Bitcoin technical analysis shows more pain ahead as the analyst hints at the bottom of BTC. Here are two major price predictions for the coming days.

Bitcoin price next action

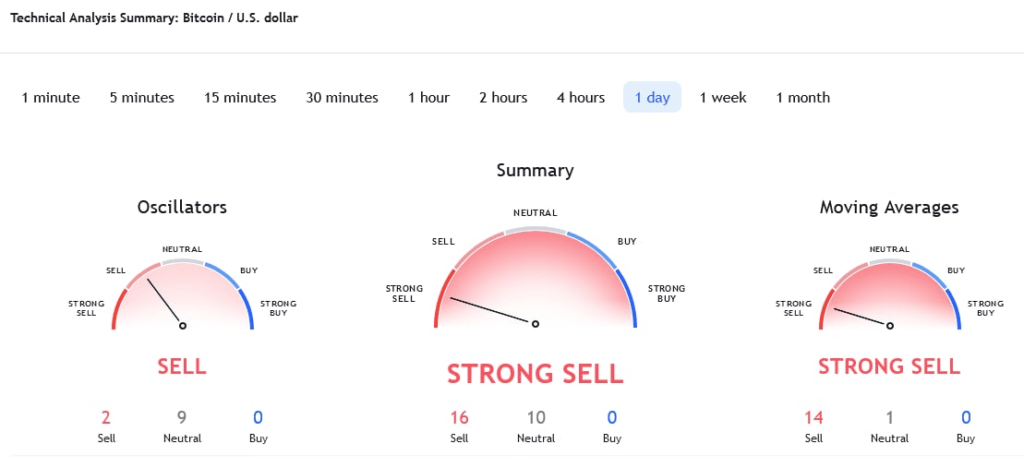

Technical indicators show that the oscillators are suggesting a two-for-one sell, with nine indicating neutrality. Based on the moving average, techniques point to a strong sell at 14 while only one shows neutrality. Overall, the analysis can be considered that Bitcoin is in an oversold state as the market is looking for the possibility of a rally.

