Bitcoin price is pricing in economic developments in the US in its latest move to $27,500. The next price targets of 7 professional analysts offer an outlook above expectations.

Bitcoin price poised to rise, according to Glassnode co-founder

Yann Allemann, co-founder of on-chain analytics firm Glassnode, stated that Bitcoin could be ready to rally. In a tweet, Allemann highlighted that Bitcoin’s shorts are exhausted after the bears failed at the 200-day SMA, a key support level.

Also, a bullish cross of the 50-day SMA over the 200-day SMA will signal that a Bitcoin price spike is on the horizon.

Bitcoin price targets $27,500 as debt ceiling debate continues

According to Kitco senior technical analyst Jim Wyckoff, June Bitcoin futures prices were trading steadily in the early hours of Monday. However, “Prices are still bearish on the daily chart.”

“The bears generally have the short-term technical advantage,” Wyckoff warns. This means that “the path of least resistance for prices continues down the horizontal.”

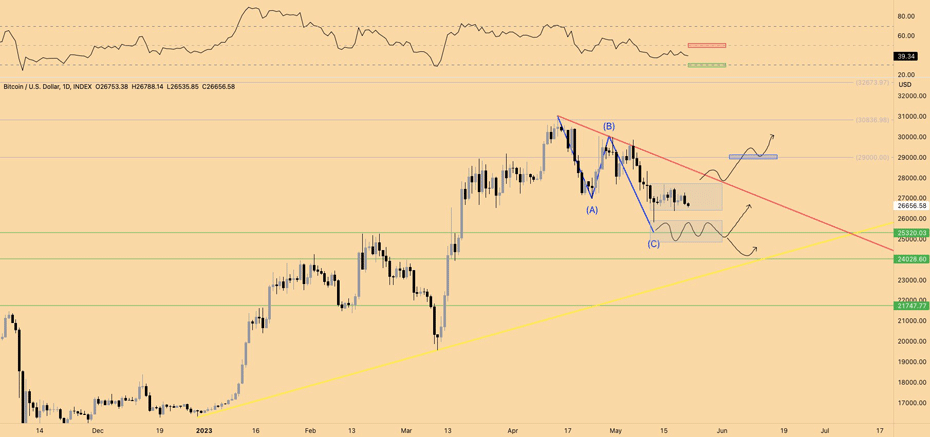

Elsewhere, for analysts at Eight Global, the price action seen since mid-April has reached an ABC pattern that “technically could be complete for BTC” at this point.

Eight Global noted that although wave C was lower than the first wave, the two were roughly the same length in terms of price drop. He also said it’s worth considering that “there may be the bottom of wave C” at this point.

Eight Global said, “The price appears to be consolidating as expected. Just a little higher. If there is to be another drop, it should be in the first half of this week. If the price climbs above $27,700 or even reverses the descending trendline, this will be early signs that the consolidation is over. According to analysts, “Bitcoin price is ready to continue up.”

Analysts are waiting for this level in Bitcoin price

Analysts pointed to $29,000 on which levels to watch for on the upside. However, “RSI going above 50” will also be critical.

An analyst from Eight Global said, “On the other hand, if we catch a daily candle below $26.7k, another foot becomes more likely. My target for this is still $24-25.3k. I have stopped most of my shorts at loss at both breakeven points. I secured it with $27.8k and $29.1k for BTC.”

Whichever scenario happens, Eight Global says both will lead to bullishness in the medium-term “as long as the Bitcoin price doesn’t drop and stays consistently below $22,000.”

Dave the Wave sets $40,000 for year-end

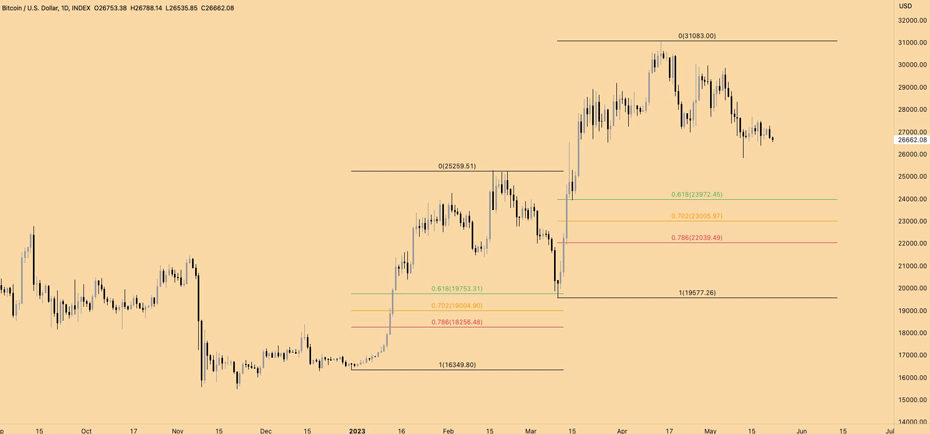

The crypto analyst says that Bitcoin is currently consolidating within the “buy zone” of its logarithmic growth curve.

Dave the Wave’s growth curve (LGC) analysis ignored short-term volatility. Thus, it aims to predict long-term highs and lows over the lifetime of Bitcoin. Roughly below $31,000 is still very important, according to the analyst’s “buy zone.”

The closely-followed analyst says the next key milestone for BTC is $32,000, which could signal an exit from the consolidation channel, based on the current market structure.

Dave the Wave says that if the price continues to rise at the same support level, his target by the end of the year will be roughly $40,000.

Can Bitcoin price reach $30,000 before the end of this weekend?

Bitcoin price is gathering strength for critical resistances as it rises. The price is currently approaching the $27,300 region. However, a minor support is needed to break above the critical resistance at $27,500. Although the leading crypto exhibits uncertain movements, the probability of a bullish breakout after the recent rise seems quite high.

Moving average levels are considered one of the important resistance or support levels. Hourly or daily MA levels offer the floor in case of a long downtrend. Breaking above these levels therefore signals bullishness for crypto in the short term. However, if the price breaks above the weekly MA, it can be considered bullish in the long term, regardless of whether the rally is under bearish influence in the short term.

Currently, BTC price is trying to bounce off the 200-week MA, which shows the accumulated strength among the bulls. The bulls are slowly raising the price, which seems like a stagnant trend for the bears. Therefore, this may be the reason why the price is stuck inside the zone without breaking above the resistance or falling below the support levels.

As a result, it is now important for Bitcoin (BTC) price to stay above $27,000 and attempt to break beyond the critical resistance of $27,500 initially and then $28,000. However, the price must somehow climb above $29,000. This could trigger a healthy rise to test $30,000. While the bears are quickly trying to dominate the rally, the bulls could keep the price above the support levels and trigger a good uptrend in the future.

Bank of America says volatility will be missing in the short term

The bank expects the cryptocurrency market to remain under pressure as retail investors stay on the sidelines. He said in a research report on Friday that there is limited upside for crypto markets in the short term. According to the conclusions of analysts Alkesh Shah and Andrew Moss:

Low faith, limited catalysts and high year-to-date performance leave the cryptocurrency industry stuck in a trading range with a tough macro backdrop.

In conversations with customers, the bank found that hedge funds are returning to token trading. He also says that “acceleration strategies take advantage of increased volatility to some extent, possibly due to their declining volume.”