There are serious cold feet on the outlook, as September has historically been a “red” month. Bitcoin (BTC) is on track to see its worst August performance since the 2015 bear market. According to analysts, it is likely to be even worse next month.

September means an average 5.9% Bitcoin price loss

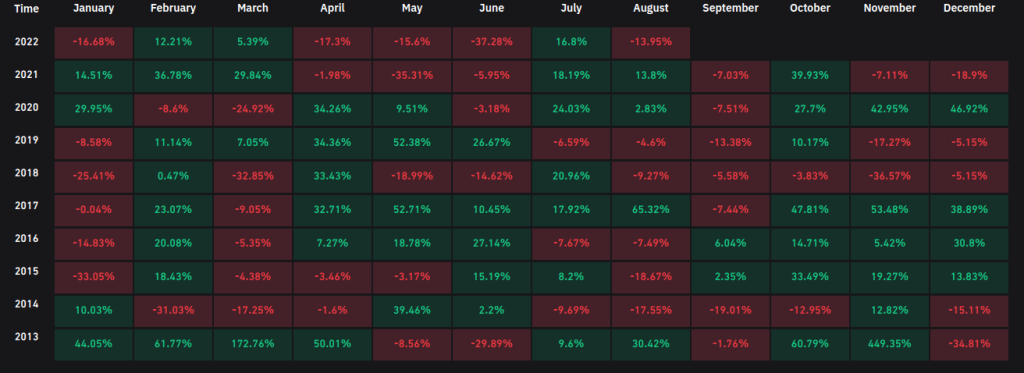

Data from on-chain analytics resource Coinglass shows that BTC hasn’t had such a bad August in seven years. In recent weeks, Bitcoin has seen two major price drops. After these, BTC scares its holders. But historically, September has performed even worse than August.

As you follow on Kriptokoin.com, BTC has dropped 14% this month to $20,000. This made August the biggest loser since 2015, when BTC posted a red 18.67% monthly candle. The following years have proven that August can be a mixed bag when it comes to BTC price performance. For example, in 2017, the leader crypto gained over 65% on its bullish record.

However, September is a month in which no one can predict the possible price direction. Because September is already famous as a ‘red’ month for Bitcoin. Average losses since 2013 have been almost 6%, according to Coinglass records.

Historically September Down Month

'Septembear'

— Trader_J (@Trader_Jibon) August 26, 2022

“This drop in BTC is a reflection of that”

This time, macro instability combines with tradition to offer bleak projections from analysts. Analyst Josh Rager comments as Bitcoin threatens $20,000 support:

The stock market is not looking good overall at the moment. So this drop in BTC is a reflection of that. September is not a historically great month in general. Possibly dive in here with buyer opportunity for the next months. I will be a long-term spot buyer for under $20,000.

Josh Rager, Mt. Gox continues a debate over the possibility that Bitcoins from the rehabilitation process will be sold in bulk by creditors after an eight-year wait. However, many say that such an event will not happen. So, according to experts, the fears are unfounded.

BTC monthly return chart / Source: Coinglass

BTC monthly return chart / Source: Coinglass“Bitcoin monthly chart is really ugly”

Returning to the monthly close, nervous commentators focused on whether Bitcoin could prevent the monthly candle from ending below the $20,000 mark. Failing that, BTC could rival June in terms of lows that haven’t been on the chart since late 2020. Worse still, such an event is likely to trigger a snowball sale. Analyst Galaxy Trading warns his Twitter followers over the weekend:

On a monthly TF things are really ugly. If the monthly candle closes below 20k in 3 days, this is likely to trigger a big sell to at least 14k where the next big support is. The reason is below 1,900 which means bearish candlestick which is really bad on a big TF.

“BTC is ready for a deeper retest of the key pivot range”

Caleb Franzen, senior market analyst at Cubic Analytics, says a move significantly below $20,000 violates an existing pivot zone since the first move above this level in 2020. The analyst makes the following statement:

Bitcoin is poised for a deeper retest of the key pivot range defined using the December 2017 monthly wick and close. This December served as an excellent resistor in 2019. It also served as a launch pad in 2020. Now trying to act as support in 2022.

BTC 1-month candlestick / Source: Caleb Franzen / Twitter

BTC 1-month candlestick / Source: Caleb Franzen / Twitter