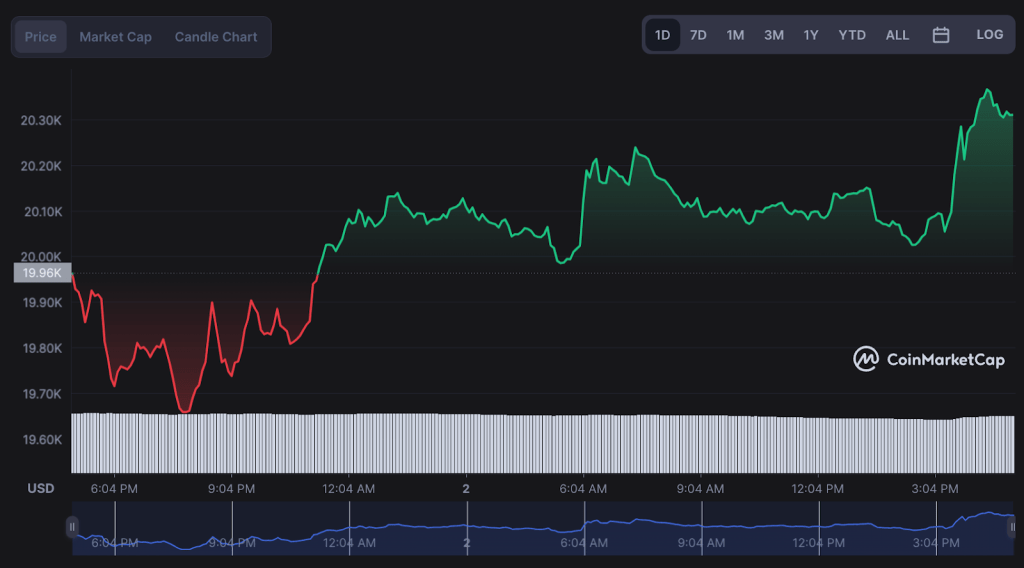

BTC price extends losses below $20,000

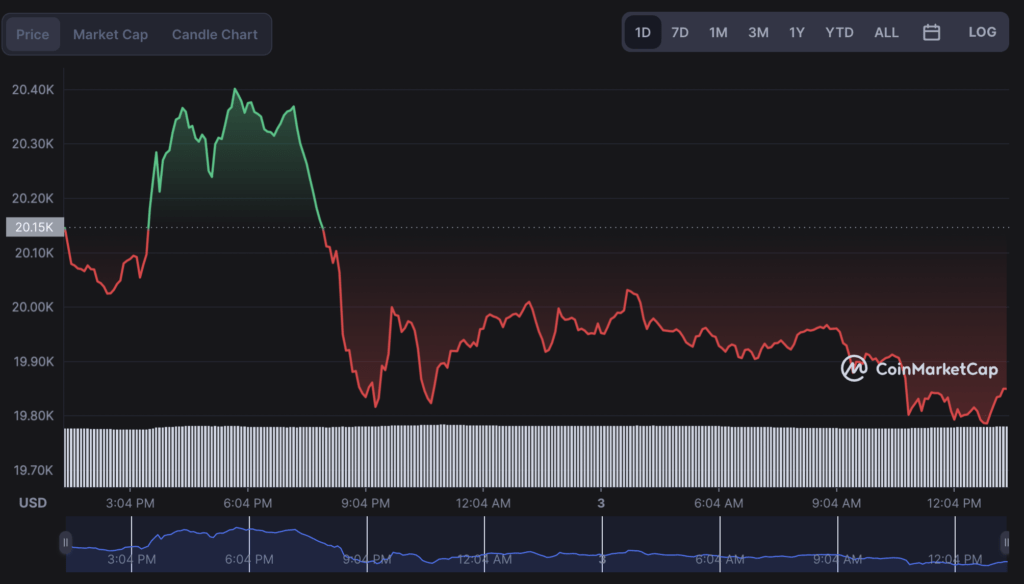

After a strong US jobs report, we saw Bitcoin briefly rise above $20,000 on Sept. BTC momentarily pushed the overall market to take back $1 trillion in capitalization. However, it has since dropped almost 2% in the last 24 hours to $19,800.

Overall, Bitcoin has made short-term gains with the price seeing $25,000. Then, it traded at $20,000 for several weeks. The price action inspired a section of analysts to suggest that Bitcoin has found its bottom.

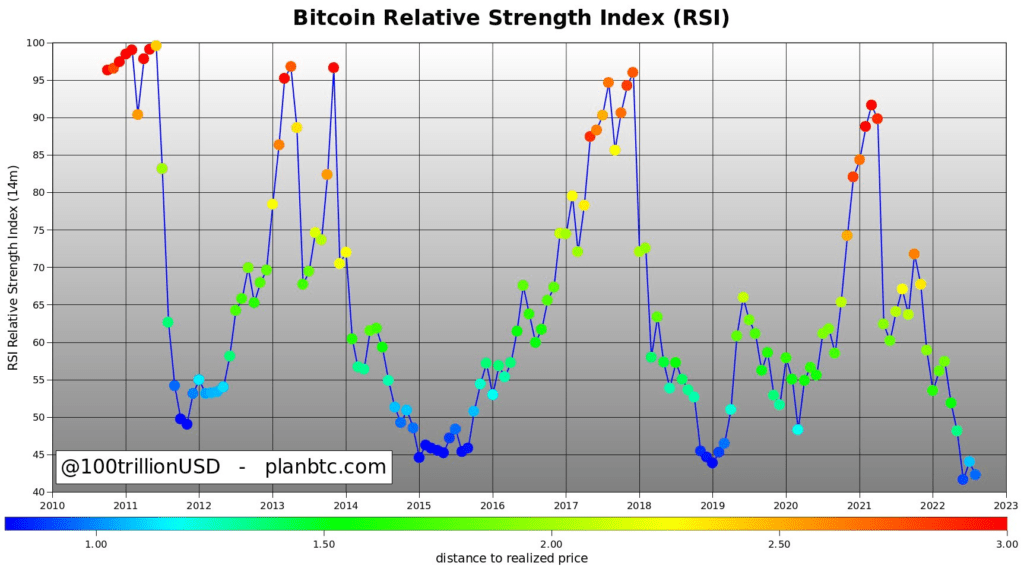

For example, when Bitcoin hits the monthly RSI of 42.2, crypto analyst PlanB suggested that it could signal that BTC is ready for another rally based on its historical trends. The analyst said in a tweet on Sept.

Bitcoin RSI 42.2. If history is any guide, the RSI could be 90+ in 1-3 years if you don’t think history says anything about the future and this time is different.

