BTC managed to make big gains last week. However, Glassnode says several on-chain metrics for Bitcoin (BTC) are still in the bearish range. He also states that the uptrend will require the continuation of the recent price recovery, increased demand and higher fees over the network. Let’s take a look at Glassnode’s weekly crypto market report together.

Bitcoin drop not over

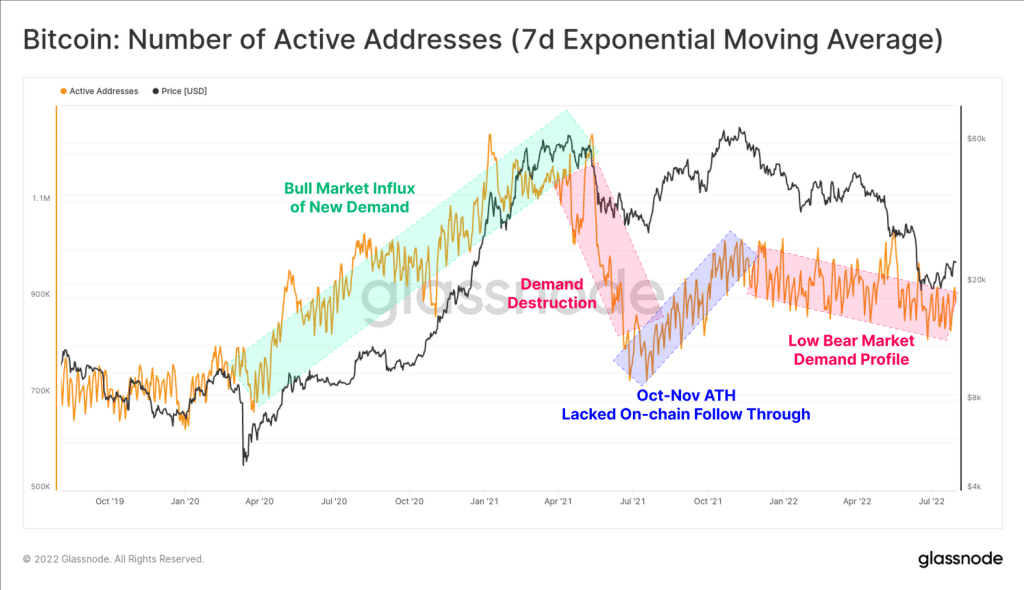

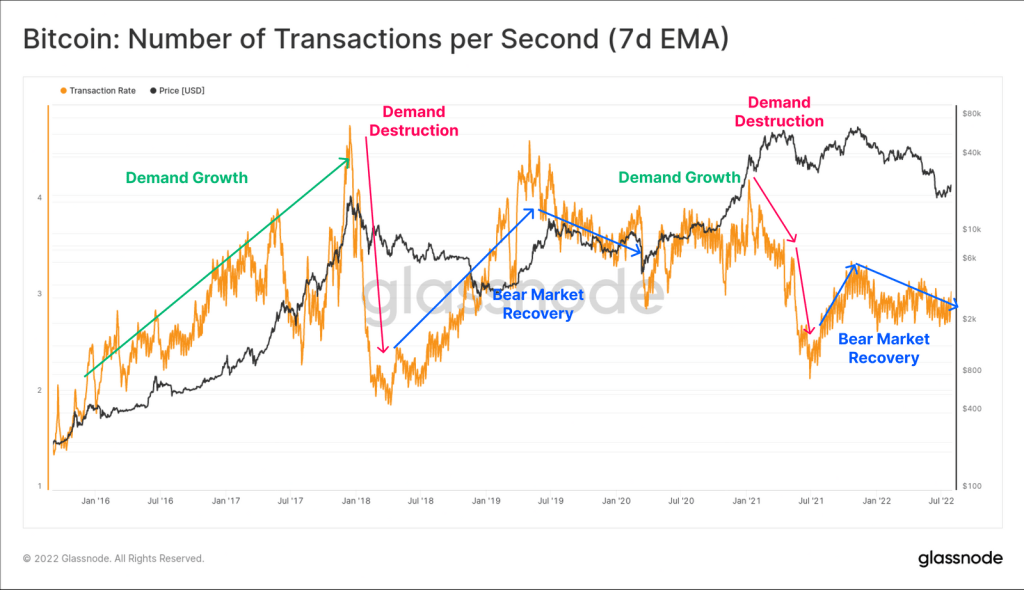

In the report, analysts drew attention to the side growth in transaction demand. He also pointed to the fact that active Bitcoin addresses remain “in a down channel” and low network fees. As a result, it dampened investors’ excitement and expectations about the 15% increase in BTC price last week. As we reported as Kriptokoin.com, BTC has fallen by 2% in the last 24 hours. Accordingly, it was trading at $22,899 below $23,000. The report shows a drop in on-chain activity. It also begins by highlighting the characteristics of a bear market that includes a return from speculative investors to long-term investors. He explains that the Bitcoin network still displays each of these features.

Glassnode mentioned the drop in network activity, speculative traders on long-term holders (LTHs). However, he stated that there are investors who believe in network technology at a high level. According to the report, these two cases for the Bitcoin network seem to indicate a lack of new demands. The report describes several higher activity spikes during the Great capitulation events. However, he points out that current network activity shows that there are very few new demand flows yet.

When will the BTC bear market end?

We saw that a significant demand level was formed for BTC at the level of $ 20,000 and the base was produced. For this reason, Glassnode says that the additional demand needed to sustain the price increase cannot be observed. The firm talks about its steady decline in active addresses. He refers to the decline mainly as the “lower bear market demand profile” that has been in effect since last December. The analysis observed similarities between the current network demand model and the one established during 2018-2019. Similar to the previous cycle, network demand fell after April 2021, which hit an all-time high in BTC price. There was a notable recovery in demand as prices rebounded to a new ATH. Said recovery lasted until November following the ATH.

However, since last November, demand has been trending downwards, with a big drop during the bulk sales in May. “The Bitcoin network remains dominated by HODLers,” Glassnode says. He also states that there is no significant new demand return yet. According to the firm, weak demand from people other than Bitcoin maximalists is forcing network fees into “bear market territory.” Last week, the daily transaction fees were just 13.4 Bitcoin. In contrast, when prices hit ATH last April, daily network fees exceeded 200 BTC. The report says that if fee rates increase in the future, it will mean positive results for the Bitcoin network. So an increase in fee rates means an increase in demand for BTC. As a result, if rates increase on the indicator, it will signal a recovery rally.