The price rises in the crypto market continue. However, analysts are worried about whether Bitcoin and Ethereum will be back in range. That is, they doubt whether they will approach the higher timeframe resistance levels.

Bitcoin price crossed $24,000

Cryptocurrency investors continue to enjoy the rise of BTC, ETH and altcoins this week. The upswing started with the emergence of a rally on July 20 after gains in traditional markets. The data shows that Bitcoin bulls pushed the price up to the daily high of $24,281. The crypto community on Twitter is therefore moving with a new bullish sentiment. A week-long rally helped boost investor sentiment. Meanwhile, several analysts are warning investors not to go too far. This concern of analysts continues as the market still provides some red flags to consider.

“A major retreat is approaching”

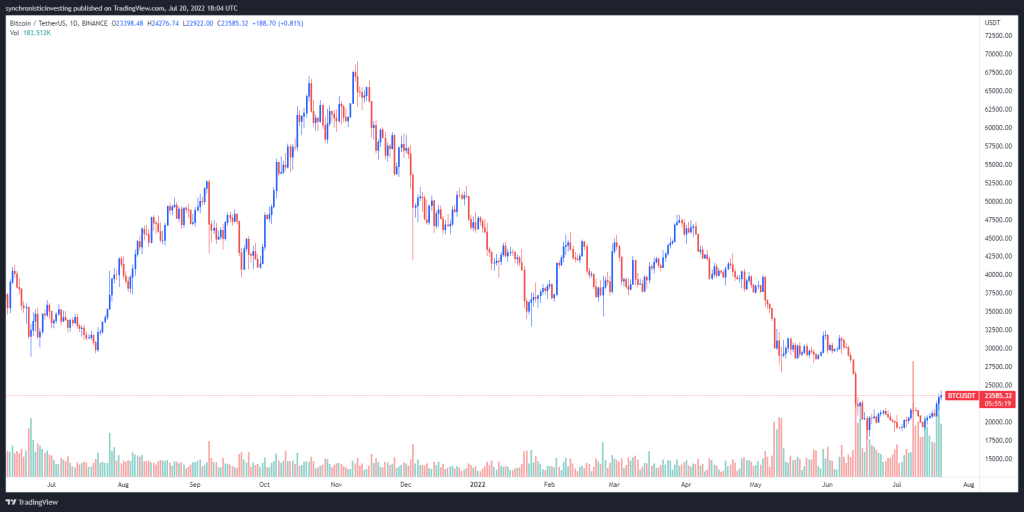

Market analyst Caleb Franzen published the chart below. He then pointed to the question the market is currently facing. According to him, Bitcoin’s surge above $24,000 confirmed new levels. Accordingly, BTC will experience a breakout from the previous trading range between $18,000 and $22,500. “The next retreat is very important,” Franzen said. “I anticipate that this will be a big test.” Then, “Will the bulls intervene in a pullback or capitulate?” asked the question.

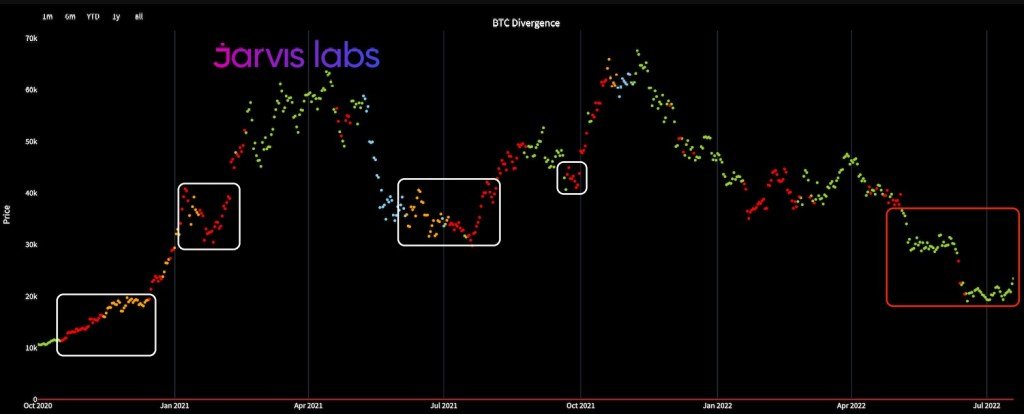

“Nearly no whale movements”

On-chain research firm Jarvis Labs studied whale wallet activity. Accordingly, whale wallet activities are quite low. For this reason, investors need to be very careful with the current rally. The red and orange dots on the BTC divergence chart below show whale activity. Accordingly, it reveals the purchases of large and small whale wallets at different times. As shown by the red dots, activity from whales has been virtually non-existent over the past few months. The reason for this is that Bitcoin (BTC) shows a bearish trend.

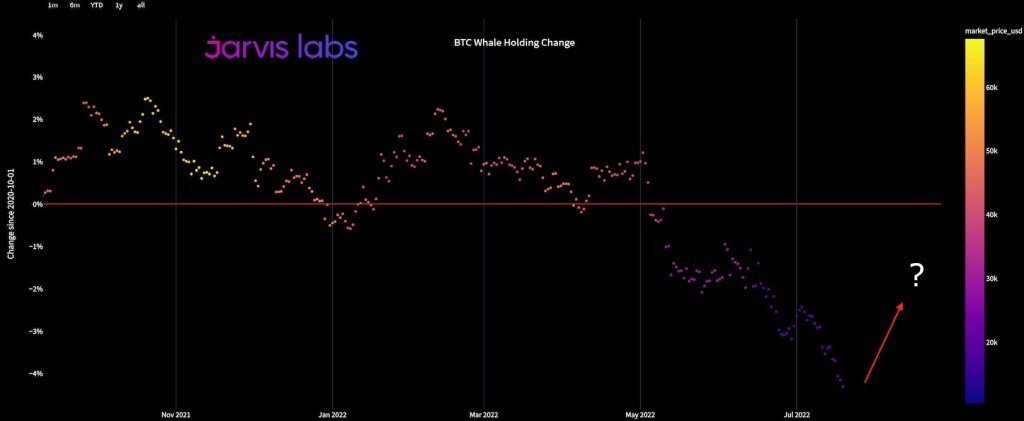

Data from Jarvis Labs also showed that larger organizations are not yet actively buying. The chart below shows the change in BTC whale holdings. Jarvis Labs tells us to wait for the pattern of colored dots to go right and up. If this happens, it will show that there is a significant force behind the rally. “It is not possible to get too excited about a rally that goes beyond liquidity around $28,000,” the firm said. “The bottom $25,000 for now will likely be the target,” he adds, instead.

Extended time frame reveals bearish bias for Bitcoin

Famous crypto analyst Capo was also among the names who analyzed the price of Bitcoin. According to him, the rebound in sentiment last week was a bullish move on a short time frame. “There’s no doubt about it,” says Capo. However, the analyst states that the trend in the wide time frame is still in a downtrend. He also describes the current rise as “another low high”. The analyst published the following chart as a warning for his followers. Then he gave the levels. Accordingly, bearish confirmation is located at $22,000 in the short time frame. The main targets of the price are to the downside as the sentiment is bearish in the wide time. The analyst expects $15,800 to $16,200 for BTC.