTC weekly chart

BTC weekly chartAs such, BTC price is not in a sweet spot against the current macro dynamics that are seeing investors flee to safe havens. It pushes towards $19,036 until the lower end breaks. Therefore, it is possible for the price action to fall on the high. On the downside, BTC is likely to go as high as $16,020, the new monthly S2 support for September.

Markets and Bitcoin believers want a bullish signal from their favorite cryptocurrency. The green weekly close will already be a good sign. If BTC price breaks above $22,000 and closes above the 55-day Simple Moving Average (SMA), something important will change in the price dynamic of cryptocurrencies. Bitcoin is not going to return to $28,695 or $30,000. However, at least $26,000 is likely in the medium term.