Celsius Network has repaid over $900 million in DeFi debt since it stopped withdrawing funds. Celsius has paid back stablecoins to DeFi platforms Aave, Compound and Maker. After that, the altcoin price skyrocketed. On the other hand, there are legal questions about who should be paid first.

Celsius pays Aave, Compound and Maker, price jumps

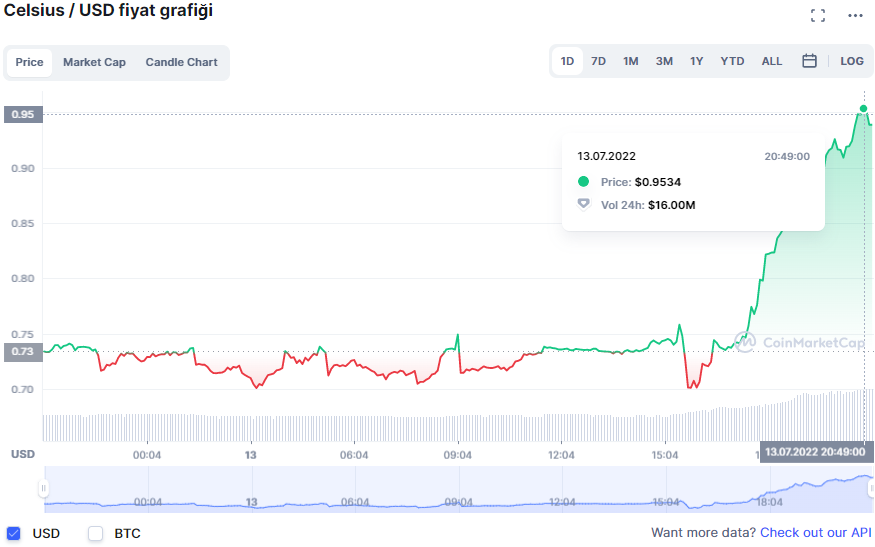

As you follow on Kriptokoin.com, Celsius Network Ltd. has taken a full month to freeze customer withdrawals. The crypto lender repaid a number of debts to decentralized finance platforms during the same period. The total amount of the said payment exceeds 900 million dollars. After the news of the payment, the altcoin price increased significantly. At press time, Celsius (CEL) was trading at $0.9259, up 25.23% over the past 24 hours.

Ceisius (CEL) daily price chart / Source: CoinMarketCap

Ceisius (CEL) daily price chart / Source: CoinMarketCapCelsius stopped customer withdrawals on June 12. However, since that date, DeFi platforms Aave, Compound and Maker have paid back in stablecoins.

There are legal problems with payments

The payments, on the other hand, brought up the specter of a legal controversy. This discussion, too, is about how distressed crypto companies should repay creditors, and in what order. Loans from DeFi platforms often need to be over-collateralized. Thus, it allows Celsius to recover the extra coins locked on the platform, thus securing more assets on the net. Thad Wilson, financial restructuring partner at Atlanta-based law firm King & Spalding, says:

Like most cryptocurrencies, we are in unknown territory as to who needs to get paid first from other parties and who can eventually. This is further complicated by the smart contracts involved and the nested DeFi lending contract relationships.

Celsius is one of the crypto lending companies suffering from negative bets in the current bear market. It is now exploring options, including restructuring its obligations. People familiar with the matter told Bloomberg that the company hired Kirkland & Ellis law firm for advice. At one point the company had more than $20 billion in user assets. However, it did not disclose current asset and liability figures.

Regulators in Vermont said they believed Celsius was “highly bankrupt” and lacked the assets and liquidity to meet its obligations. However, Celsius did not say it was considering bankruptcy. In addition, the company did not comment on debt repayments.

Are payments made by Celsius a problem?

Meanwhile, legal and credit experts say that while it’s not uncommon for a financially distressed company to pay certain counterparties while not paying others, doing so carries the risk of litigation.

According to Jared Ellias, a professor of bankruptcy and corporate law at Harvard University, Celsius’s ability to repay some debt before possible bankruptcy raises the issue of so-called preference claims. In Chapter 11 bankruptcy, some creditors are not necessarily better off than others and would be in a full liquidation simply because the bankrupt company chose to pay them before it came into court protection. Ellias says:

It’s fair to say that any payment or swap made without creditors being allowed to receive their money in the normal course of business is potentially subject to bankruptcy recovery proceedings. I would advise anyone taking money from Celsius to consult a lawyer before making decisions they will regret.