Bitcoin price expects $22,000 recovery as the market structure is ‘yet to be broken’. One analyst suggests that crypto sentiment is ‘hysterical’ as Bitcoin is below $22,000, but a key trendline has yet to disappear. Other analysts also share their own estimates.

Analyst denies ‘hysterical’ crypto sentiment for Bitcoin

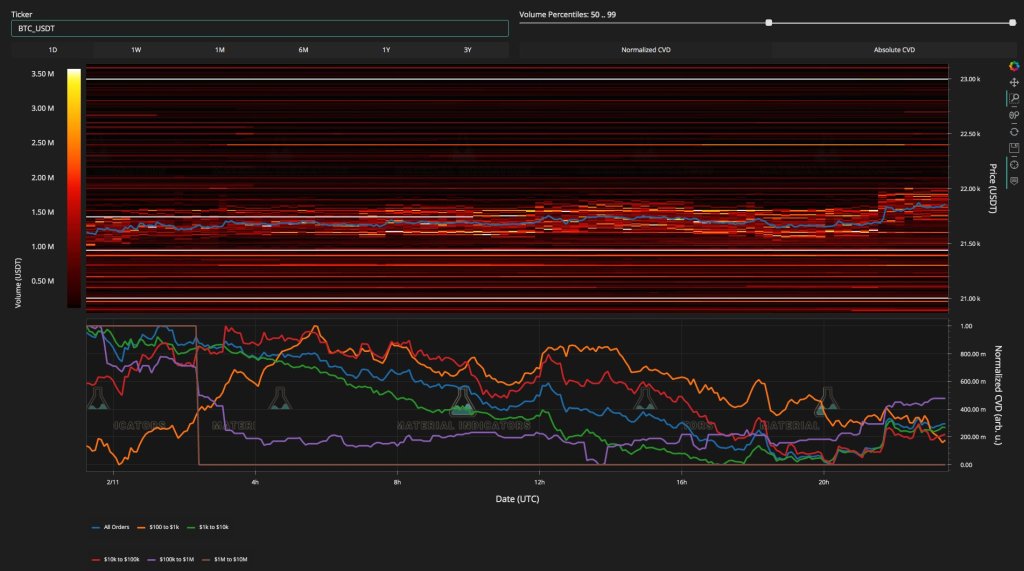

As you follow on Kriptokoin.com, Bitcoin (BTC) saw small increases until February 12. On-chain analytics resource Material Indicators says Bitcoin is a target for opportunistic whales after hitting three-week lows the previous week. Uploading a chart from the BTCe order book on Binance, Material Indicators caught higher resistance slippage with the potential increase in spot price offering a more advantageous sell level for large volume players. He adds the following to his comments:

FireCharts shows that weekend crypto whales are interested in trying to take advantage of the lack of upside liquidity in the Bitcoin order book to sell higher. Personally, I’m fine with that.

BTC order book data (Binance) / Source: Material Indicators / Twitter

BTC order book data (Binance) / Source: Material Indicators / TwitterMeanwhile, the week’s lows saw moderate reactions from market participants. Also, some of them oppose calls for a mass capitulation event in short time frames. “He is hysterical about a bear market when CT fails to retest a major Fib or moving average that broke down after 3 waves,” says Filbfilb, co-founder of trading platform DecenTrader. Popular trader Crypto Tony is similarly cool about the current price action. In this context, it implements the following logic:

I am staying short as per my updates while living below the main resistance zone between $22,400 – $22,600. Overall, I could see another touch of the highs if we can hold it above $20,300 total. The market structure has not deteriorated negatively yet.

