Bitcoin traders await new year lows after BTC’s $25,000 rejection. Crypto analyst Marcel Pechman looks at margin trading and options and tries to determine the direction of Bitcoin. We have prepared Marcel Pechman’s analysis for our readers.

Bitcoin 17 thousand dollars passenger?

As you follow on Kriptokoin.com, Bitcoin (BTC) tested the $25,000 resistance on August 15. However, it later lost 5%. The move has liquidated over $150 million in leveraged longs. This has led some traders to predict a move towards the lowest level of the year in the $18,000 range.

The price action coincided with worsening conditions for tech stocks, including Chinese giant Tencent, which is expected to post its first quarterly revenue decline. The overall bearish sentiment came after a simple $25,000 rejection. Traders started placing targets below $17,000 after the rejection. This move, described by crypto analyst ChrisBTCbull, continues to haunt crypto investors.

https://twitter.com/ChrisBTCbull/status/1559412315845529600

Margin traders continue to rise

Monitoring the margin and options markets provides excellent information for understanding how professional traders are positioned. For example, a negative reading would occur if whales and market makers reduce their purchases as BTC approaches the $25,000 resistance.

Margin trading increases returns by allowing investors to borrow cryptocurrencies to take advantage of their trading positions. For example, it can increase risk by borrowing stablecoins to buy an additional Bitcoin position. Bitcoin borrowers, on the other hand, only bet that its price will drop. That’s why they short cryptocurrencies. Unlike futures contracts, the balance between collateralized longs and shorts does not always match.

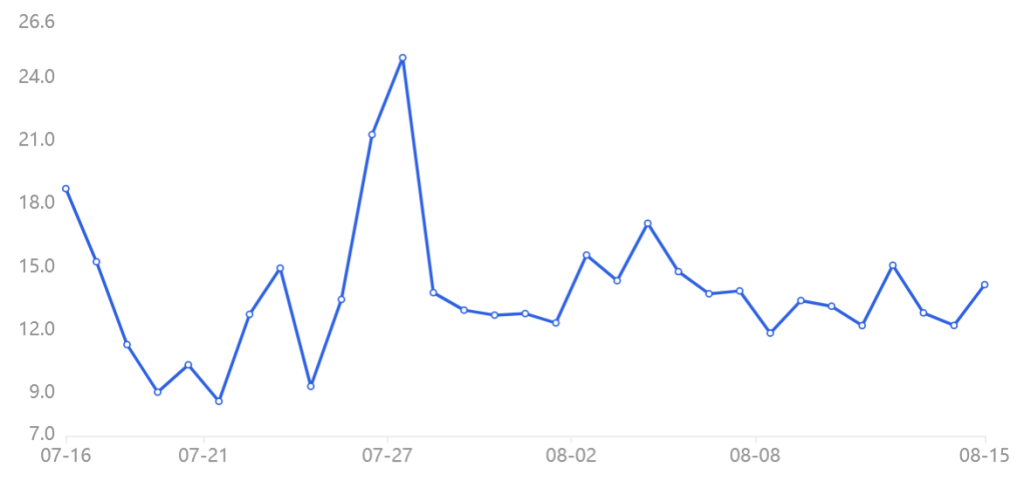

OKX USDT/BTC margin lending rate / Source: OKX

OKX USDT/BTC margin lending rate / Source: OKXThe chart above shows that the margin loan ratio of OKX traders remains relatively stable at around 14. He also explains that the Bitcoin price rose 6.3% in two days but was rejected after reaching the $25,200 resistance. Also, the metric continues to rise, supporting stablecoin borrowing by a wide margin. As a result, professional traders keep their bullish positions. Also, no additional bearish margin trading emerged as Bitcoin retraced 5.5% on August 16.

Options markets take a neutral stance

There is uncertainty over whether Bitcoin will make another run towards the $25,000 resistance. However, the 25% delta skew is an important sign when arbitrage tables and market makers over-price to hedge up or down.

The indicator compares similar call (buy) and put (sell) options. It also turns positive when fear is rampant. This is because the premium of the protective put options is higher than the risk call options. If traders fear a Bitcoin price crash, the skewness indicator will rise above 10%. On the other hand, generalized excitement reflects a negative 10% skewness.

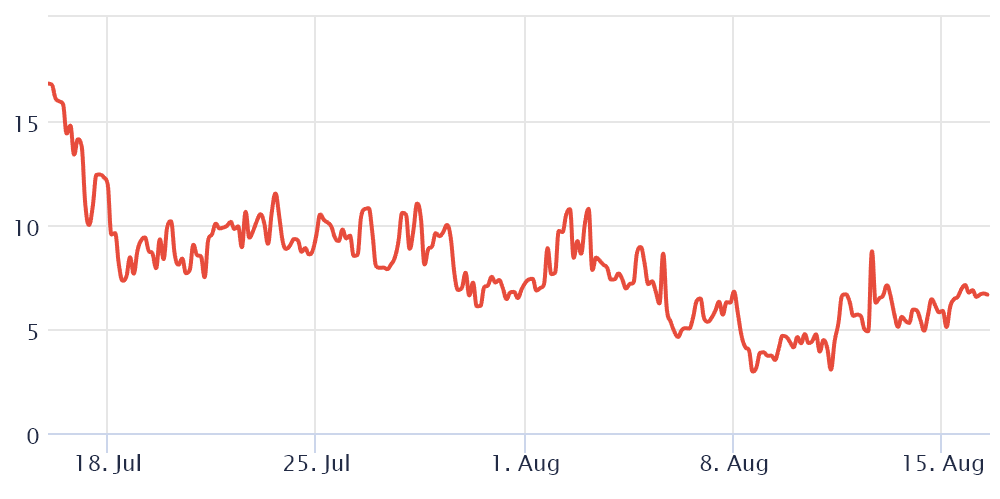

30-day Bitcoin options show 25% delta curvature / Source: Laevitas.ch

30-day Bitcoin options show 25% delta curvature / Source: Laevitas.chAs shown above, the 25% delta curvature has hardly moved since August 11. It oscillated between 5% and 7% most of the time. This range is considered neutral. That’s because options traders price the risk of a similar unexpected pump or drop. If professional traders were in a ‘fear’ mood, this metric would have risen above 10%, reflecting a lack of interest in offering downside protection.

Despite the neutral Bitcoin options indicator, the OKX margin lending rate showed that whales and market makers continued their bullish bets after a 5.5% BTC price drop on August 16. Therefore, investors should wait for the $25,000 resistance to be tested once again as soon as global macroeconomic conditions improve.