35 Fintech experts of the Australian benchmarking platform Finder expect prices for Bitcoin (BTC) between $81 thousand and $ 65 thousand by the end of the year.

Crypto experts think Bitcoin price will peak this year

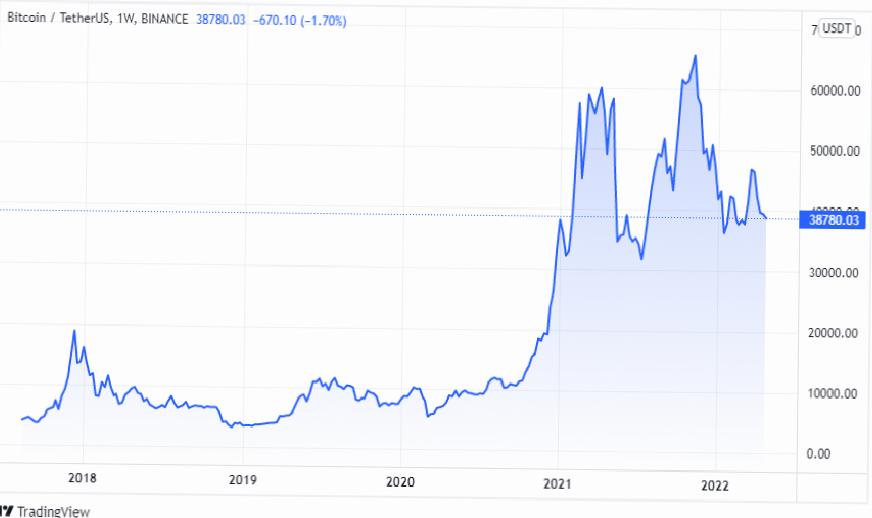

In a recent Finder research compiled by Cryptokoin.com, 35 Fintech experts said that BTC will hit $81,680 at the end of 2022 before dropping to $65,185, and then 2025. He estimates it will return to $179,000 by the end of the year. Experts’ opinion three months ago predicted $76,360 for BTC by the end of the year. Collective perspectives have changed over time due to changing conditions and new economic indicators. Also, the panel’s current estimate of the value of BTC through 2025 is down 7% from its January estimate of $192,800.

The panel’s BTC price forecast for the end of 2030 looks more positive at $420,240 compared to the previous $567,472 expectation. So, how do experts evaluate Bitcoin as a long-term investment?

Analysts trust long-term BTC despite falling price forecasts

Despite falling long-term forecasts for BTC, most analysts still see it as a worthwhile investment. 67% of panelists now say buying BTC is a good idea, while 9% believe selling BTC is preferable. 24% think now is the time to hold BTC. Meanwhile, experts highlighted BTC’s dependence on fossil energy and environmental concerns as the reason for leaving. Blockware analyst Joe Burnett believes BTC is the only asset in the world that has “no counterparty risk or dilution risk” and describes it as “the world’s best savings technology.”

Experts Bitcoin is on the rise in the long run

BTC is currently trading at $38,834.88 (down 1.09%) and most investors and experts are positive despite the crypto market’s recent lows.

Nexo CEO Antoni Trenchev, for example, told CNBC that BTC is likely to reach $100,000 in a year as Bitcoin’s short-term performance isn’t particularly bullish on it. He stated that he believed. While VC investor Tim Draper forecasts $250,000 for Bitcoin in late 2022 or early 2023, it’s unclear whether his views have changed in light of the current economic turmoil.