BTC caption / Source: Crypto Tony/ Twitter

BTC caption / Source: Crypto Tony/ TwitterCPI leads the week of key macro data

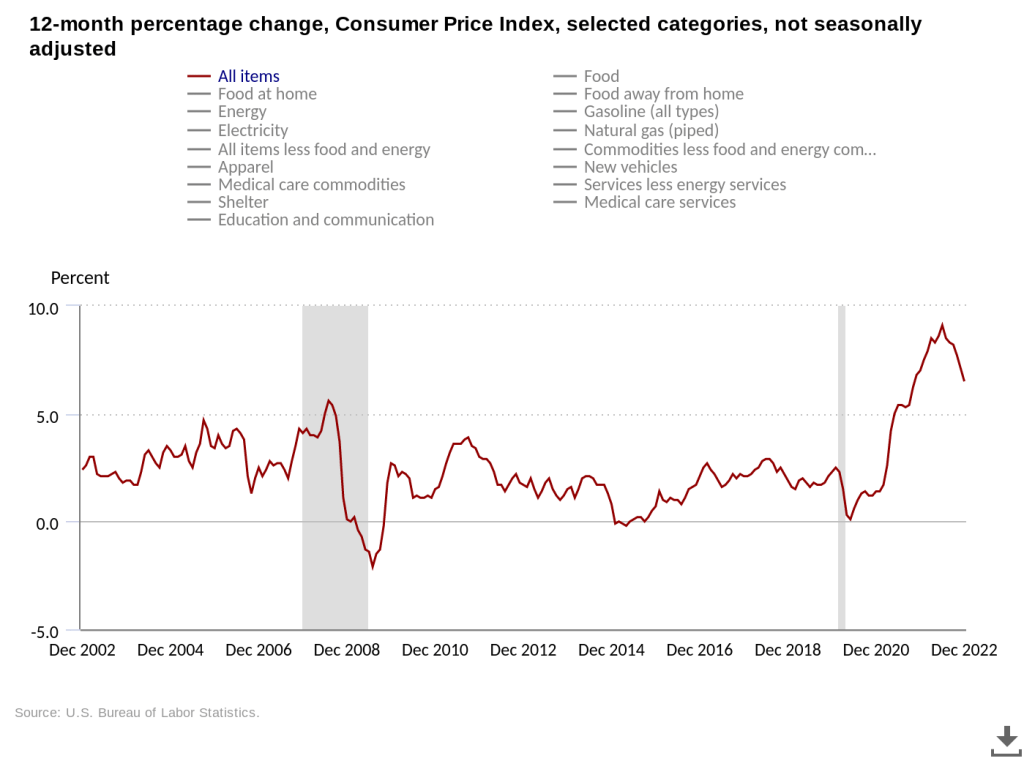

Before the weekly close, others focused on next week’s macroeconomic data as the next potential volatility catalyst. The January Consumer Price Index (CPI), which will be released on February 14, is making the headlines among many news stories in the US this month. ‘We have a big week ahead of us,’ Michaël van de Poppe, founder and CEO of trading firm Eight, sums up, noting the retail sales, the Empire State Production Index and the Producer Price Index, which will be released throughout the week. In this context, he makes the following statement:

My thoughts are that we are likely to see inflation continue to fall and fall rapidly. Gasoline prices are also falling like a rock and this drop is pulling the markets up.

Material Indicators acknowledges this, saying that “volatility is expected to continue until Tuesday’s CPI Report.”

Consumer Price Index (CPI) graph / Source: Bureau of Labor Statistics

Consumer Price Index (CPI) graph / Source: Bureau of Labor StatisticsAny more gains ahead for Bitcoin?

Bitcoin price is undergoing a correction, mainly due to regulatory concerns arising in the US, after weeks of recovery to briefly retrace $24,000. Amid the uncertainty, investors are looking at various technical indicators that are likely to provide clues as to what to expect next.

Notably, the crypto analyst of Twitter alias Elcryptoprof noted in a tweet on Feb. 12 that the Rainbow Relative Strength Index (RSI), one of Bitcoin’s key technical indicators, has turned green for the first time after a long correction. This is an important development for Bitcoin as the trend indicates that the long-term momentum is likely to be bullish. According to the expert’s analysis, similar green transitions in the past marked the beginning of important bull runs.

Bitcoin price analysis chart / Source: Elcryptoprof

Bitcoin price analysis chart / Source: ElcryptoprofFor example, the green pass in 2012 marked the start of a bull run, while the green pass in 2019 heralded the start of the last major rally. However, Elcryptoprof points out that the trend in 2015 resulted in a ‘fakeout’ before a major rally. It is worth noting in this line that past performance is not indicative of future results.