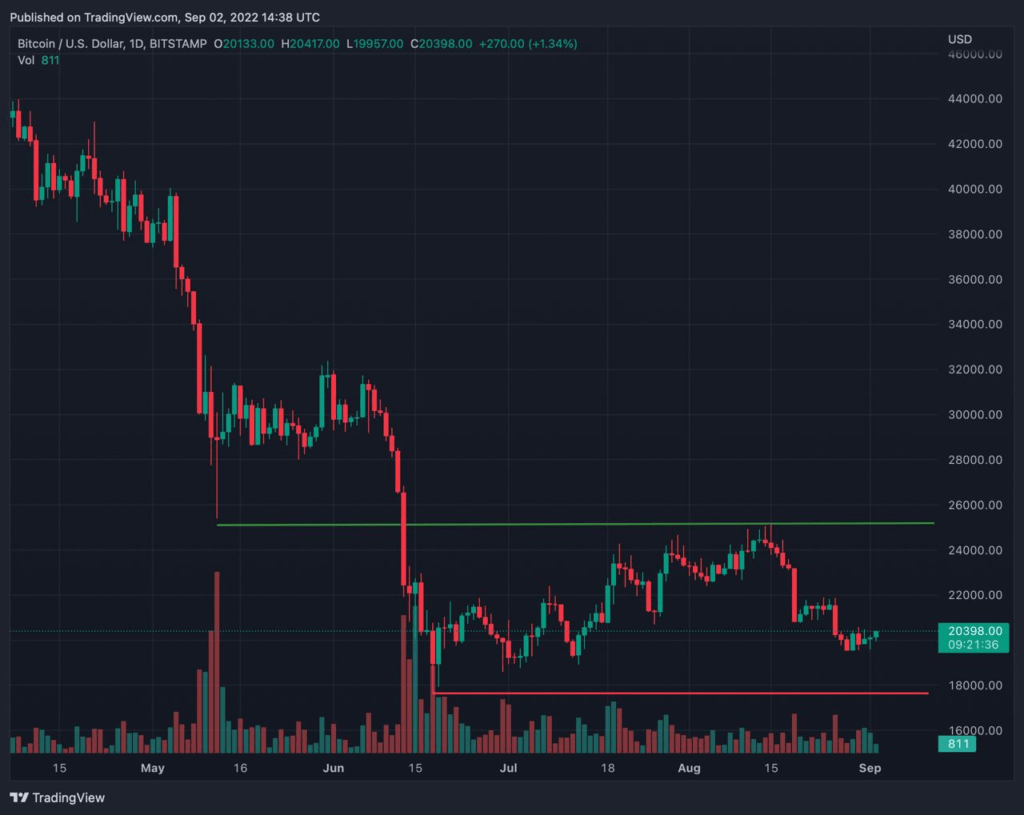

BTC must break this price threshold for any chance of recovery

Bitcoin remains firmly in the region, although the $20,000 position appears to be under threat. Accordingly, the market is exploring possible scenarios that will trigger an upward trajectory for BTC. Therefore, according to Kitco News analyst Rajan Dhall, $25,066 is one of the important levels to watch out for as it will signal the possibility of a recovery while offering a way out of the protracted bear market. Any hope of reaching this level means Bitcoin is targeting $21,760 first. He also suggests that he should rely on the bulls to maintain the position.

On the other hand, if the bears remain strong, Bitcoin is likely to consolidate at the $17,567 bottom.

Bitcoin posts small gains amid positive jobs report

However, it’s worth noting that Bitcoin is posting slight gains following the US jobs report. Notably, 315,000 were added in August, slightly higher than expected due to rising interest rates and sluggish economic growth.

On this line, BTC has gained almost 2% in the last 24 hours, trading at $20,300 at press time. The small gains were also instrumental in bringing the crypto market capitalization closer to $1 trillion.

BTC price threatened by Fed’s next action

Also, as Bitcoin is reeling from macroeconomic factors, there is an expectation that the jobs report will likely push the Federal Reserve to implement more aggressive measures such as raising interest rates to tame rapidly rising inflation. As a result, analysts had predicted that a positive business report could drop Bitcoin to around $15,000. The scenario will jeopardize the $20,000 position as BTC has recently been tied to macro sentiment. As Kriptokoin.com, we have conveyed Nouriel Roubini’s thoughts on this subject.