On-chain data shows Bitcoin price to be discounted, but analysts warn against expecting a quick recovery.

Bitcoin price is at a discount, but analysts expect a deep correction

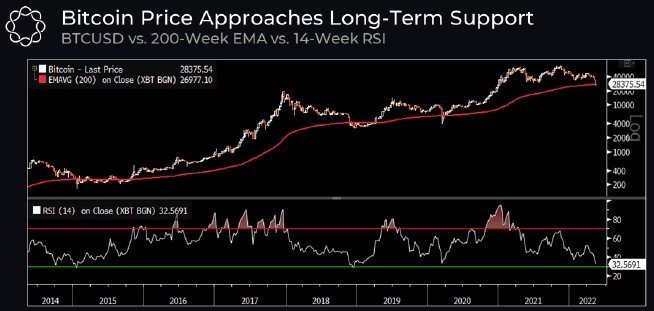

, even as the May 12 drop to $26,697 marks the bottom since 2020, most metrics suggest current levels are opportunities. The pullback to this level is marked by a retest of Bitcoin’s 200-week exponential moving average (EMA) at $26,990. According to crypto research firm Delphi Digital, this metric has historically “served as a key area for previous price dips.”

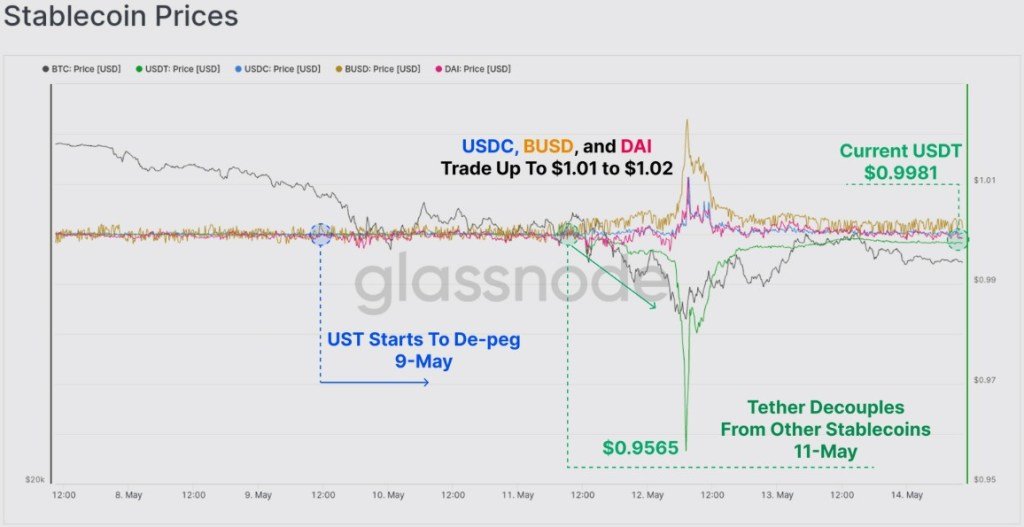

Bitcoin wasn’t the only one that had a rough May 13

The stablecoin market also saw the highest volatility level since the start of the Terra crash and the dollar saw the deviation from its constant and Tether (USDT) experienced the biggest deviation among them. Major stablecoin projects have also had tough times, as the chart below from blockchain data provider Glassnode shows.

Bitcoin is approaching its actual price

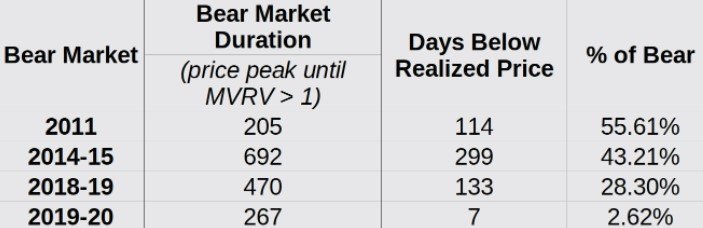

All four of the top stablecoins by market cap managed to return $0.001 in dollar pegs, but the long-term confidence of crypto investors has certainly been shaken by the events of the past two weeks. As a result of the market pullback, Bitcoin price is now trading closest to its realized price since 2020. According to

Glassnode, realized price historically “provided solid support during bear markets and signaled a market bottom formation when market price traded below it.” Previous bear markets saw the price of BTC transactions below its actual price for long periods of time, but the amount of time actually decreased with each cycle, with Bitcoin’s price only seven days below what happened during the 2019-2020 bear market.

On-chain data shows that many crypto investors could not resist the temptation to buy Bitcoin under $30,000, which started on May 12 and ended May 15. It shows an uptick in accumulation that continues until the next day, but some analysts warn not to view it as a sign of a rapid decline.

Senior analyst Gareth Soloway, He said Bitcoin could drop as low as $12,000 as a result of the LUNA crash.

“Wait for these 4 levels in Bitcoin”

This sentiment was echoed by Delphi Digital, who stated that “the longer we see price increase in these areas, the more likely it is to continue.” Delphi Digital analysts say:

If this happens, look for the following levels: 1) weekly structure and volume structure support between $22,000 – $24,000; 2) Retested the 2017 ATH level of $19,000 – $20,000.