Some popular analysts are explaining their expectations for the cryptocurrency Bitcoin (BTC), which has been moving sideways recently. While investors are patiently waiting for a breakout in BTC, this breakout may be on the downside for some analysts. Here are the details…

Dave the Wave: LGC is important for Bitcoin

As we reported as Kriptokoin.com, an analyst named Dave the Wave, who correctly knew the collapse in Bitcoin (BTC) and the crypto market last year, says that the largest cryptocurrency may be on the verge of ending its downtrend. According to the analyst, Bitcoin is currently at the bottom of its logarithmic growth curve (LGC). That is, implying that BTC is at a critical support level. According to the analyst, Bitcoin needs to see at least modest gains from now on for the LGC to hold true.

Dave the Wave states that BTC has essentially gone through exaggerated cycles of extremely long rallies and steep corrections. It says it maintains solid support levels below every downturn. According to the analyst, LGC has been a reliable model for over four years. He points out that many users are getting excited, but the markets can be brutal. He stated that those who have followed the LGC purchasing region since 2018 have not had any problems. In the shorter term, Dave the Wave says the November monthly candle holds the support of LGC. He says that BTC is currently in the “buy zone”.

Willy Woo says “maximum pain”

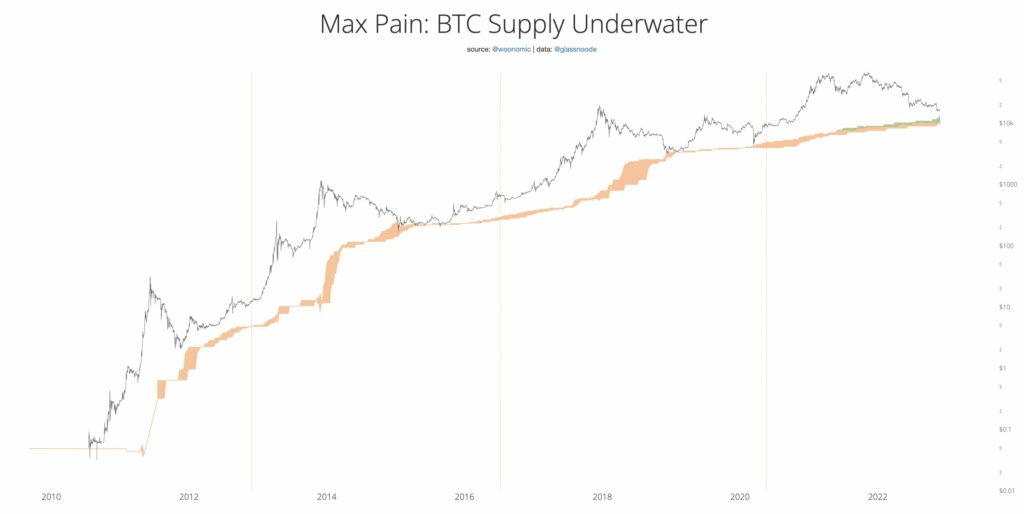

On the other hand, popular on-chain analyst Willy Woo, who also stands out with his predictions, points to a “maximum pain” model that suggests a floor price for Bitcoin at the bottom of the bear market. Woo tells his one million Twitter followers that he predicts Bitcoin bottom by looking at where the price of BTC would be if 58-61% of all coins were below the purchase price or at a loss. The analyst uses the following statements:

Bitcoin bottom is approaching under the Maximum Pain pattern. Historically, BTC price has reached macro cycle lows with 58%-61% of coins at a loss (orange). The green color shows the coins locked within the GBTC Trust.

Looking at the zoomed-in view of the chart, the pattern seems to suggest that Bitcoin could still drop into the $12,000 price range. In a separate, less serious model, Woo says BTC is testing a bottom based on CVDD (Cumulative Value Disappearing on a Daily Basis). Woo says the CVDD model is based on the idea that BTC tends to form a new price floor as the next generation of investors enter the market.

Bobby Lee reveals bottom target in Bitcoin

Bobby Lee, a veteran in the crypto industry, also made statements. You can see Lee’s correct predictions here. He says bad actors who are unaware of the regulation should be kicked out of the market. Lee, co-founder of Hong Kong-based crypto exchange BTCC, explains at what point he expects Bitcoin (BTC) to bottom out at the end of the bear market. Lee uses the following expressions:

[Bitcoin] fell below $16,000. Earlier, I said it would probably go for $15,000. Given the size of the FTX boom, it could drop to $13,000 and even touch $10,000. This is going to be a very, very hard crash. There must be more bad news to come out. As we know in the market, for the past week we have been looking into the problems of Genesis, one of the most important brokers in the crypto market. So if something bad happens with it, we could see much worse prices appear in a few weeks.

Lee says that as a young industry, many quirks still need to be resolved, including a lack of regulation and a large number of bad actors. He says it’s a good thing the FTX crash happened now, not a few years from now.

9 thousand dollar expectation in Bitcoin

Finally, InTheMoneyStocks.com chief market strategist Gareth Soloway stated in an interview that Bitcoin could drop to $9,000 in 2023. However, he said he is not too worried about the long-term performance of the token. Soloway, who observed the performance of the S&P500 after the collapse of Lehman Brothers and noted that the stock market fell by about 40-45% in the following five or six months, calculated using the same formula that Bitcoin could drop to $ 9,000 in the months following FTX.