According to DappRadar, the transition to the PoS mechanism with the Ethereum merge will negatively affect some altcoin markets.

Ethereum merge DeFi could shrink loan pools

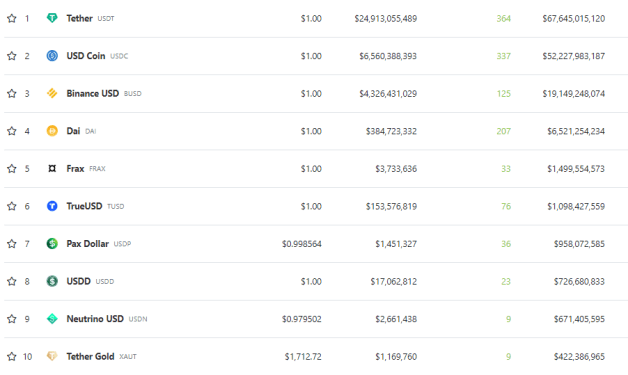

According to a new report released on Friday, the Ethereum merge update will significantly affect the way DeFi protocols work. The research highlights the issues that will arise during Ethereum’s transition to the PoS consensus mechanism known as merge. According to the report, the long-awaited (and often delayed) technology upgrade can slow down processing times. Moreover, it will create service disruptions in DeFi lending protocols, causing headaches for platforms. In turn, stablecoin usages are in danger of declining. If DappRadar’s predictions come true, the biggest stablecoins affected by the merge will be the following names.

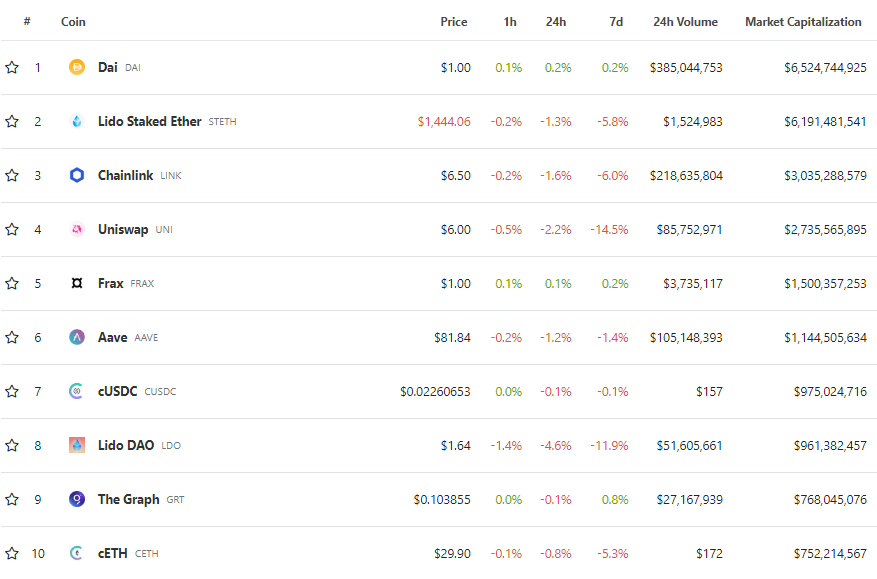

Meanwhile, DappRadar’s report mentioned that DeFi loan pools will shrink. Decentralized finance (DeFi) refers to the infrastructure, processes and technologies used to democratize financial transactions. Some of the biggest DeFi projects by market cap are as follows.

Ethereum also hosts an ecosystem of DEX, DeFi, and farming projects that process billions of dollars daily. These DeFi protocols rely on Ethereum’s consensus mechanism for their services to work properly.

Why will DeFi projects be negatively impacted by the merge?

Pedro Herrera, data analyst at DappRadar, says that the negative impact of the merge on Ethereum market supply could affect DeFi liquidity pools even if the transition goes smoothly. According to Herrera, some issues that will occur during the update:

If Merge fails to launch successfully, we will experience delays in DeFi protocols that will affect stablecoins. But in terms of supply dynamics, this could also affect how stablecoins are used for liquidity pools in the DeFi space and beyond.

The transition to the PoS consensus mechanism is expected to slow the issuance of new tokens, especially in the months immediately following the transition. As token issuance slows down, Ethereum’s token burning mechanism will continue to remove ETH from circulation at the same rate as before the merger. Over time, this reduces the total market supply of Ethereum. As Kriptokoin.com, we have covered everything you need to know about the Ethereum merge in this article.

Ethereum will become more disinflationary with the merge

The report also mentions that it is possible for DeFi platforms to experience network disruption as some Ethereum-based protocols lag behind Ethereum in their transition to the PoS consensus mechanism. Herrera summarizes the situation as follows:

There is a risk that the merge will result in technical difficulties such as timestamp synchronization between nodes or other technical issues that prevent it from synchronizing after PoS merge. This may force Ethereum to pause block production and even temporarily halt [production] while its developers work on the issue.

Despite this, the platforms themselves envisage a confidence that Unification will not affect their functionality. Popular DEX platform Uniswap said its services will “continue to run smoothly” throughout the upgrade. Earlier this week, the Ethereum Foundation released an official timeline and framework for the completion of the merge. On September 6, the Bellatrix upgrade will go live on the Beacon Chain, kicking off the official transition to the Proof-of-stake consensus mechanism.