After the strong US CPI, the possibility of an aggressive rate hike by the Fed has strengthened. On this medium, gold fell from a five-week high. Bitcoin analysts, on the other hand, are watching these BTC price levels as the important trendline emerges.

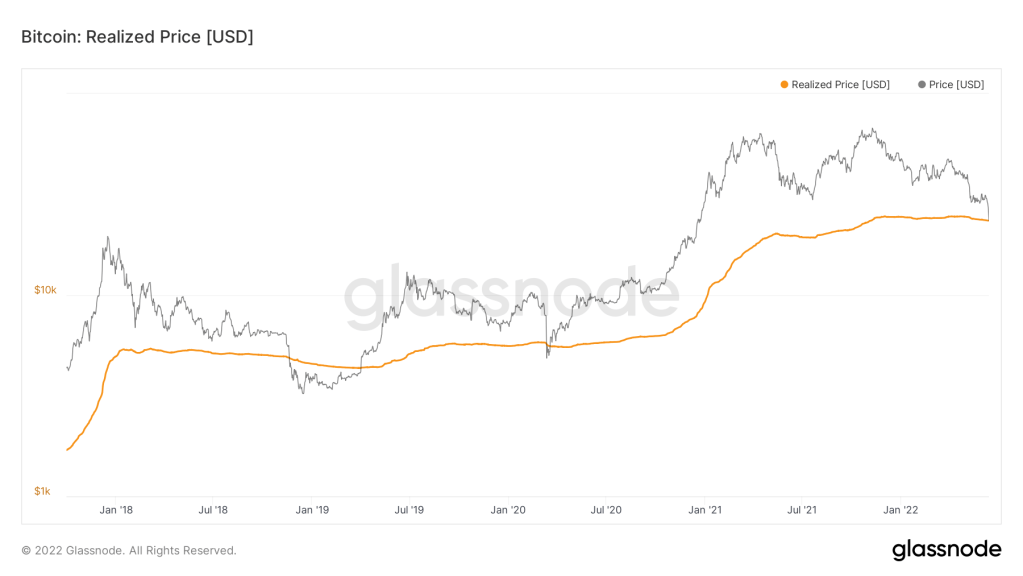

Bitcoin clings to the realized price

Consensus says that $22,400 for Bitcoin (BTC) marks the beginning of the possible bottom zone. However, he notes that the downside targets technically extend to $11,000. As you follow on Kriptokoin.com, BTC is trading at its lowest level since mid-December 13 June 2020. However, the bottom can be anywhere.

BTC’s weekend sales intensified. According to TradingView data, BTC fell below its price for the first time since March 2020. The price, which is settled near $23,400, acts as the first solid support ever on the lower timeframes.

Bitcoin actual price and BTC chart / Source: Glassnode

Bitcoin actual price and BTC chart / Source: Glassnode Previous levels, including those highlighted as potential bottoms, failed to hold. Post-Celcius sentiment continues to support further sell-side pressure, thanks to inflation and future actions by the Fed.

Meanwhile, where BTC might land on an eventual macro footing is now a hot topic of debate. Traders and analysts agree that the first call point for a significant drop is the 200-week simple moving average (200 SMA).

The 200 SMA, at $22,370 as of June 13, served as key support throughout Bitcoin’s lifetime. Also below that, only short wicks mark generational spot price dips. The 200 SMA has never broken its own uptrend. So the hope is that reaching it will give the bulls a rest period.

BTC 1-week candlestick chart with 200 SMA (Bitstamp) / Source: TradingView

BTC 1-week candlestick chart with 200 SMA (Bitstamp) / Source: TradingView “I don’t think the price will go that low”

Analyst Josh Rager, “People out there he wants to buy, it will probably jump more in that region,” he says. He describes the jump in the 200 SMA as a ‘self-fulfilling prophecy’ thanks to the scope of interest. He warns that there is a guarantee that BTC will not continue south this time. This was thanks to historical precedent that saw Bitcoin plunge as much as 84% below the ATH level. At $69,000, such a bottom was therefore only $11,000. The analyst continues:

This would be harmful. I don’t think the price will drop that much. So basically you’re looking at a full follow-up of the entire bull market and we’ve never seen it.

