One of the biggest GameFi coin projects by market cap, it’s up 50% since last week. So what are the reasons for this special performance?

This GameFi coin continues the rally with an additional 20% gain

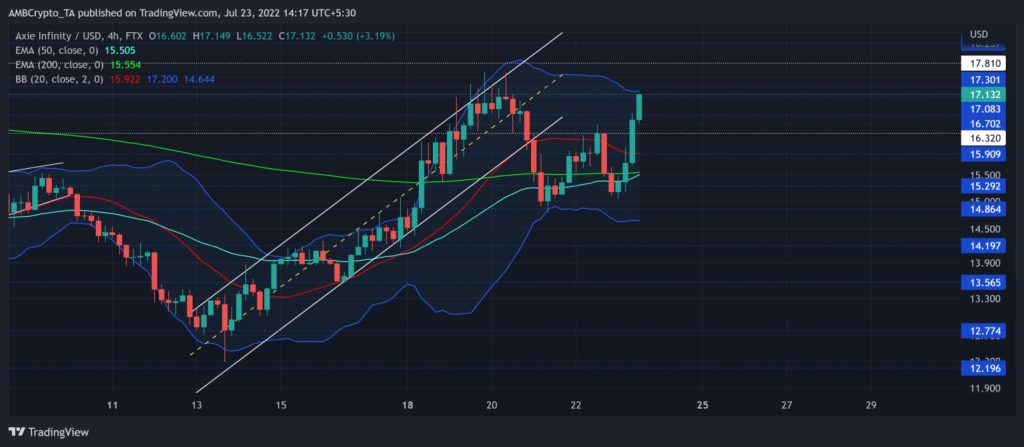

Axie Infinity (AXS) was one of the top performers among the top 100 by market cap. Meanwhile, it formed a higher low (HL) point on its chart, which is the first sign of a trend reversal. It reached above $17 again, accompanied by buyers from $12.4.

According to analyst Arman Shirinyan, the $17 zone can act as a trampoline. Later, AXS bulls will expect a bounce from this level to $35. This represents an almost 100% increase from current levels. The most recent positive move by AXS is the successful break of the 50 EMA resistance level.

Why is Axie Infinity rising?

Compared to NFTs and DeFi, GameFi has suffered less than the market overall, as industry entries remain stable through 2022, keeping a number of projects running. AXS remains one of the biggest and most important projects in the GameFi industry. Thanks to this, Ethereum saw a sharp increase in inflows from whales as its market rallied.

AXS, which we have transferred as Kriptokoin.com, has reached the list of the top 10 tokens that Ethereum whales buy the most. Its price has also increased by almost 45% since then. Numerous technical signs indicate that Axie Infinity still has a chance to rise. But it will all depend on the new money entering the market. On the other hand, some analysts predict that AXS price will correct to $12 before surging higher.

Why AXS may see a short-term retracement before it bounces back

AXS price has been down from $18 since the end of June. This trend has resulted in a bearish wedge formation on the four-hour time frame. Posting an expected breakdown from this structure, the bulls made up for their strength last week. On the technical side, the RSI balance has turned to support after buyers showed their last-day advantage. Any reversal from the 64 level will hinder short-term progress on the chart, according to the analyst. AXS’s RSI is currently hovering around 59.

On the technical side, the drop below the channel below confirmed lower lows. According to analyst Yash Majitia, buyers will now aim to narrow their buying efforts near the upper band of BB and the $17 resistance. A sustained close below this level is pulling AXS price towards the BB baseline. A close below this level could extend the downside towards the $14-15 range. On the contrary, a sudden recovery from $17 will likely be short-lived with resistance in the $17.8-18 range.

Also, it becomes vital to note that the altcoin shares a 68% 30-day correlation with Bitcoin. Therefore, keeping an eye on Bitcoin’s movement will be essential to making a profitable move.