Instead, the analyst’s interests are around 2017’s ATH level of $20,000. Then the area just below extends to $17,000. Also, $14,000 is worth paying attention to, which equates to an 80% pullback from current all-time highs.

Many of these levels have already been highlighted as potential bottoms by others, including trader and analyst Rekt Capital. The importance of the 200 SMA came into play again in a series of tweets on June 13.

Fed is the last chance hall of gold and BTC bulls

Meanwhile, at the time of writing, BTC has managed to avoid a new drop in line with US stock markets. By contrast, the S&P 500 fell 3% in the first hour of the session. The Nasdaq Composite Index fell 3.6%.

Some argue that only the Fed can step in, reversing monetary tightening as rising interest rates slow growth. In this regard, he hopes that crypto’s decline will stop. Economist Alex Krueger told his Twitter followers:

Realize how little this crypto crash has to do with the Celsius and stETH drama. Understand how little this has to do with common panic and distorted graphics in risk assets. This wouldn’t have happened if Friday’s CPI figures and stocks hadn’t crashed.

However, illusions were few for long-time Bitcoin market participants. If BTC falls below $20,000, it will be the first time the ATH level of the previous halving cycle has been passed.

Asset manager Capriole CEO Charles Edwards said, “Without the Fed pivot “I expect this to be the first cycle where Bitcoin has dropped below the ATH level of previous cycles,” he said.

Bitcoin bounce levels

A crypto enthusiast ‘Bull of Binance Street’ said that crypto has hit lows. Earlier this year in April, he predicted the next lows for Bitcoin, Ethereum and BNB token. The initial Bitcoin forecast to reach between $22,000 and $25,000 turned right on Monday.

Finally, the analyst made a new prediction about the new Bitcoin bounce level. The analyst expects Bitcoin to bounce around $22,000. “I think we should bounce above $22,700,” the analyst said.

Meanwhile, some traders also believe that a new rebound level of $19,500 is likely in this cycle. Katie Stockton, founder and managing partner of Fairlead Strategies, predicts Bitcoin’s next support price to be $19,500. She talked about this in a statement and said:

The next support is roughly $19,500 for Bitcoin. We also think it can be done as part of this cycle. A bottom would be a natural place to explore.

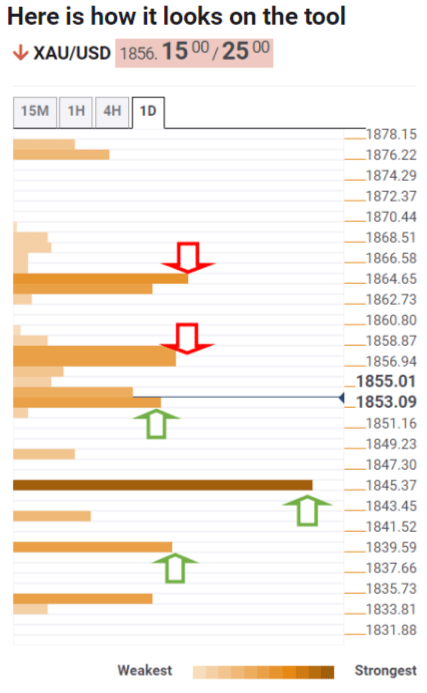

Important levels to watch for gold price

Market analyst Dhwani Mehta is trying to determine the direction of gold price using the Technical Confluence Detector (TCD). Dhwani Mehta evaluates the results of the analysis as follows.

TCD shows that gold price is challenging the fierce support at $1,853, which is the convergence point of the 10-day SMA and 200-4 hour SMA. The next important downside target is at $1,845, where both the daily and weekly 61.8% Fibonacci retracements converge.

Farther south, the 200-day SMA of $1,842 will test bullish commitments once again. It will also pave the way for a retest of the weekly pivot point S1. Additionally, it will open the ground for the daily pivot point S1 where they intersect at $1,839.

On the other hand, bulls will test the combined daily and monthly Fibonacci 38.21% retracements at $1,858. Also above this, a fresh increase towards $1,863 cannot be ruled out. At this level, the monthly Fibonacci 61.8% and daily and weekly Fibonacci 23.6% retracements coincide. Friday’s high of $1,876 will be tested if the bulls continue their recent momentum.